Passive funds are meant to be a staple of any investor’s portfolio and putting the lot into a global tracker is an easy way to cover off diversification. Job done.

But it’s not that simple.

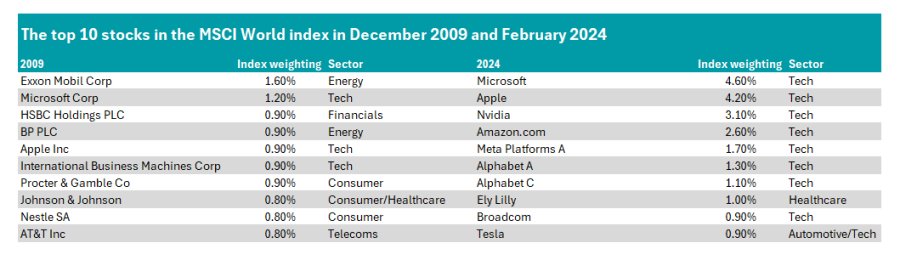

Data this week from Wealth Club shows just how overly concentrated the global market has become. In 2009, the 10 largest stocks in the iShares MSCI World ETF, which follows the MSCI World index, accounted for 9.6%. Today that figure is a shocking 21.4%.

Only two stocks remain from the top 10 of 15 years ago: Microsoft and Apple. The rest have fallen down the pecking order.

No longer present are the likes of oil giants Exxon Mobil and BP, as well as consumer businesses Johnson & Johnson and Nestle. Mobile network provider AT&T is also off the list, as is banking group HSBC.

In their place has come the tech titans, which have been on a meteoric rise over the past 15 years. Nvidia, Meta Platforms, Alphabet (twice through two different share types), Broadcom and Tesla now make up the remainder of the top 10, along with healthcare provider Ely Lilly.

Source: Wealth Club

After such a strong run of domination, it is strange to think that it was not that long ago that these companies weren’t such headline names.

But markets can be fickle. Going back even further, in 1990 eight of the world’s 10 largest companies came from Japan – today there are none from the country, which has gone through several ‘lost decades’ – only recently recapturing its market high, according to data from outgoing Columbia Threadneedle manager Scott Spencer on his LinkedIn page. In fact, the top 10 looks radically different at the start of every decade with very few remaining from one to the next.

So while it may feel like the tech giants are unbeatable and that they are only going to go rocketing, by 2030 it could be a whole new set of names dominating the headlines.

Of course, this time around it may well be different and the tech stocks may go on forever.

But just in case, investors should get diversification elsewhere. While a core passive tracker is a good start, it should by no means be viewed as a one-stop shop.

Given the massive overreliance on the tech giants, now is a great time to add specialists to your portfolio, removing some money from the big global trackers and putting cash into the more unloved areas.

Nicholas Hyett, investment manager at Wealth Club, said the good news for investors is that this is incredibly easy to do.

“Investing in a wider range of funds, especially outside of the US, will mean you aren’t as exposed to just a few companies. Investors might consider European or Asian funds, or those investing in smaller companies. That could include passive index funds or actively managed funds,” he said.

“Alternatively, you could consider funds investing in corporate or government bonds – which can help insulate a portfolio from some volatility.”

I wrote earlier this year about adding a UK smaller companies fund to my daughter’s junior ISA to diversify away from the global tracker she is invested in – something I have now done.

Meanwhile in my own ISA, I have an Asia fund co-existing with my global exposure, and I will continue to look for opportunities to add more funds when appropriate.

All investors should at least question if their portfolios are diversified enough and if a global tracker is your only holding – the answer is potentially no.