While actual picks and shovels are useless for mining Bitcoin, taking a ‘picks and shovels’ approach to cryptocurrency could help you avoid many of the pitfalls associated with the asset class. Taking its name from the theory that the only people to make money from the gold rush were the ones selling the picks and shovels to prospectors, this approach involves buying the stocks that sell goods or services to someone hoping to make money from a new craze, rather than taking direct exposure to the craze itself.

Another oft-repeated mantra is to only invest in what you understand. This simple principle keeps many investors away from cryptocurrencies, which they find perplexing.

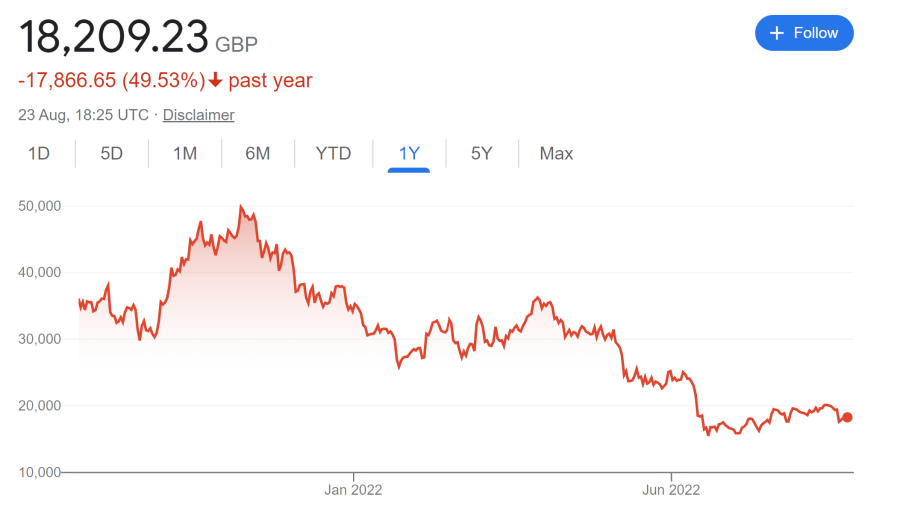

This has proved to be a good call this year, with Bitcoin, the most recognised cryptocurrency, down more than 60% from its peak of November 2021.

Value of Bitcoin over 1yr

Source: Google Finance

The extreme volatility is only one reason why cryptocurrencies are unsuitable for most investors.

In a recent Trustnet article, PGIM said you could add to this the lack of “a clear regulatory framework, an effective store of value, and a predictable correlation with other asset classes”.

Yet looking at the number of major asset managers moving into cryptocurrencies in some way, it appears unlikely they will disappear anytime soon.

Earlier this month, the world’s largest asset manager BlackRock announced plans for a Bitcoin trust. This news came shortly after it said it would link its Aladdin technology platform to the Coinbase crypto exchange, allowing 82,000 investment professionals to offer these assets to their clients.

Schroders’ and abrdn’s clients will also be able to access cryptocurrencies after the groups bought significant stakes in digital asset firms this summer. Meanwhile, Charles Schwab launched a synthetic crypto ETF earlier this month.

Christopher Mellor, head of EMEA ETF equity and commodity product management at Invesco, sees huge potential for growth in the blockchain technology that underpins cryptocurrencies.

“The analogy we often use is the way the internet transformed the movement of data,” he said. “Similarly, the blockchain has the potential to transform the movement of assets.”

But how can more risk-averse investors capture this potential?

Andy Merricks, manager of the 8AM Focussed fund, finds the picks-and-shovels approach appropriate.

“The facilitators of the phenomenon are more appealing as a potential investment opportunity rather than trying to dodge the next crypto currency to go bust,” he said.

PGIM analysts also promoted this strategy in a recent paper about cryptocurrency investment. In the publication, they highlighted three main areas of interest.

The first one is the so-called private – or enterprise – blockchain. Here, investors could try to gain exposure to real-world blockchain applications like those currently being implemented in the financial services and supply chain sectors.

A second option would be to invest in the infrastructure and ecosystem supporting blockchain applications.

Examples of such services are blockchain enablers.

“Present-day blockchain networks do not interact with each other in a meaningful way. Products that allow their interoperability could open up new possibilities for record and document management in healthcare, law and real estate by allowing important business information to be securely sent back and forth between private and public networks in a customisable and controlled manner,” explained the paper.

One last sector on PGIM’s radar is the tokenisation of real assets, or fractionalising ownership of real assets into digital tokens on a distributed ledger (a database that is shared and synchronised across multiple sites).

“In theory, any real asset – precious metals, real estate, artwork or infrastructure – could be tokenised and substantially reduce frictional costs from transactions and servicing. This would increase liquidity, simplify transactions, enhance price transparency, and allow more granular portfolio construction,” said the paper.

“It would also allow investors to potentially benefit from increased liquidity, shorter and more flexible lock-up periods, and easier proof of ownership.”

However, it is currently difficult for investors to access companies offering these technologies, as many of them are at an early stage.

UK investors in search of a fund to gain exposure to this area only have four options, which Merricks identified in three exchange traded funds (ETFs) and one active fund.

The ETFs are: Invesco CoinShares Global Blockchain, HAN ETC Group Digital Assets & Blockchain Equity and Mirae Asset Global X Blockchain.

However, Merricks said: “The fact that the latter two have fallen about twice as far as the Invesco option since February suggests that they are purer crypto plays.”

Mellor said his fund takes a less direct approach.

“A team of analysts identify stocks with exposure to blockchain activity and measure such exposure on a scale from one to five,” he explained.

“To do so, they take into account what is the stage of development of the blockchain business, how sustainable it is and how large a proportion of the business is exposed to blockchain activity, among other parameters.

“On the back of this data and by weighting stocks based on their blockchain score, an index is constructed.”

In this way, the portfolio not only has exposure to blockchain-heavy businesses such as crypto miners, but more established companies such as IBM.

“IBM is a tech consultancy, but also a market leader in blockchain technology,” said Mellor. “For example, it runs The Food Trust network, which was set up by a group of large food retailers and producers (the likes of Walmart, Carrefour and Nestle), working together to improve supply chain management and monitoring to a blockchain-based solution.

“You won't find Walmart or Nestle in the index, whereas IBM is in the index on the basis of accruing profit from the consultant activity.”

This approach has helped limit the fall of Invesco CoinShares Global Blockchain to 25% this year.

Performance of ETF vs sector over 1yr

Source: Google Finance

Merricks said the BNY Mellon Blockchain Innovation fund represented an interesting alternative to the passive ETF approach.

Unsurprisingly, it has had a torrid time this year, but Merricks said it may be one of the most sensible options for anyone who has their heart set on gaining exposure to blockchain technology.