With rising interest rates and underperforming stock markets, investors could be tempted to turn to cash for better returns, but this has rarely been worth it, a new study by Janus Henderson Investment Trusts found.

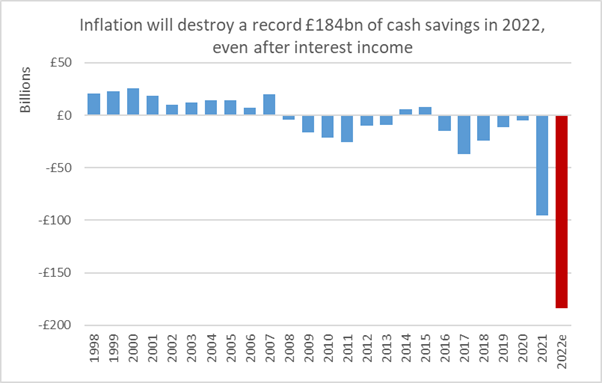

Taking into account inflation, 2022 looks set to be worse for cash savers, who will lose double the money in real terms than they did in 2021 – which was a previous record high. This would lead to the erosion of £184bn from UK savings accounts even after interest.

This corresponds to a 10.1% inflationary erosion, which, if the UK’s record £1.9trn of savings were evenly spread around the UK’s households, would cost every family £6,706.

When looking at it without equally weighting the figures, inflation will eat £1,087 from the median household’s cash ISAs after interest income, the study found.

Source: Janus Henderson Investment Trusts

Right now, interest rates are on the up and this may tempt savers to keep their money in cash assets, but history suggests their cash savings will fail to keep pace with inflation, and even more importantly, they are likely to fall far behind stock-market returns over time, according to Dan Howe, head of investment trusts at Janus Henderson.

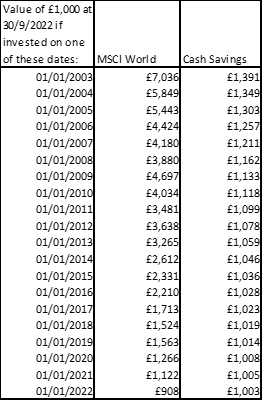

“Over the past 20 years, we have endured periods of great market turmoil, like the global financial crisis or the pandemic lockdown, and yet stocks have still outperformed cash nearly sevenfold,” he said.

“Times of market upheaval naturally make people anxious – nobody likes to see the value of the shares they own fall. But the bear only roars intermittently while inflation is a constant foe, consistently destroying the purchasing power of our cash nest eggs.”

As the table below shows, 2022 is set to be one of only four years in the past 20 years in which shares have performed worse than cash savings.

“More importantly, good years for shares have tended to be very good, so the cumulative return over time is far, far ahead of cash,” read the report.

Source: Janus Henderson Investment Trust

If £1,000 were invested at the end of 2002 it would be worth £7,036 today, compared with £1,391 for cash. Even if one had invested in shares at the worst possible moment (in October 2007 before the global financial crisis), their £1,000 nest egg would be worth £3,837 today, compared to £1,170 from cash, the report found.