It has been a disappointing start to the year for investors in the Finsbury Growth & Income Trust and WS Lindsell Train UK Equity fund, which have made a loss of 2.4% and 2.5% respectively so far in 2023.

Yet FE fundinfo Alpha Manager Nick Train believes there were positives as well as negatives for his quality-growth strategy between January and March.

What didn’t work in the first quarter was luxury, particularly companies exposed to the Chinese consumer, he said in the trust’s latest monthly factsheet.

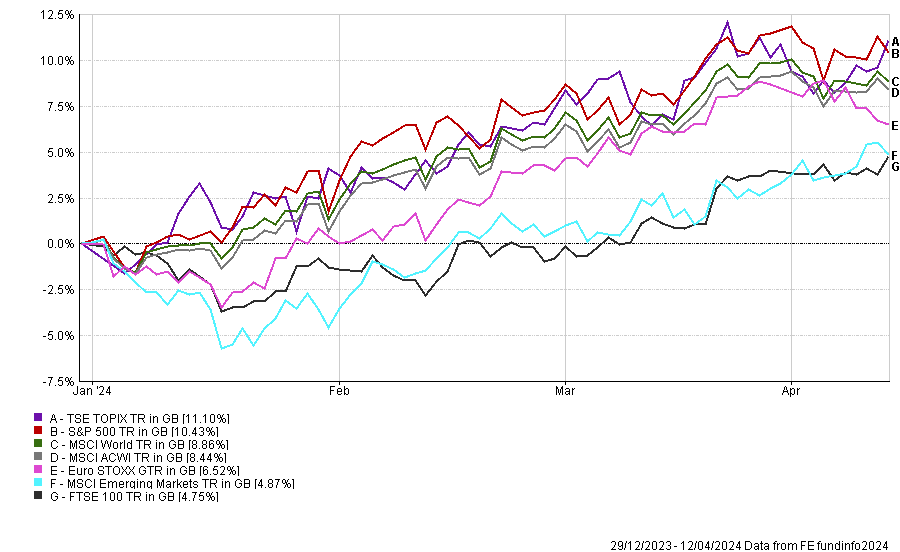

Performance of fund and trust vs sectors and benchmark over YTD

Source: FE Analytics

“Our worst performers were Burberry and Remy Cointreau, both down well over 10%, both with important franchises in Asia and greater China,” he said. “It is frustrating to note that the two are now trading at below half the peak share prices they set in 2023 (Burberry) and 2022 (Remy).”

China has been a contentious area of the market since Covid as the country emerged from lockdown much later than most of the rest of the world. It has also suffered myriad issues surrounding its property sector as well concerns over government intervention in areas such as tech.

However, of more concern to luxury companies is the trend of Chinese consumers preferring domestic products to foreign goods – a change that has taken place since in recent years.

“What has undermined them [Burberry and Remy] has been justified concerns about weakening Chinese demand for western luxury products,” said Train, although he noted that “we must hope these big share price falls have created future opportunity”.

“We know both companies continue to invest behind their brands in the region and that one day growth and consumer confidence in Asia will recover.”

Diageo has also been a poor performer over the quarter. Last week Liontrust’s Anthony Cross said the “jury was still out” on the company after stocking problems in Latin America led to a profit warning.

Train said Diageo’s premium spirits portfolio marginally underperformed during the quarter, with a gain of 3.5%, but noted that the firm was able to reassure investors that its problems in Latin America are easing. “Many, including us, now hope for an improvement in its sales performance elsewhere,” he said.

Asset managers also struggled in the first quarter, with Schroders down 9% and Rathbones also trailing.

“We understand the reasons the industry is out of favour, but believe the companies we hold have differentiated and winning strategies and, as a result, their share prices have become undervalued,” said Train.

“For instance, Schroders has a clearly-articulated and patiently executed strategy to shift its business mix to higher growth and higher margin segments, such as private wealth and private equity, and the strategy is clearly working. If the company can deliver even a smidgen of secular growth then that rating and share price could change meaningfully for the better.”

It was not all doom and gloom however. Tech continued to do well, which the Finsbury Growth & Income Trust has access to through UK-listed data and software companies such as RELX (up 10.1%), Experian (8.4%) and Sage (9.1%).

Performance of stocks in Q1 2024

Source: FE Analytics

Train said: “A smart shareholder asked me recently – which of your holdings really has the potential to double or treble profits over the next decade or more and, as a result, become a much bigger market capitalised company and higher share price?

“My answer was that we believe in all our companies – you have to be a true long-term investor. But that amongst the large-cap holdings in the fund, it is readily conceivable that RELX and Sage have transformative profit potential ahead.”

Another in this sector, LSEG was up 2% in the quarter, underperforming the index, but “creeping back” toward its share price peak set in 2021. It is now 4% adrift.

“We hope that further business progress for LSEG and a likely final placing of the Refinitiv vendors’ stake will clear the way for new share price highs in due course,” he said.

There were idiosyncratic winners in the quarter too, such as tonic maker Fever-Tree, which was up 14% on the back of strong growth numbers in its year-end results. While Train noted the shares currently seem expensive, he said they “will look a bargain” if it can live up its potential.

Unilever was up 5% after announcing the sale or demerger of its ice-cream division, which he said “demonstrated the management’s ambition to highlight and realise the growth and value intrinsic in the group’s portfolio”.

The only meaningful change to the portfolio was Train continued to add to its newest holding Rightmove, taking its position to 3.5% of the net asset value (NAV).

“We have been able to build this position easily, because there are ready sellers at current prices. Those sellers are concerned that UK interest rates higher for longer will continue to retard the UK housing market and, in addition, that new competition may challenge Rightmove’s market share and profitability,” he said.

Last year was the lowest number of housing transactions in the UK (1 million) in a decade, but revenues were up 10% and Train noted the company is developing new products and services which “help its customers close more deals, more efficiently in a difficult market”.