Once upon a time, a balanced approach meant weighting a portfolio 60% to equities with 40% in bonds – but nowadays that portfolio is no longer viable as the latter part of the equation could be in trouble.

Bonds have risen for much of the past 30 years, and with fixed income yields either negative or extremely low, alternatives are needed.

Some stocks too look expensive and with central banks raising rates – a negative for both bonds and the high-growth tech companies that have driven markets over the past decade – investors might wish to diversify their portfolios.

As such, Trustnet asked five fund pickers for their top recommendations for 2022 that would suit the wide cross-section of investors that sit in the ‘balanced’ category for risk.

Monks Investment Trust

First on the list is Monks, which Canaccord Genuity Wealth Management investment analyst Kamal Warraich said was “Scottish Mortgage’s more conservative stablemate”.

“This might raise eyebrows under the disruption banner and it doesn’t make the news as often. But the trust typically invests the bulk of its assets into ‘rapid growth’ companies – described as innovators attacking existing profit pools, or early-stage businesses with vast growth opportunity,” he said.

The trust has fallen to the bottom-quartile over the past year, making just 1.4% versus an 11.5% return from the average peer in the sector and 20.1% gain from the FTSE World benchmark index.

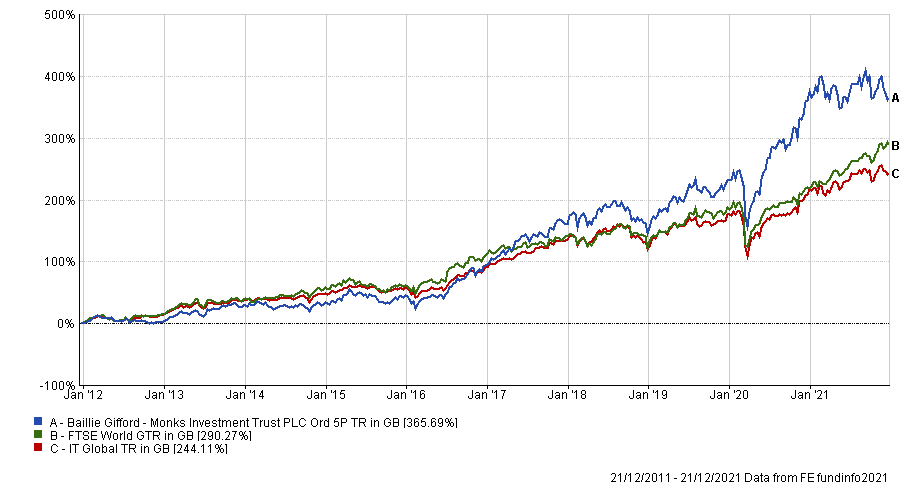

However, over the past decade Monks has been the third-best performer in the IT Global sector, returning 365.7%, as the below chart shows.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“The trust is diversified across a number of sub-themes, regions and stocks and performance has been good over the long term,” Warraich said.

Ninety One Global Environment

Staying with the global theme, Tertius Bonnin, assistant portfolio manager at EQ Investors, highlighted the Ninety One Global Environment fund managed by Deirdre Cooper and Graeme Baker.

“This provides exposure to perhaps some of the most exciting listed companies in the journey to net zero by 2050,” he said.

“With the decarbonisation topic really brought into the fore following COP26 in Glasgow, we think this strategy’s focus on companies whose products and services provide solutions to renewable energy, electrification and resource efficiency is extremely well placed to benefit from the ever-blowing tailwind that is catapulting portfolio companies into dominant market positions.”

The $1.3bn (£1bn) fund has had a strong start to life, having launched in February 2019, returning 95.9%, almost double the 51% return of the MSCI ACWI index over that time.

Performance of fund vs benchmark since launch

Source: FE Analytics

Mid Wynd International Investment Trust

William Heathcoat Amory, head of research at Kepler Trust Intelligence, also went global, choosing the Mid Wynd International Investment Trust.

“It offers investors a ‘balanced’ solution to global equities, in the sense that its managers aim to balance their portfolio’s allocation across a range of different thematic buckets in a risk-conscious manner,” he said.

“The managers target high-quality growth opportunities and pay particular attention to the downside risk of their investments, aiming to protect their shareholders from the worst of market downturns – though this is by no means an absolute return strategy.”

Over the past decade, Mid Wynd International has beaten the MSCI World index and average IT Global peer, returning 330.4%, as the below chart shows, ranking it in the top quartile of the sector. It has also achieved this feat over one, three and five years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“The fund is likely, in our view, to be better equipped than most of its peers to cope with volatility surrounding the current Omicron crisis,” Heathcoat Amory said.

Janus Henderson European Focus

Turning to regional funds, Chris Metcalfe, investment director at IBOSS, selected the Janus Henderson European Focus fund. Europe has been in the doldrums for much of the past decade as investors have bemoaned its lack of technology and high-growth companies, but over the past year the market has been resurgent.

Metcalfe said the discount of European equities to their US peers has “never been greater”, adding that within Europe there are some growth companies, but they have not had the same recognition from investors as their American counterparts.

However, he warned that these stocks looked “increasingly vulnerable” as “even the ECB is becoming marginally less dovish”. Rising interest rates would hit high-growth stocks hardest, as their future earnings would be benchmarked against a higher discount rate.

“A fund we particularly like in this changing environment is John Bennett’s Janus Henderson European Focus fund. He manages without a particular style bias, and this flexibility will be key in 2022,” said Metcalfe.

Indeed, the fund has made 316.9% over the past decade, beating both its FTSE World Europe ex UK benchmark and the average IT Europe peer.

“Many different factors will collide, including inflation, the pandemic and the reaction function of the ECB, all impacting stock valuations but where we currently have limited visibility,” Metcalfe added.

LF Gresham House UK Multi Cap Income

Last up, Rob Burgeman, investment manager at wealth manager Brewin Dolphin, said he would back the domestic UK market.

“As the UK exits Covid and life returns to whatever normal looks like then, we are optimistic about the outlook for the UK economy,” he said.

One way of capturing this is through medium- and smaller-sized companies, he added, where the LF Gresham House UK Multi Cap Income fund invests.

“Manager Ken Wotton has established a strong record and the fund has little exposure to the types of stocks held by traditional UK funds,” he said.

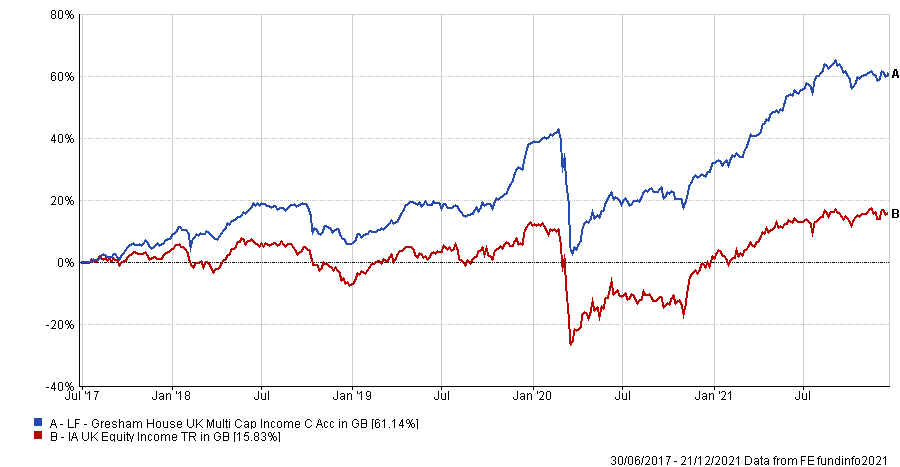

Since its launch in 2017, the £178m fund has made a total return of 61.1%, more than four times that of the average IA UK Equity Income fund, which made 15.8%.

Performance of fund vs sector over 10yrs

Source: FE Analytics

“Wotton actively avoids capital-intensive companies whose prospects are largely determined by the macroeconomic cycle, making for a market-neutral-to-low beta, which results in good downside protection in risk-off markets,” said Burgeman.

“But the team have also delivered attractive alpha in rising markets driven by stock selection and a focus on valuations which can lead them into more cyclical quality names that benefit to a greater extent in rising markets.”

| Fund | Sector | Fund size | Manager name(s) | Yield | OCF | Gearing | Discount/Premium |

| Mid Wynd International Investment Trust | IT Global | £526m | Simon Edelsten, Alex Illingworth | 0.76% | 0.69% | 0.0% | 2.0% |

| Monks Investment Trust | IT Global | £3,216m | Spencer Adair, Malcolm MacColl | 0.15% | 0.43% | 1.8% | -1.8% |

| Henderson European Focus Trust | IT Europe | £345m | John Bennett, Tom O'Hara | 2.05% | 0.80% | 3.1% | -9.2% |

| LF Gresham House UK Multi Cap Income | IA UK Equity Income | £178m | Ken Wotton, Brendan Gulston | 3.74% | 0.86% | N/A | N/A |

| Ninety One Global Environment | IA Unclassified | £967m | Graeme Baker, Deirdre Cooper | N/A | 1.00% | N/A | N/A |