As the first six months of 2023 are behind us, a harsh divide seems to have arisen among asset managers, with one faction believing we have entered a new regime with persistently higher inflation and another keeping its faith in central banks, positive that they will win the interest rates war by taming price increases back to an annual average of 2%.

Only time will tell who’s right and who’s wrong, but it might be beneficial to investors to know what these two possible scenarios could mean for their investments.

In this article, James Yardley, investment adviser to the VT Chelsea managed funds looks at the first scenario: if you believe inflation is going to remain high around the current levels, this is the portfolio for you.

Be aware however, that a portfolio comprising of only the five funds below would be quite unbalanced, as it is geared heavily to the view that inflation and interest rates remain higher for longer, which is not Chelsea’s view.

Yardley began by tilting towards value stocks. His first pick was therefore Jupiter UK Special Situations, which he described as “a solid UK value fund”.

Performance of fund over 3yrs against sector and index

Source: FE Analytics

Square Mile analysts agree with him: “Manager Ben Whitmore is a high conviction, long-term, contrarian investor, who has managed money in this style for the vast majority of his career and is prepared to persevere with investments despite the potential for continued underperformance, particularly over the short term.”

“This fund's longerterm cumulative returns are impressive, however. For those investors looking for a value-focused fund that invests in UK companies, this is certainly one that should be considered,” they said.

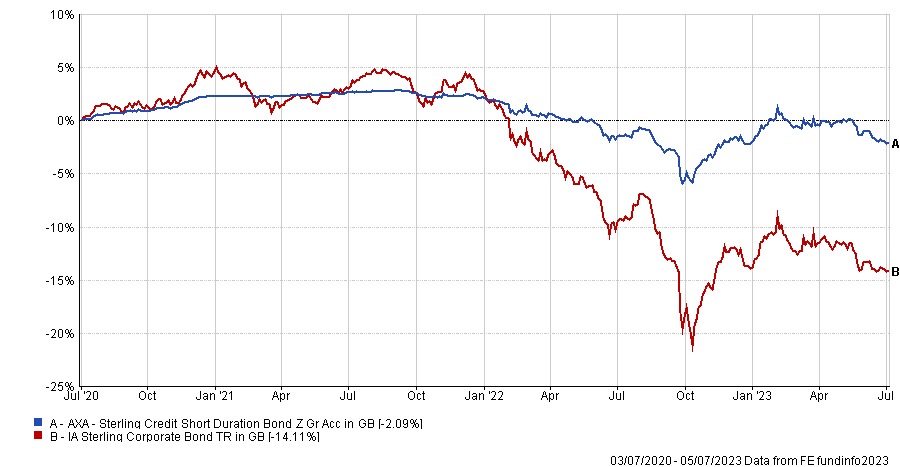

Yardley then recommended avoiding long-duration assets like growth equity or long-duration bonds, going instead for a short-dated investment-grade credit fund such as the Axa Sterling Short Duration Credit fund.

Performance of fund over 3yrs against sector

Source: FE Analytics

It invests in shortdated bonds which produce an income, but which tend to have less volatility than the wider market and would be “a key staple of this portfolio”.

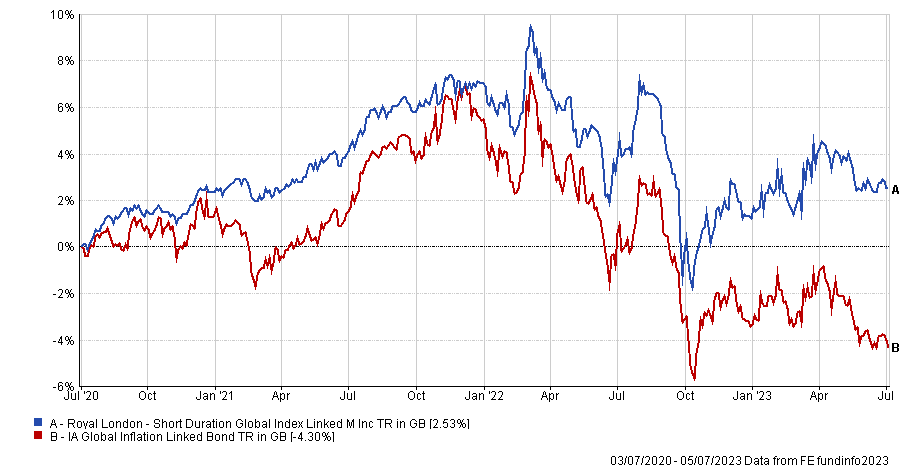

The next addition to the portfolio was Royal London Short Duration Global Index Linked, a short-duration global index-linked bond fund that “is a good choice to protect your capital from high inflation” according to Yardley.

Performance of fund over 3yrs against sector

Source: FE Analytics

Both the Axa and Royal London funds offer good yields at the moment, he said (3.44% and 2.98%, respectively), but “they won't take a big loss as you would on longer-term bonds if interest rates remain high”.

He went on to suggest leaving a large chunk of this portfolio in cash or money market funds.

“This will earn more as interest rates rise and central banks suck money out of other areas to deal with inflation,” Yardley said.

The final pick was Schroder Global Recovery.

Performance of fund over 3yrs against sector and index

Source: FE Analytics

“If inflation persists, a global value fund will also probably do well. Nominal growth will be high, which will benefit cheap value stocks,” he said.

The fund focuses on businesses that have been through periods of stress and whose share prices have fallen significantly below what they consider a fair value.

FE Investments analysts praised the management team and the “huge” resource behind it, which they would hold alongside growth strategies for added diversification benefits.

“The portfolio is not overly concentrated, with only 30% of the companies represented in the top 10; no individual stock should have a significant impact,” they said.

“Despite holding some considerable sector bets, the team insists this is a result of its strict valuation criteria, deeming some sectors, such as technology, too expensive to invest in. The fund has significant revenue exposure from emerging markets, a risk that investors should be mindful of before investing.”