The markets haven’t priced in all the bad news available and should tread carefully on the tightrope between the potential upside surprises in inflation on one side, and the risk of a recession on the other, said Steve Russell, FE fundinfo-ranked Alpha Manager of the LF Ruffer Absolute Return fund.

In his £4.3bn, five FE fundinfo-crowned fund, which he co-manages with Jos North, he puts risks at the forefront, with the aim to never lose money on a 12-month rolling basis.

Below, he tells Trustnet how he sets about achieving this admittedly impossible goal, where he sees the risks and rewards going forward and how his inflation protection strategy hasn’t quite worked out in the past year. He also reveals the stock he would own if he could only have one in the next few years.

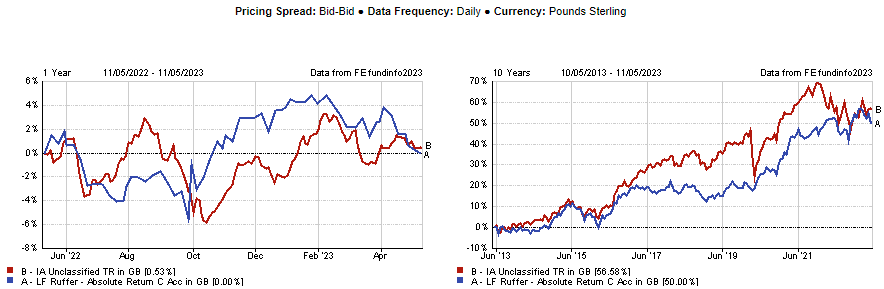

Performance of fund over 1yr and 10yrs against sector

Source: FE Analytics

Can you describe your investment process?

Instead of maximising returns and then protecting against risks, we protect against risks first and then use risk assets to make sure that the overall portfolio delivers a positive return, even when things are not so bad.

Our portfolio always holds some “fear”, or defensive assets, to protect against things we think will go wrong in the market, and some “greed”, mainly equities, to deliver in the good times. We look at the market and then ahead over the next one, three, maybe 10 years and assess what we think might go wrong.

We try to make somewhere between 8% and 10% a year overall and not to lose money on a 12-month rolling basis – ever.

Is this a risk-free investment, then?

We would never claim that clients are completely safe from risk with us. Our target of never losing money on a 12-month view and making a decent return is, to all intents and purposes, probably impossible.

What we offer investors is a track record of always having protected them against major losses in markets, be it the tech bubble in 2000, the global financial crisis in 2008 or the Covid mini-crisis in 2020. In every single one of those crises, we have either protected our investors or made a return that is significantly ahead of the only realistic alternative to the sort of risk profile we have, which would be cash.

Our long-term return is generally somewhere between 8% to 10% and the biggest drawdown ever in more than 25 years was about 6% peak to trough.

Where will the greatest risks come from, going forward?

Right now we’re trying to protect our investors against both potential upside surprises in terms of inflation and China’s reopening, but also the risk of a recession, which is growing the longer interest rates stay high – essentially against what we think will be an environment of persistently above-target and higher inflation. That is something that we don't believe equity markets, especially the Nasdaq and the FAANGS, have yet priced in correctly.

How defensively skewed is the portfolio right now?

We are generally cautious, but today even more so. Our equity weighting is as low as it’s ever been in our history. We have 20% in equities and the rest in either inflation protections (index-linked bonds, gold or commodities), or higher-yielding cash-like assets (mainly US floating rate notes, where you can get 4% to 5% cash return, unlike savers get in banks these days).

This reflects more difficult times to come through this year, as we face the twin risks of persistent and unpleasant inflation surprises and what we think is almost certainly going to be a recession by the end of the year.

What were the worst-performing assets in the fund in the past 12 months?

Strangely enough, the worst performers were our core protections against inflation, long-dated inflation-linked bonds.

We knew interest rates would rise, but we expected inflation expectations to rise as well, and so far that simply hasn't happened, inflation expectations haven't moved in the slightest. Markets still expect inflation to get back to 2%, although I sense there's more and more doubt being voiced.

Inflation-linked bonds acted as if they were conventional, non-inflation-linked bonds, and got hurt significantly, costing us 5% in attribution. We have to admit that something we viewed as a core inflation protection didn't work, or at least hasn't worked yet.

And the best?

Oil and energy majors. Investors had decided that nobody was going to be using any fossil fuels or oil within five or 10 years, and it was clear to us that it would take a lot longer than that. Not only were the stocks and companies very cheap, but there was also a lack of investment across the board in delivering energy security.

The events of last year, and unfortunately Ukraine too, brought that home pretty quickly, so we've had really strong gains from these stocks, which were already pretty attractive at the start, with dividend yields of 6% plus and 10% plus free cash flows.

What’s the most exciting stock in the fund?

Within our top 10, the company that most characterises what we like at the moment is Bayer, a German pharmaceuticals and agrochemicals business. Underinvestment across almost all industries and most obviously in renewables, combined with a world of higher volatility, inflation, deglobalisation and pressures on supply chains, means that commodities and agricultural commodities will be very attractive.

Bayer has a global leading position in this, even though it's having some issues with litigation in the United States. We think the management is changing to be in a very good position, but the key thing for us, and what we really like, is companies that have very high capital expenditure already invested.

The winners going forward are going to be the opposite to an Apple or an Alphabet, with massively long on intellectual capital and zero actual capital in terms of plant machinery and factories. Bayer has a really good mix of that, which makes it really attractive. If I could only own one stock for the next two or three years, I'd probably go with Bayer.

What do you do in your free time?

I watch slightly sad and nostalgic television programmes such as Great British Railway Journeys with Michael Portillo, who I don't agree with on anything and I enjoy cooking, often whilst drinking wine. I also have a passion for re-doing houses – over the years, I've rebuilt and redesigned quite a few houses, progressively doing less DIY work myself, but back in the day I did.