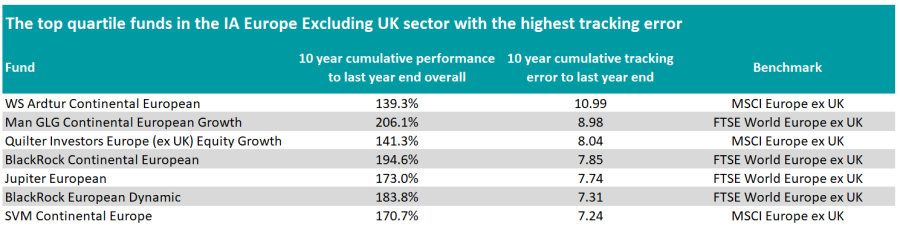

Seven European equity funds managed to deliver top quartile returns in the past 10 years by ignoring their benchmark and offering something significantly different.

Research by Trustnet identified funds with a high tracking error that beat their benchmarks and sit in the top quartile of the IA Europe Excluding UK sector. We ruled out funds that use their sector as a benchmark.

Man GLG Continental European Growth has been the best performing benchmark-agnostic fund in the IA Europe Excluding UK sector, returning 206.1% to investors over 10 years (to 31 December 2023) with a tracking error of 8.98.

Managers Rory Powe and Virginia Nordback invest in established European leaders but also in emerging winners in both new and existing industries.

The fund is concentrated, with the top 10 holdings accounting for over 60% of the portfolio, according to FE Analytics.

Analysts at FE Investments said: “This top-heavy weighting can lead to greater volatility if several of its companies fall at the same time, and as such the fund is a punchy way to invest in Europe. Powe is a dedicated investment manager who learns from any mistakes and, although the starting point of a qualitative screen is unusual, it shows the manager’s dedication to the bottom-up process.

“The emerging winner’s bucket of the portfolio has acted as a drag on performance, starting from 2021. To react to the change in interest-rate environments, the portfolio manager has significantly decreased the exposure to these names, which continue to sit at its lowest level. The fund has been a consistent performer through time but is best suited to a patient, long-term investor as it will be subject to bouts of volatility.”

Two funds from BlackRock – BlackRock Continental European and BlackRock European Dynamic – also made it to the list.

Analysts at Rayner Spencer Mills Research (RSMR) suggested using the former as a core European ex-UK fund, while the latter would be more suitable for investors seeking higher alpha.

Jupiter European, managed by FE fundinfo Alpha Manager Mark Heslop and Mark Nichols, is another top quartile fund with a high tracking error.

The managers look for companies with strong business models, benefiting from drivers of secular growth and boasting sustainable returns on capital.

Heslop and Nichols gain exposure to secular growth opportunities based on trends such as demographics, emerging wealth, the environment, consumer behaviour and data/digitalisation.

Analysts at RSMR suggested using Jupiter European as a complement to a tracker of a more benchmark-aware fund.

Source: FE Analytics

While not the best performer among the top quartile funds, WS Ardtur Continental European has the highest tracking error in the list.

It has a value bias and typically consists of 20 to 30 positions. It is also one of the few funds in the IA Europe Excluding UK sector that has ‘ticked all the boxes’ since 2021, scoring well against a variety of performance and risk metrics.

Further top quartile funds that have strayed from their benchmark in the sector include Quilter Investors Europe (ex UK) Equity Growth and SVM Continental Europe.

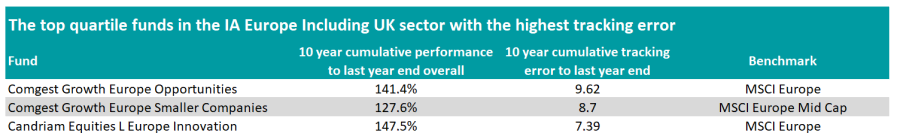

IA Europe Including UK

Three funds have achieved the same feat in the IA Europe Including UK sector, including two portfolios from the Comgest stable: Comgest Growth Europe Opportunities and Comgest Growth Europe Smaller Companies.

The former fund invests in European companies capable of delivering above-average quality earnings growth that FE fundinfo Alpha manager Franz Weis and co-managers Eva Fornadi and Denis Callioni find to be attractively valued.

Source: FE Analytics

Comgest’s smaller companies fund seeks to identify high quality and growing small- and mid-cap businesses.

Analysts at Square Mile said: “The portfolio can have some sizeable positions at the stock, sector and country level. This can be a double edged sword at times, as the concentration in the portfolio can be a good thing when stock selection is working right.

“However, it can also add to the fund's volatility, already an inherent feature when investing in smaller companies, as usually the share price performance of smaller companies is more volatile than their larger peers. They are also more vulnerable to sharp declines during weaker periods.

“More broadly, we would expect this fund to do well when the growth style is in favour, but lag in more value or cyclically driven markets.”

Finally, Candriam Equities L Europe Innovation has been the best performing of the benchmark-agnostic top quartile funds in the IA Europe Including UK sector.