The Bankers Investment Trust has been a top vehicle for investors seeking exposure to global companies with both a growing dividend and return.

Trustnet found that the £1.2bn portfolio was among the top trust that grew their dividends the most over the past decade, with pay-outs to shareholders increasing by 63% over the period.

Here, long-running manager Alex Crooke – who has been at the helm of the trust since 2003 – explains why the US could take a leaf out of the UK’s book and increase company dividends.

Total return of trust vs sector and benchmark over the past decade

Source: FE Analytics

What is the objective of the trust?

We invest in equities around the world like a lot of other trusts, but we've got twin objectives to both grow capital above the benchmark and also grow dividends above inflation.

I don’t think many trusts have that commitment to investing both for growth and income, and we’ve got the longest record there behind City of London for consecutive dividend growth.

We’re a little behind because of inflation spiking last year, but we're rapidly catching up. We're forecasting a minimum of 7% dividend growth so hopefully that will get us above inflation by the end of the year.

We also have one of the lowest ongoing charges to any of their peers and that's partly because we do everything in house. F&C is probably our most direct competitor because they still do a lot in house, but most others have outsourced to different specialists.

What unifies everything is cashflow. We’re looking for companies with growing cash flows because we think that surplus cash allows companies to pay down debt, make acquisitions, grow its business and ultimately pay us dividends.

What’s driven the trust’s dividend growth?

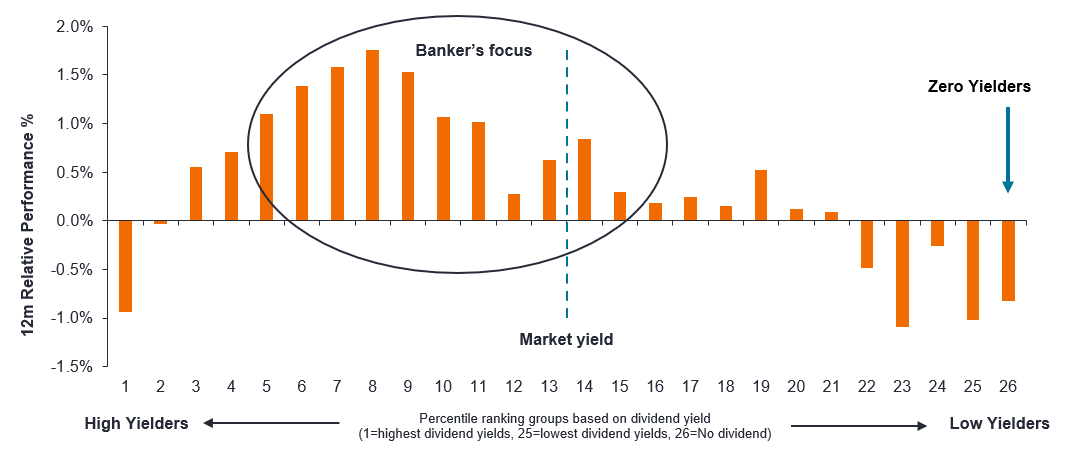

Principally, we've not chased high yield. Our overall portfolio is around 2.5% so we're not the highest yielding in the market, but we also haven't chased those stocks offering 4-5% yields where the growth is very modest.

We've prioritised companies that grow their dividend. In the US for instance, we've had a slightly lower starting yield than the rest of the market but really gone after those companies with surplus cash that they've been able to give it back to us.

Is a 4-5% yield the highest you’ll go?

There’s no hard and fast rule to exclude them, but our sweet spot is between 1-4% and if you stick in that range, you're usually okay.

Anything beyond that and you're beginning to sacrifice some growth opportunities for that big yield. We have a small allocation to utilities, real estate, oil and energy because we try not to put our money in sectors where you’re getting very low growth compensated by a comparatively high dividend.

Those very low yielding stocks can have some problems because you get businesses failing but equally the returns tail off, but then the very highest yielding stocks struggle to give you a decent total return.

It does vary by market – in the UK you’d probably be fine up to 5% but in the US and Europe you would reduce that down to 3%.

Average 12-month relative return by dividend yield ranking group over the past 40 years

Source: Bernstein Analysis

Do you like share buybacks?

The US model is that they love share buybacks but the challenge with that is when there’s a surplus of cash, often the share price is elevated. There's plenty of evidence that says US businesses are bad at buying shares back when they're cheap.

Whereas a dividend – because it's an annual thing that’s regularly – has pound cost averaging that’s returned to investors when they may reinvest at good point in the market.

The truth with share buybacks is you're flush with cash when life is good and then you buy back your shares at a very high price when it isn’t, which I don't think works so well. They do work if a company does it religiously every year, but a good dividend is typically more consistent.

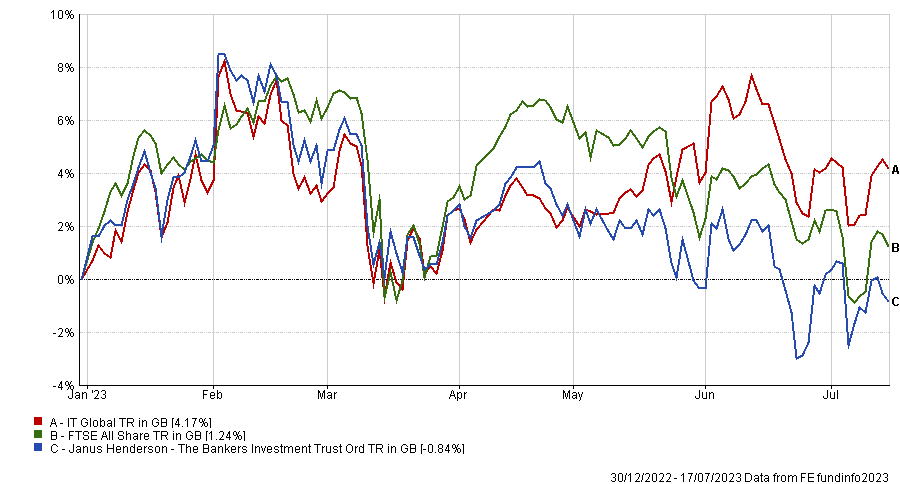

You’re down this year whilst other global trusts are making a recovery – why is that?

It's been a very narrow rally because only a handful of stocks in the US have contributed to almost all this year’s return and that’s mostly been focused around artificial intelligence (AI).

Holding Microsoft and Apple has done well for us, but they're not quite the turbocharged returns of Nvidia and others.

The rest of the market is definitely repricing on worry that a recession in the US will make things more difficult and that there’s a risk earnings are going to be falling.

That risk has been priced in to most stocks but there’s this subset of anything AI that has just gone through the roof because people think it’s the only game in town. We think some of that enthusiasm will wane as reality kicks in.

Total return of trust vs sector and benchmark in 2023

Source: FE Analytics

What has been your best performer over the past year?

Microsoft has done well for reasons we’ve discussed – that contributed 0.56% to the trust’s performance – but there’s also been Unicredit.

The banking system was expected to have a very difficult period through Covid but bad debts are not rising and those businesses look quite good as rates have been going up, so Unicredit contributed 0.37%. Banks in general have been good for us.

What were you worst performers?

On the negative side there were some healthcare names but we’re expecting that theme to do well for us over the next few months.

Olympus makes medical supplies and said it needed to reinvest more, so has got some new products coming but it’s been slow to get approval. That’s been a bit challenging but we have faith it will work well over the medium term. It detracted 0.14% from performance.

Healthcare is one area we’re very excited about and been allocating to though. A lot of doctors and nurses were very tired and needed some time off by the end of Covid, so it’s been difficult to employ them in many markets, but they are slowly coming back. I think the healthcare market is due for some decent growth in the next coming years as it gets through the backlog of procedures.

Share price of stocks over the past year

Source: Google Finance

What are your interests outside of stock picking?

I love watching sports. I played rugby for many years so that has always been my passion.