Investing with environmental, social and governance (ESG) principles has changed the asset management industry in recent years, with more investors deciding to do good with their money.

But the definition of ESG is still elusive and James de Uphaugh, FE fundinfo Alpha Manager of the Edinburgh Investment Trust, said these principles wax and wane as recent changes of view on different industries illustrate.

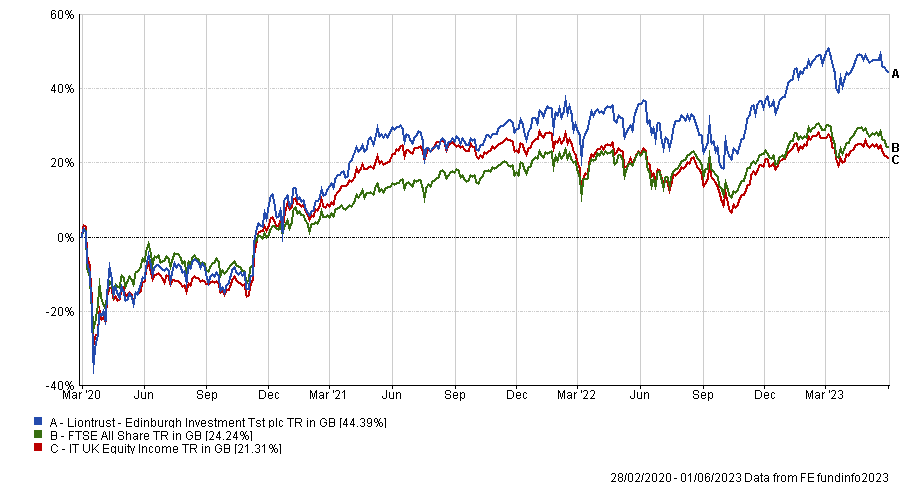

The four FE fundinfo Crown-rated trust has just released its three-year results, which prompted Investec to put out a ‘buy’ note as “the company can now demonstrate an impressive medium-term performance record”, ranking nineth out of an extended peer group of 92 IT UK Equity Income trusts since March 2020.

The £1.1bn trust’s discount has moved from the mid-teens to the current 7%, while the debt has also been refinanced, moving from a high coupon to “a stellar number” of 2.4% on an average of 25 years.

Performance of fund since March 2020 against sector and index

Source: FE Analytics

Below, de Uphaugh discusses why banks and defence companies are seen as improving their ESG credentials and why the UK is much better than the US at “responsible capitalism”.

Can you describe your process?

We are looking to achieve a good total return through a mix of capital and income through an active portfolio with a high-conviction range of stocks. We select companies by deep fundamental analysis that is ESG-aware.

What do you mean by ‘ESG-aware’?

Long-term investors like us need to be very sure that a company is calibrating its profits in a way that works for all stakeholders and societal inputs.

ESG is not a static thing and ESG signatures wax and wane, as illustrated by people's change of view on the international energy companies.

The banks’ signature is also waxing, as in improving. Through Covid they were seen to be purveyors of good through loans – agents to get loans to small and medium enterprises.

We need to spend a lot of money in emerging markets in order to transition as a world. If you think about what HSBC and Standard Chartered do, they’re ringmasters for many of these big projects.

What was your best call in the past 12 months?

The best would probably be BAE Systems, which contributed 1.2%. The reality is we now know that to fight a conventional land war requires a depth of stock and munitions that defence forces didn't have prior to this [war in Ukraine].

BAE Systems’ short-term order book is strong and its medium-term and long-term order books are strong because we're also seeing changes in the geopolitical order. Defence spending projections are going up in France, Germany and Poland as well as Japan and Australia, which speaks to the longer duration behind BAE Systems.

The company was involved in the new nuclear-powered submarines that the Australian navy is looking to bring in in mid next decade and also in the development of next-generation fighters with Mitsubishi.

Investors generally like depth, breadth and length of order book and defence has that now, because of the geopolitical change.

Do you expect the defence sector to increasingly come off investors’ exclusion lists?

There is a bit of a gradual reappraisal going on. The likes of BAE sells under democratic government contracts to other mainly democratic governments. In the case of nuclear, there is political consensus here in the UK around continuing with nuclear weapons. There are obviously areas that are beyond the pale and that is indiscriminate munitions such as cluster munitions, but BAE Systems doesn't do that. When you take a step back, the reality is that to avoid conflict, you need to be strong.

What do you make of the anti-ESG reaction in the US?

The US at the moment is in the early phases of an election cycle and is unusually polarised on that front. This is being used as a lightning rod to a degree and it actually speaks to an advantage of the UK at the moment, as we're one of the few countries that doesn't have a populist on the ticket. We've done an experiment with extremes, with Corbyn and Trussonomics, and now whatever happens in the 2024 election, it feels like the outcome is going to be more centrist.

In the UK equity market, corporates have also incorporated what we call ‘responsible capitalism’ from an early phase and so they are much better on that in a way. If you think about Exxon versus Shell, Exxon has moved much later than Shell, for example.

And what about your worst call?

The worst would be probably Ascential, which has been growing a business that FMCG [fast-moving consumer goods] players use to work out their competitiveness on the digital shelf, so through Amazon and the like. It gives those players like Unilever or Glaxo the ability to see how their market shares are moving. It's a business that's been growing by acquisition and the growth rates in that arena are not as strong as they were, so that piece has been off the boil.

They also have businesses like WGSN, which has moved out of predicting trends for clothing and fashion in the year ahead. Although this part of the business is doing well, the digital shelf piece slowing was enough for the shares to come off a bit and it cost the trust 0.6% of negative contribution.

They've announced a strategic review to realise value for shareholders, so we still hold that stock.

What do you do outside of fund management?

My family puts up with me; I keep relatively fit, so I run and play some pretty average tennis.