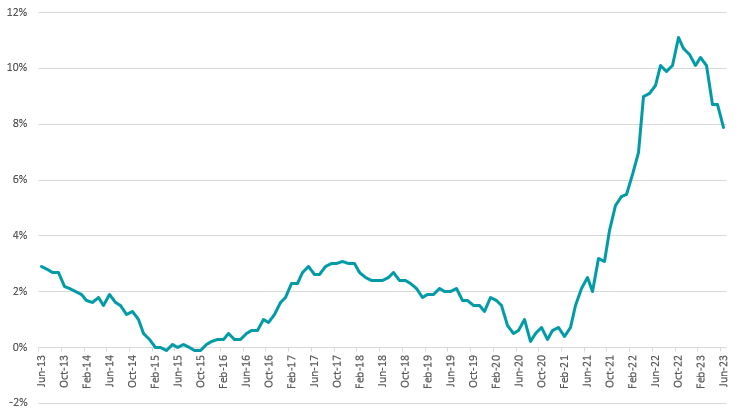

UK inflation fell to 7.9% in June, the first time the headline number has dropped below 8% since March 2022, according to the Office for National Statistics.

This came as a pleasant surprise for the market as the fall in the consumer prices index (CPI) from 8.7% in May is more than expected.

Core inflation, which strips out the more volatile items such as food and energy, also fell, albeit less sharply, from 7.1% to 6.9% in June.

UK inflation over 10yrs

Source: Office for National Statistics

Alice Haine, personal finance analyst at Bestinvest, said this indicates that the Bank of England’s cycle of interest rate rises is finally having the desired effect to bring stubbornly high inflation closer to its 2% target.

However, she expects the Bank to further hike interest rates at the next monetary policy meeting on 3 August.

Haine added: “The improving inflation data is unlikely to prevent the central bank from pushing ahead with another interest rate rise when the Monetary Policy Committee meets next month – as high prices are still causing significant pain for households and businesses up and down the country.

“But at least the numbers are moving in the right direction with markets now expecting rates to peak below 6% in March next year.”

The UK central bank increased interest rates from 4.5% to 5% last month, but some expect the next hike to be smaller.

Rob Morgan, chief investment analyst at Charles Stanley, said: “Setting interest rate policy can be like an overly-sensitive shower dial. When the water is coming through too hot the dial needs to be turned to cool things down. However, turn it too far and you get an uncomfortable cold stream of water in the form of a recession.

“Today’s CPI print could mean the Bank of England chooses to ease off on the dial with a smaller 0.25% increase rather than a previously widely expected 0.5% one at the Monetary Policy Committee’s next meeting on 3 August.”

However, Tomasz Wieladek, chief European economist at T. Rowe Price, warned that a lot of the improvement in the inflation figure is due to energy and food but not to domestic factors.

He said: “The Bank of England’s battle against inflation will only be over once wage growth comes down significantly.

“Overall, the Bank of England needs to take out the heat out of the labour market to return inflation to its target in the medium term. We are still very far from this point.”

Marcus Brookes, chief investment officer at Quilter Investors, also expects further hikes and added that that the UK is “probably on the path to recession in 2024”.

He added the “choppy waters” are here to stay for at least the next 18 months and suggested that investors should seek shelter in quality businesses that can navigate a difficult environment, while also considering UK fixed-income investments.

With the news that inflation cooled more than expected, the FTSE 250 initially jumped 3%. This is the strongest daily movement in UK mid-cap stocks since February. The FTSE 100 only advanced 1.3%, as UK blue-chips have less exposure to the domestic economy.

Danni Hewson, head of financial analysis at AJ Bell, said: “A further decline in inflation for July could really get the ball rolling for UK equities and lift them out of the mud.

“While the FTSE 250 is in party mode today, the rally only puts the index back to levels last seen in June.”