Investors who are looking for high levels of income from their portfolio might be tempted to allocate their money into whichever funds are paying the highest yields.

Currently, as equity income is back on investors’ radars, the UK’s best-paying fund is offering 7.21% but it was beaten by a global equity income strategy that yields 10.62%.

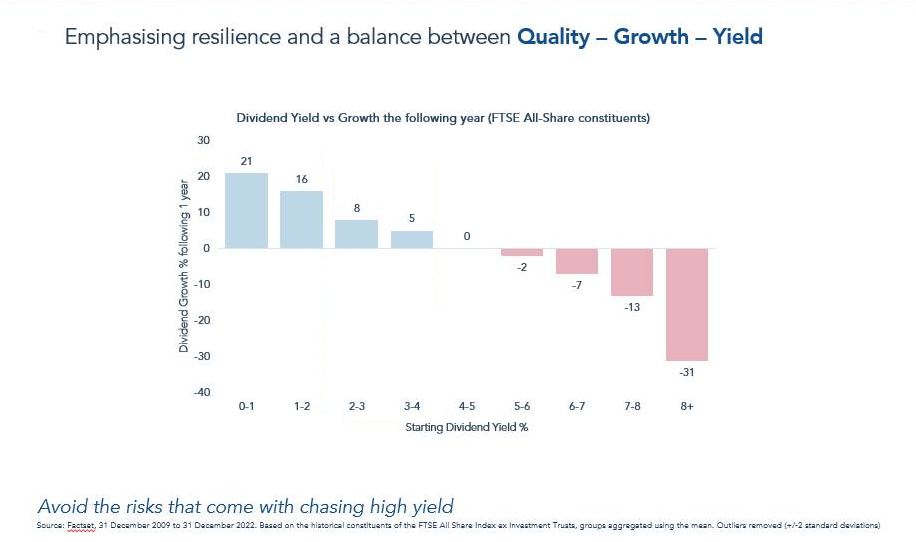

But yield isn’t everything for Blake Hutchins, manager of the £1.1bn Trojan Income fund, whose favourite chart suggests that investors will be better off backing dividend growers instead of high-dividend payers.

In his latest interview with Trustnet, he said as we can get fixed income at a decent yield, “right now is not the time to try and move into high-yielding equities”.

“Equities have already de-rated and what's going to be really important is dividend growth, not high dividend yield. Investors can get high yields from bonds now and what they need from equities is dividend growth,” he said.

Below, he shares his favourite chart to show why. With starting dividend yield on the horizontal axis and subsequent dividend growth in the following year on the vertical axis, what the columns show is that the higher the starting yield, the greater the fall in dividend growth the vehicle suffered the following year.

Troy’s dividend ‘sweet spot’

Source: Troy Asset Management

With yields above 4%, dividend growth becomes negative – meaning that yields are actually decreasing.

“I really like this chart because it shows what sets us apart from a lot of our equity income peers and illustrates a conversation that we're having with a lot of our investors who think that, given the gilt yields at 4% to 6%, they need dividend yields of the same level. I just don't agree with that,” he said.

“That would take you into a really risky area of the market, which means that you won't be getting any dividend growth – and without it, you’d be missing a long-time driver of capital growth. These areas of the market may suck some investors in for the high yields but, particularly in a more difficult economic environment, dividends will decline in this area.”

For his Trojan Income fund, Hutchins focuses on his “sweet spot” of between 2% and 4%, as history would say that picking stocks of good companies in this range will get you subsequent dividend growth of mid-to-high single digits.

“Our portfolio is bang in the middle at 3.3%. With a 3.3% starting dividend yield (and that's only on dividends, then you've got the earnings yield and the cash generation) we think we are embedding good high single-digit, maybe double-digit total return going forward,” he said.

“This is one of my favourite charts at the moment as it beautifully shows that yes, you can go through a super low dividend yield and get dividend growth, but the yields are just so low. And while you can go to high yield, that comes with a massive health warning. Instead, we stick to consumer staples, high quality industrials and software companies that are in this 2% to 4% range and can deliver compounding dividend growth, come what may.”