US banks have been joined by those in Germany, France and other European nations as being the worst hit in the ongoing sell-off spark by the collapse of Silicon Valley Bank (SVB), FE fundinfo data shows.

Global stocks have sank in recent days after a series of problems at SVB – which focused on lending to technology start-ups and venture capital firms – caused a run on the bank. At the heart of the problem was the fact that the bank’s holdings of US bonds had fallen in value because of rising interest rates.

Customers tried to withdraw $42bn of deposits in the panic over the health of the company and SVB ran out of cash, representing the biggest failure of a US bank since the financial crisis in 2008.

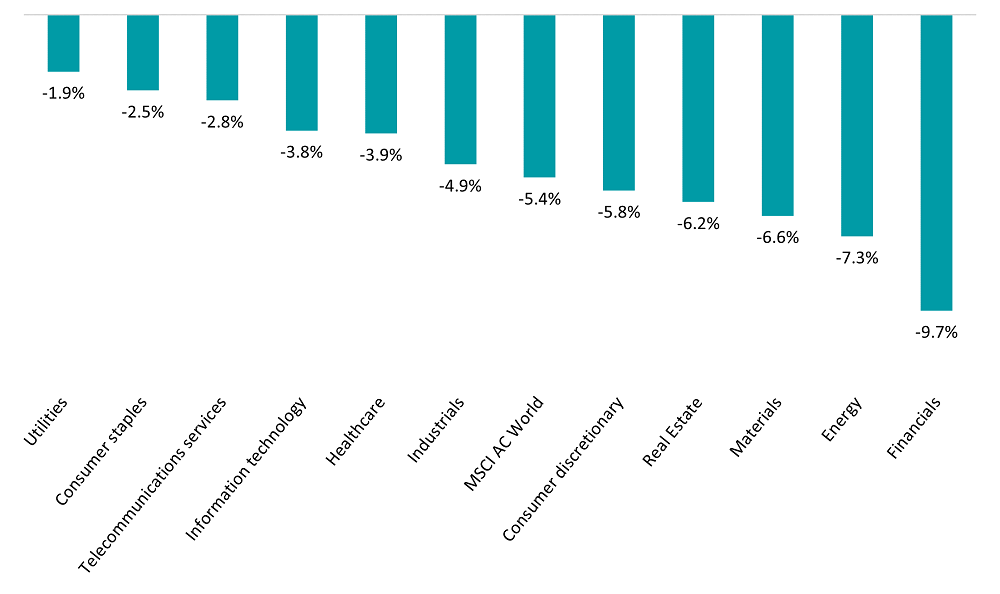

A rescue deal for customers of SVB has been agreed in the US, while HSBC has announced it was buying its UK arm for £1. However, the collapse has sparked a rout in global stocks markets – the MSCI AC World index is down 5.4% in a week – led by financials.

Performance of global stock sectors since 6 Mar 2023

Source: FinXL

Andrew Johnston, investment director at Square Mile, said: “Whether this will be enough to calm markets is yet to be seen and they remain, especially banking shares, under pressure. We take some comfort from the fact that the fall-out seems fairly contained. Most other banks do not appear to carry the same level of asset-liability mismatch and the authorities have acted swiftly.

“Bad risk management has undoubtedly played its part in this instance. Nevertheless, events such as this are also examples of the unforeseen consequences that rapidly tightening monetary conditions can cause. This may therefore give central banks something more to consider, especially the pace of the current interest rate hiking cycle.”

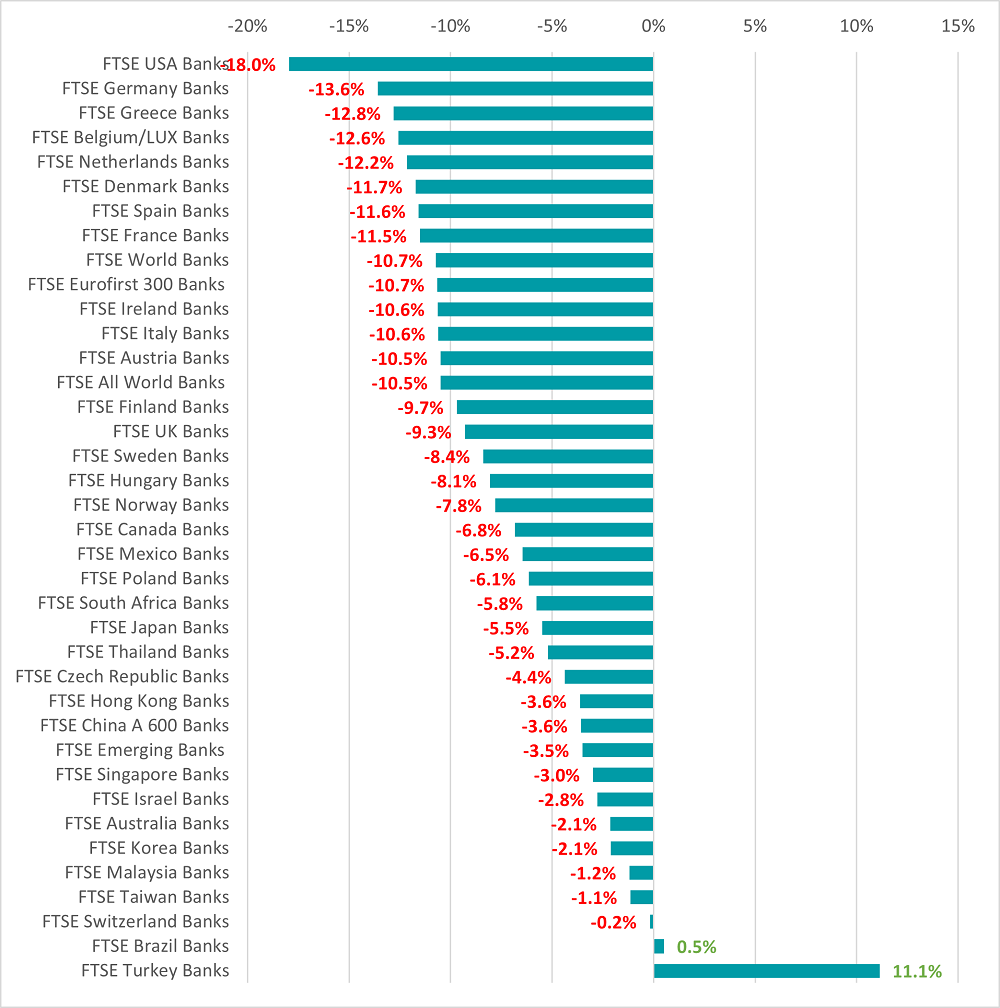

Banks around the world have been at the centre of the sell-off and the FTSE All World Banks index is down 10.5% since Tuesday 6 March, just before the problems at SVB hit the headlines.

As would be expected, those in the US have borne the brunt with the FTSE USA Banks index down 18%, However, Germany, Belgium/Luxembourg, the Netherlands, Spain and France are among those that have fallen further than the global banks index.

The FTSE UK Banks index, meanwhile, has dropped 9.3% over the past week. Only two banks indices have made a positive return over this period: FTSE Turkey Banks, up 11.1%, and FTSE Brazil Banks, up 0.5%.

Performance of global banks indices since 6 Mar 2023

Source: FinXL