Over the past year there has been two standout areas for investors to tuck their money into: the UK market and cash. These two asset classes provided security last year at a time when most others struggled.

One area that caught the eye last year was UK income, which benefited from rising yields as well as the return to favour of the domestic market. However investors need to be careful to make sure they are getting the best available.

Indeed, about 70% of funds within the IA UK Equity Income sector are yielding less than the best-paying saving accounts available today, according to data from FE Analytics. For comparison we have used the top savings bond using data from Moneyfacts, which is currently a two-year fixed from Gatehouse Bank paying 4.45%.

The savings market is benefitting from today’s high-interest-rates environment and remains attractive despite having come slightly off the boil lately, as Trustnet recently reported.

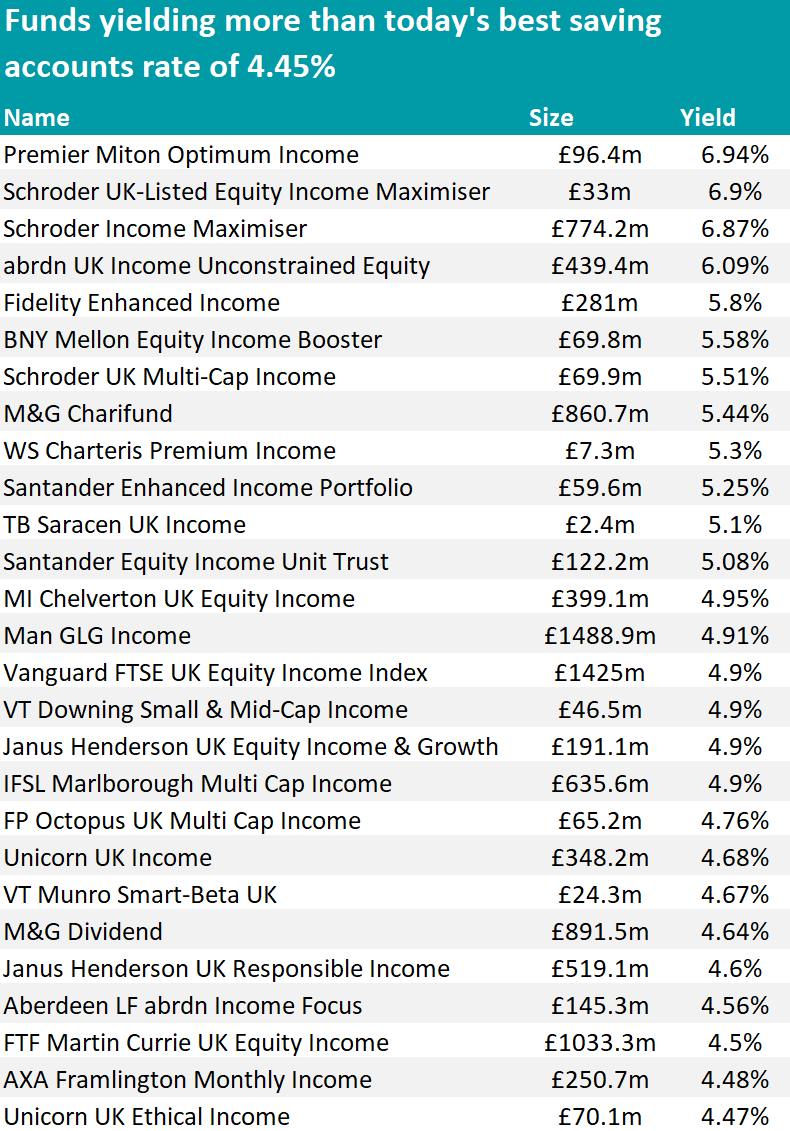

Among the 82 funds in the IA UK Equity Income sector, only 25 currently manage to beat the best savings rate, as per the list below.

Source: FE Analytics

But having acquired one of these funds isn’t a guarantee for returns, as the dividend-only return as expressed by the dividend yield is only one side of the equation.

While funds paying a higher yield might look instinctively attractive, other parameters are better indicators as to whether the fund will deliver on its promises, said Dr Ian Mortimer, chartered financial analyst (CFA) at Guinness Global Investors. In this Trustnet article, he claimed that chasing yields higher is a fool’s errand.

“In an inflationary environment, one should remain cautious of ‘high yield’ dividends,” he said.

“Return on capital, balance sheet strength and dividend growth are better indicators than dividend payment history, dividend cover and a high dividend yield.”

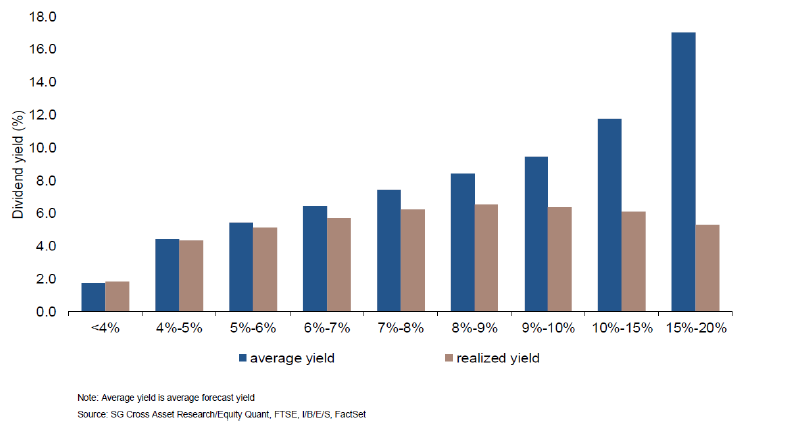

Historically, in fact, realised yields haven’t kept up with average forecast yields, as shown in the chart below. This is because absolute returns are also affected by other factors, such as underlying performance and future dividend growth.

Comparison of forecast and realised dividend yields between January 1995 and June 2022

Source: Guinness Global Investors

When taking into account the wider UK market and not only the Investment Association sector these funds belong to, it emerges that few have beaten the FTSE All Share index.

Indeed, just 24% of the IA UK Equity Income sector has beaten the index over the past year following a strong January, although this figure rises to 46% when looking at 22%.

It means that finding a fund that combine the two – above-cash levels of yield and above market total returns – has been particularly tricky. In fact, only five funds now offer higher yields than cash and can boast better returns than the FTSE All Share index in the past year.

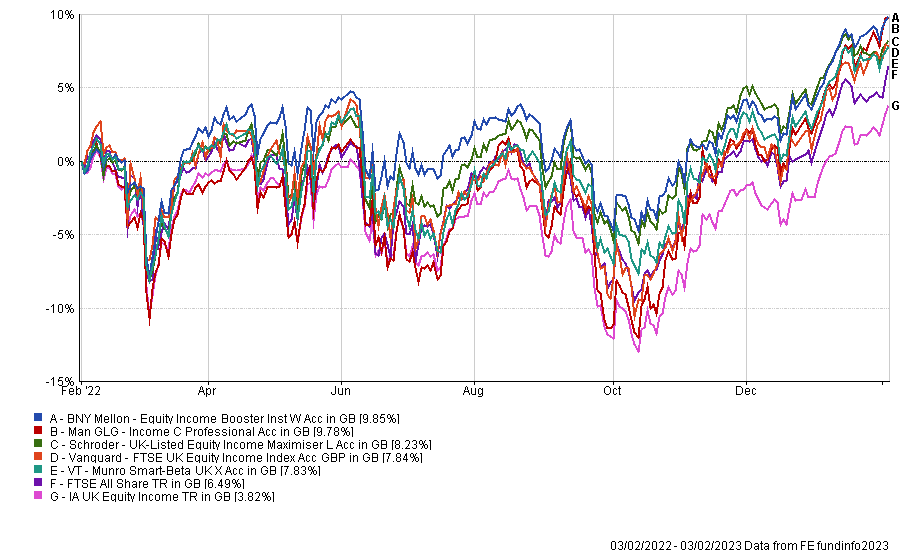

The best performer was BNY Mellon Equity Income Booster, which returned 9.9% and offers a 5.58% yield.

The £1.5bn Man GLG Income fund, which yields 4.91%, had a similar performance over one year as the previous fund, but had a better track record throughout, achieving first-quartile returns over one and 10 years and second-quartile over the three- and five-year period.

Square Mile analysts recommend it “as a complement to many UK equity investment strategies and one worthy of consideration by more benchmark agnostic investors”.

With a yield of 6.9%, Schroder UK-Listed Equity Income Maximiser is the youngest fund in the list. Launched in December 2020, it seeks to enhance the yield by investing at least 80% of its assets in a passively managed portfolio from the top 100 listed UK companies by market capitalisation.

Performance of funds against sector and FTSE All Share index over 1yr

Source: FE Analytics

Lastly, the two vehicles at the foot of the list are passive investments – the £1.4bn Vanguard FTSE UK Equity Income Index fund and VT Munro Smart-Beta UK, which aims to replicate the performance of the Elston Smart-Beta UK Dividend Index.