Volatility has caused a huge market rotation over the past 18 months and many investors have been caught out by the abrupt changes that higher interest rates, rampant inflation and war in Europe has created.

To get the maximum out of their money, investors would have had to time the moment that the ‘Covid winners’ started to sell off and move their cash into ‘value’ strategies, sometime around the beginning of 2022.

Getting this right is treacherous and few can do it. As such, most experts recommend buying for the long term as, over time, good funds should make high returns even if they struggle over shorter periods.

Here, Trustnet asked Nathan Sweeney, chief investment officer of multi-asset at Marlborough Funds, how he would build a portfolio that had a decade to make the best returns, while being able to mitigate the worst of the market falls in the near term.

His starting position was the US, where investors have been largely invested over the past decade but has struggled recently when the technology behemoths that dominate the market sold off as interest rates rose.

Unperturbed, he said investors should have half of their cash in the US, noting that technology development will continue to be crucial over the coming decade and there are few alternatives to the American giants.

“Technology improvements drive productivity and economic growth and the US is best placed to capture that because there is the structural framework in place for it to thrive and flourish. Even in China [often viewed as a direct technology competitor to the US] there are clampdowns on some companies, which tells you there is the opposite there,” he said.

He was not put off by the top-heavy nature of the market – with many of the large tech names dominating the returns over the past decade – and suggested investors leaned into this via a Nasdaq 100 tracker fund.

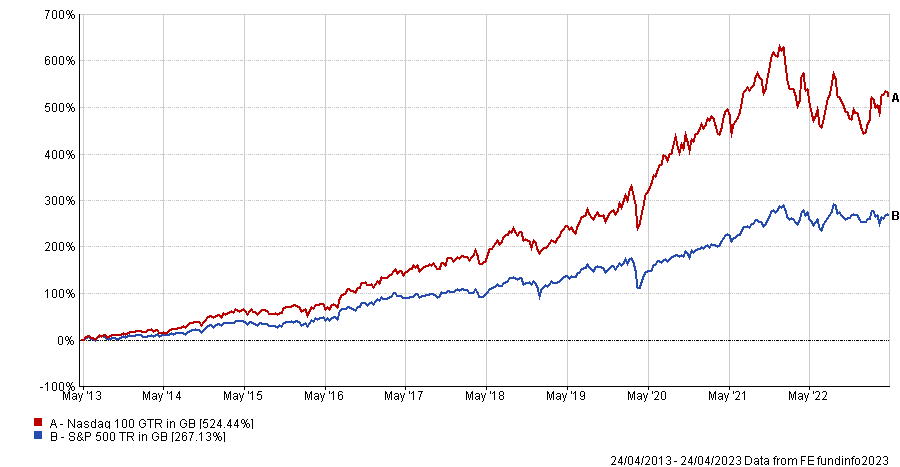

This market has been more volatile than the broader S&P 500 index, but has also provided superior returns over the past decade, as the below chart shows.

Total return of indices over 10yrs

Source: FE Analytics

“It gives me concentrated exposure to those top companies and for the US specifically – because it has that growth bias, that is what I would choose,” he said.

“If a company is a big proportion of the benchmark then it is generally a successful company and you want to have exposure to it.”

The next allocation is to the UK, which should be around 20% of an investor’s portfolio as it acts very differently to the US market. Dominated by banks, oil and other value companies, this composition means the domestic market tends to hold up better when interest rates rise – the opposite to American tech names.

“When you get a sell-off in markets, structurally the UK market always outperforms because it is defensively positioned,” Sweeney said.

“Whenever global PMIs go under 50 globally and you get a sell-off in markets, the UK outperforms because it is defensively positioned,” Sweeney said.

Here he likes an income strategy and picked the £281m Allianz UK Listed Equity Income fund managed by Simon Gergel and Richard Knight.

“They have built a nice track record and have gone slightly under the radar as well, building up the fund’s assets with good performance,” he said.

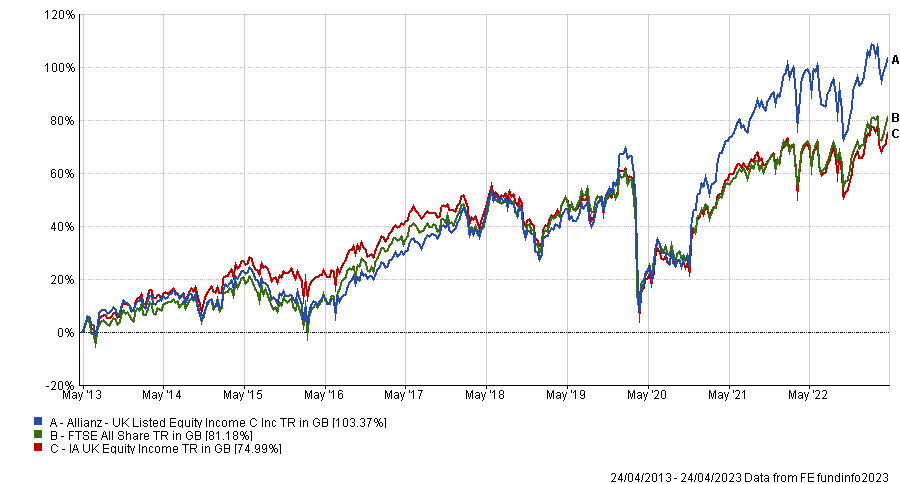

The fund has been a top-quartile performer in the IA UK Equity Income sector over the past decade, up 103.4%, but has failed to beat its peers over the past 12 months.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“Last year it will have struggled a bit because of its mid-cap bias,” said Sweeney. “But we think this is an area that should be more interesting this year because you have the scenario where currency should start to strengthen, which will be more constructive for these stocks while impacting large-caps negatively.”

Next he suggested two 10% allocations to European and Japanese funds. “Europe and Japan are diversifiers to the US and will also help manage the performance at different times,” said Sweeney.

For the former, he went for BlackRock European Dynamic, run by FE fundinfo Alpha Manager Giles Rothbarth since 2019, who took over from former manager Alister Hibbert.

It was one of the worst performers in 2022 but was in the top quartile of the IA Europe Excluding UK sector in each of the previous three years and has surged again so far this year, while also delivering over the long term.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“He took more of a defensive bias last year and started to focus on some of the companies within the universe that have better balance sheets – so the manager was mindful of the environment he was in and took that into consideration when running the portfolio – which I respect as a decision,” said Sweeney.

“I do think there is a huge opportunity in Europe because of the magnitude of the sell-off last year. It is a very unloved region and has the potential to add more value than people expect.”

There are similarities between Europe and Japan, said Sweeney, as the latter has gone through a period of extreme low growth – something some could argue faces Europe today.

“Japan is now coming out of the other side of that with huge structural reforms,” he said, but noted that it remains a “challenging market from a fund selector perspective”.

There are two options investors can go for. The first is to pick two funds with opposing styles: one in the growth camp and the other investing in value stocks. However, investors have to blend these and make tactical asset allocation calls, which is not easy.

Instead, he suggested M&G Japan managed by Carl Vine, who is “an interesting character” with “interesting views” on the market.

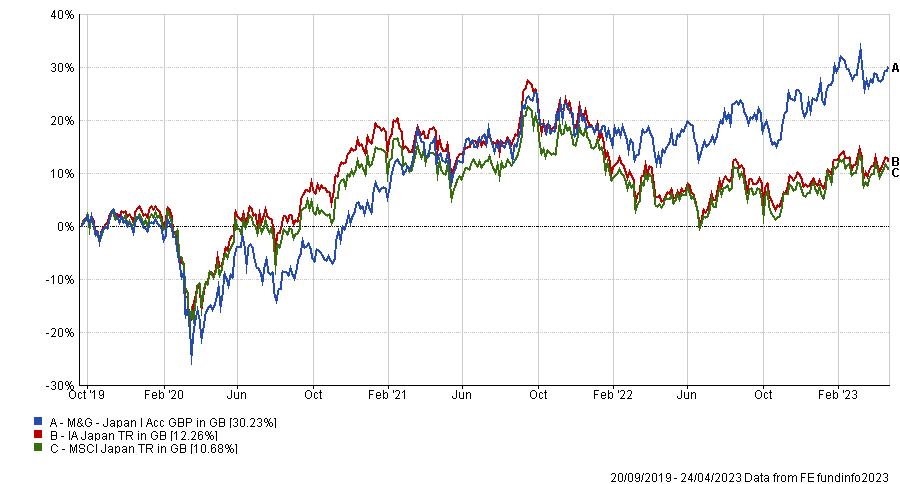

Since Vine took charge in 2019, the fund has made 30.2%, three times more than the IA Japan average peer and MSCI Japan index.

Total return of fund vs sector and benchmark since manager start

Source: FE Analytics

To show its outside-the-box thinking, M&G has hired someone to help engage with corporates, because there is a huge focus on corporate reform within Japan.

“We believe that having the expertise helps to unlock value in companies. The fund is interesting – particularly if you do not know how to allocate and it is what we use where we have portfolios with only one fund in the region,” said Sweeney.

The final part of the portfolio is a 10% allocation to something away from equities – infrastructure. However, this recommendation came with a caveat.

Nowadays, people have moved away from traditional infrastructure such as airports and toll roads and have branched out into satellites, internet cabling and other tech-led areas.

“What has happened over the past five-10 years you have had a proliferation of what people are calling infrastructure. People are changing the name. Satellites or cabling in the ground – is that infrastructure? Yes it is, but it is not essential,” he said.

“This infrastructure is more correlated to equities and less to bonds, whereas essential infrastructure is more like fixed income and in a period of economic stress you are buying infrastructure to diversify your portfolio. As an allocator I want downside protection.”

As such, he stayed close to home with his final pick, suggesting the Marlborough Global Essential Infrastructure fund, run by Australian infrastructure specialists Ausbil.

“It has a history of investing in the asset class in things like railroads, ports and airports,” he said, which are more defensive than newer areas of the market.

“The reason so many people want to invest in it, if you build an airport and lease it to the government, you are doing so for a long time, which gives you visibility on the cashflow, which means when you hit a period of instability the price doesn’t fluctuate much.”

The fund was launched in September 2022, so has little track record, but since inception has made 9% while the average fund in the IA Infrastructure sector has lost 5.1%.