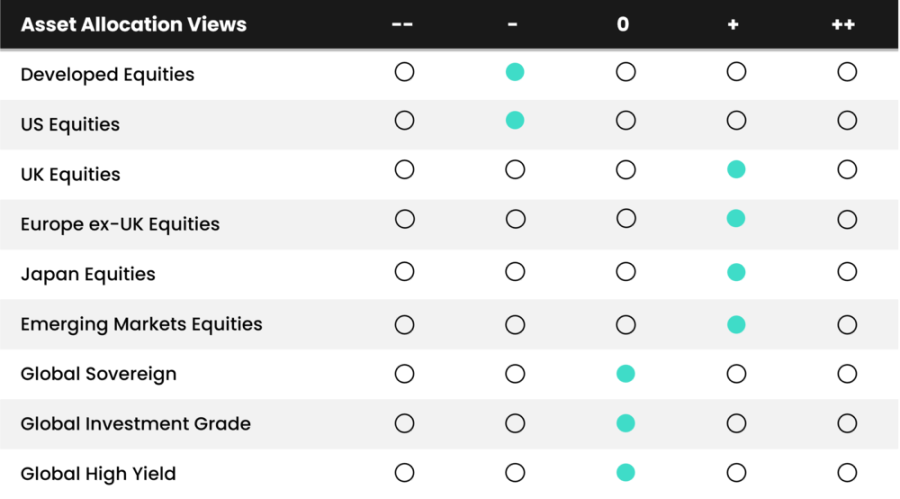

St James’s Place (SJP) has softened on high yield bonds and emerging market equities, choosing to go overweight non-US developed markets, according to the latest quarterly update from chief investment officer Justin Onuekwusi.

Yet SJP remains underweight developed markets as a whole, largely thanks to its lack of conviction in the US, where Onuekwusi believes companies are “richly valued”.

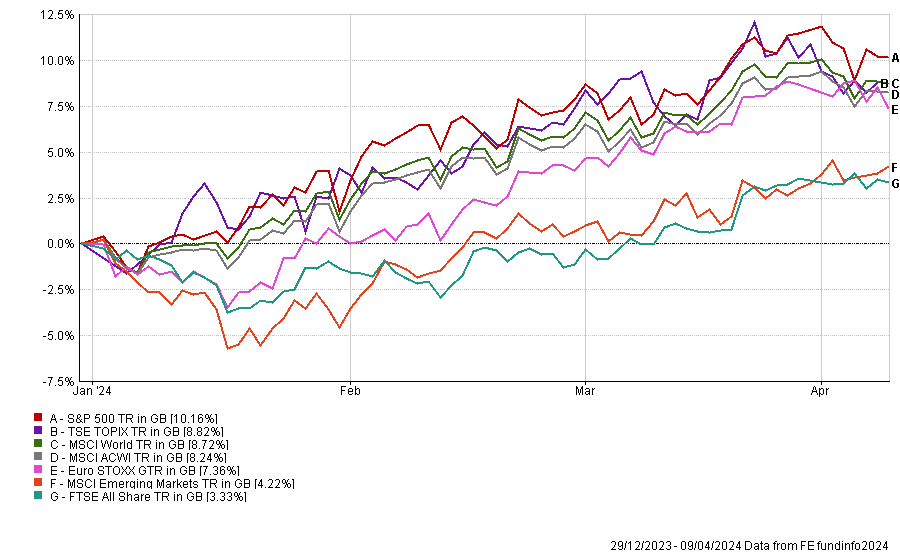

It is the only part of the stock market where the firm is underweight, despite its continued dominance. So far this year, the S&P 500 is up 10.2%, leading all major equity markets. Japan’s TSE Topix index is in second with 8.8%, while at the bottom of the list the FTSE All Share has made just 3.3%.

Performance of indices over YTD

Source: FE Analytics

“A key tail risk we see as problematic is the gap between the US deficit and unemployment rate, risking heightened US bond market volatility, which could spill over into the gilt market. It is also worth noting, albeit cautiously, volatility on average tends to be higher in US election years,” Onuekwusi said.

The chief investment officer has also softened on emerging markets. Although the firm remains overweight, this has come down slightly.

Source: St James’s Place

Here the purchasing managers’ index (PMI) remains “higher than the developed market aggregate”, while “lower inflation and upcoming US rate cuts should continue to support overall emerging market growth”.

In particular, there are moves being made in the largest emerging market – China – where the government is adding stimulus, although he had concerns about the accuracy of the data coming from the country.

“The Chinese authorities recently confirmed the 5% GDP target and 3% inflation target. Given the absence of consistent data, we face challenges in accurately measuring China's GDP,” he said.

“This means we may never know whether the target has been achieved. Nevertheless, the focus is moving away from the traditional manufacturing sector and more towards high end tech and artificial intelligence. This is likely to be a big structural theme in coming years.”

Yet he has toned down his optimism, preferring to diversify across other global developed equities (ex-US) such as Japan, Europe and the UK.

“Although emerging market equities have the highest mean expected return over a medium-term horizon, the range of outcomes is wide and exposure to idiosyncratic risks relatively high,” said Onuekwusi.

“Given all major developed equity markets offer a significant valuation discount to the US, it is prudent from a diversification perspective to spread our active risk.”

He has also reduced a previously overweight position in high yield after reducing global developed equities (ex-US).

“Following a contraction in global high yield credit spreads, we propose closing the overweight position in this asset class, which is funded by a modest underweight to global equities,” the CIO said.

“Although the yield-to-worst of the high yield market relative to equities appears attractive, this is driven by rising sovereign bond yields. The reward for assuming lower quality credit risk at this junction does appear slight.”

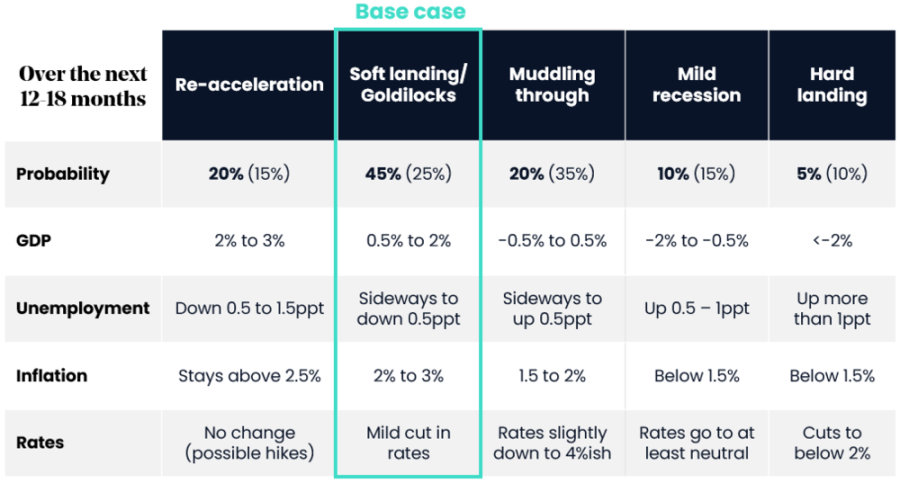

A final major change has been on the economic front, where Onuekwusi is more bullish based on improving economic data.

Previously, the SJP chief investment officer believed GDP and unemployment would be flat, while inflation would fall to below 2% and interest rates would sit around 4% - the ‘muddling through’ part of the table below.

However, this has been changed to the ‘soft landing/Goldilocks’ part of the table, with GDP growing (albeit slowly), unemployment flat – or potentially slightly dipping – inflation between 2% and 3% and only mild rate cuts.

Source: St James’s Place

“Our base case is that the economy moves broadly sideways (around trend growth). Central banks have some work left to do on inflation but once rate cuts begin, they should be able to be more aggressive. Further ahead, elections this year keep uncertainty high, especially on fiscal policy,” he said.

“The US economy has continued to perform well, and recession risks have receded further. As such, we believe the base case is now a more positive ‘soft landing’ where growth moves broadly sideways, unemployment stays low, and inflation gradually moves closer to target. This is in line with consensus.”

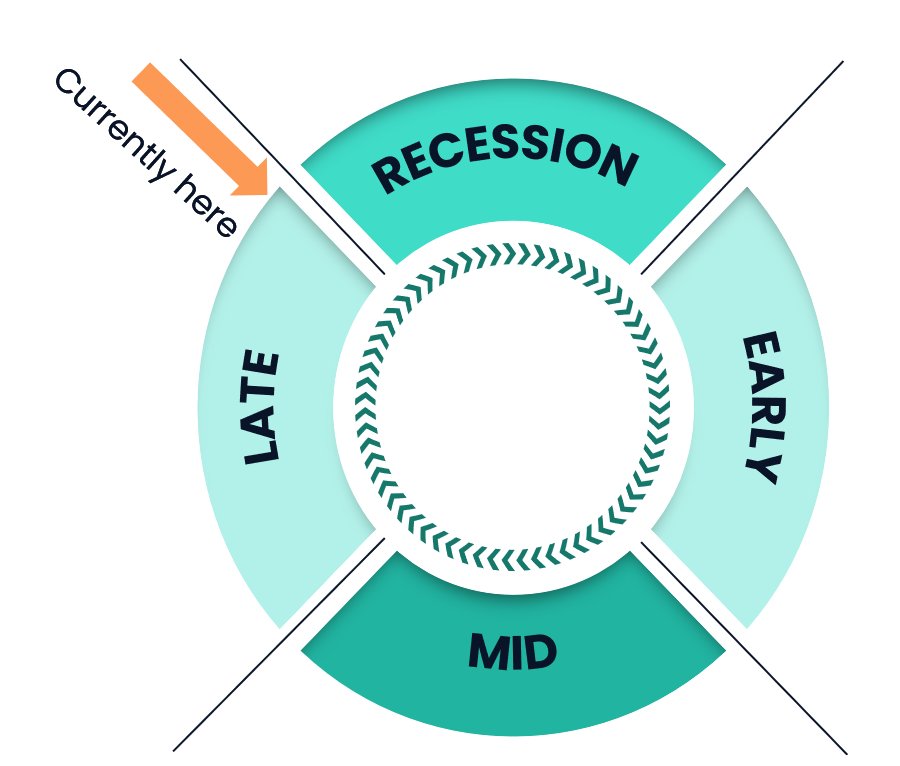

While this could be viewed as positive for equities, there is some concern around the market cycle, which he believes we are in the latter stages of.

Source: St James’s Place

“Investing late cycle is always difficult. Historically, risky assets perform well in this period, however, volatility can increase as markets assess the likelihood of a recession. We have a neutral view on equity risk but have a bias away from richly-valued US assets,” he concluded.