March was dominated by defensive vehicles,, data from FE fundinfo shows, as investors avoided unnecessary risks despite a series of positive news around the state of the UK economy and the anticipation around the possible end of monetary tightening.

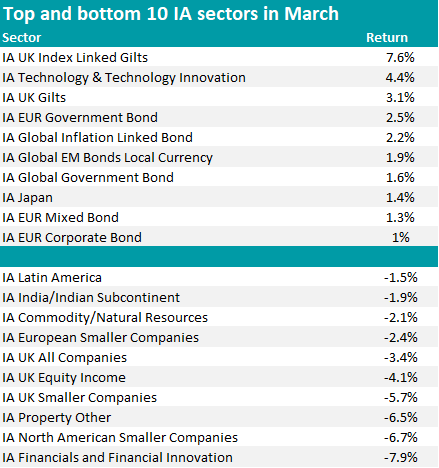

Starting with fund sectors, the top 10 was dominated by fixed income, with the highest return of 7.6% achieved by the IA UK Index Linked Gilts sector. IA UK Gilts came in third position at 3.1%.

Ben Yearsley, director of Fairview Investing, explained that investors “digested the fallout from Silicon Valley Bank and Credit Suisse and implied that rate rises were close to a thing of the past”.

“It was clearly a fixed interest month, with the Euro Government Bond and Global Inflation Linked Bond sectors also in the top five,” he said.

Technology stocks, which returned 4.4%, came in second-best.

“On the back of the Nasdaq gains, the tech sector also performed strongly last month. Gains would have been greater but for sterling’s strength,” said Yearsley

The only other equity sector to make the list was IA Japan, with a gain of 1.4%.

Perhaps unsurprisingly, the worst performers were in the IA Financials and Financial Innovation sector, which made losses for -7.9%.

“With two mainstream banks essentially going bust, and the Fed and other central banks having to put emergency funding/liquidity measures in place, even healthy financial stocks were put under pressure,” said Yearsley.

Among the most significant underperformances were smaller companies in North America (-6.7%), the UK (-5.7%) and Europe (-2.4%), which, according to Yearsley, was also related to the banking scare, as “lots of small regional banks can be found here as well as companies reliant on funding from them”.

The third-worst sector, IA Property Other, is also often viewed as a financial, and fell 6.5% as investors speculated about debt re-financing issues.

Source: FE Analytics

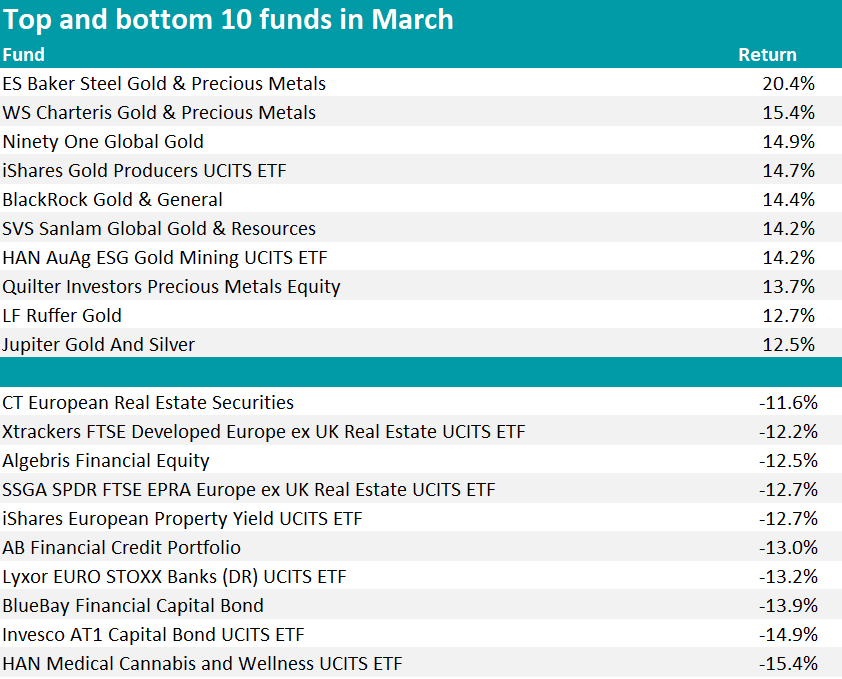

Turning to single funds, gold and precious metals were the clear winners, with the top-10 completely overtaken by funds and exchange-traded funds (ETF) that invest in these commodities. ES Baker Steel Gold & Precious Metals was the top performer, with a return of 20.4%, while other strategies, including those managed by Ninety One, Quilter, Ruffer and Jupiter made the table with returns starting from 12.5%.

Further down the list, the patterns seen at the sector level start to repeat, with bond and technology funds making their appearances. Blackrock Institutional Bond Index Linked and iShares S&P 500 Information Technology Sector UCITS ETF made 9.6% and 8.5%, respectively.

Financials and banks are heavily present at the foot of the list, with a mix of both financial bonds and equity. Real Estate also performed poorly, but the worst, with a return of -15.4%, was the HAN Medical Cannabis and Wellness UCITS ETF.

Source: FE Analytics

The trusts universe lacks fixed interest and bond sectors, which is why the indication of a risk-off month is often a wide performance differential, explained Yearsley. The list is therefore an “esoteric blend showcasing how different the structure sometimes is”.

The best-performing sector, returning 2.9%, was IT Farmland and Forestry, which, however, only contains one trust. Venture capital fared well, with environmental, health and biotech and generalist strategies making 2.6%, 1.1% and 0.5%, respectively. Outside of private equity, however, similar sectors, like IT Biotechnology & Healthcare (-8.5%) lost money instead.

The third-best sector was IT Insurance & Reinsurance Strategies, which only contains three vehicles. IT Global Emerging Markets (1.8%) and IT Technology & Technology Innovation (1.2%) also stood out.

Similarly to funds, property and smaller companies were in red territory.

Source: FE Analytics

On a trust level, Catco Reinsurance topped the tables with a gain of 23%. It was closely followed at 21.8% by the recently renamed JPM Emerging Europe Middle East & Africa – it was the JPM Russian Securities trust, as Yearsley noted.

The bottom the table was a mixed bag, with Triple Point VCT 2011 falling the most by 50%. Among the portfolios that fell the most were also European property, infrastructure and renewable energy strategies.