Investors have turned to inflation hedges in 2022 as prices continue to spiral upwards, with infrastructure being one of the few parts of the market able to make money this year.

FE Analytics shows that the average IA Infrastructure fund has made 8.6% over 2022 so far, making it the third best performing sector. The only peer groups with a higher return are IA Latin America and IA Commodity/Natural Resources, which also hold up in inflationary times.

As the chart below shows, IA Infrastructure funds have outpaced mainstream favourites such as IA UK All Companies and IA Global funds by a wide margin this year.

Performance of sectors over 2022

Source: FE Analytics

The rationale behind this positive run is mostly two-fold, said Jason Hollands, managing director and head of corporate affairs at Evelyn Partners.

“Firstly, infrastructure has low correlation to the ups and downs of the economic cycle, as the underlying contracts on projects are very long term in nature, typically over 25 years; and secondly, its proofs against inflation, as contracts often include annual adjustments for inflation,” he said.

On top of that, infrastructure is often considered a portfolio diversifier, a source of income with a useful yield, and is benefitting from significant public and private sector cashflows.

For investors who are looking to add infrastructure to their portfolios, below are four experts’ picks from the asset class.

FTF ClearBridge Global Infrastructure Income

Kelly Prior, investment manager in the multi-manager team at Columbia Threadneedle Investments, selected the FTF ClearBridge Global Infrastructure Income fund. It has performed very well in recent times, especially in terms of risk-adjusted returns, and outperformed its peers by 11.3 percentage points over one year, as shown below.

Performance of fund vs sector over 1yr

Source: FE Analytics

It is run by Nick Langley and his team at Franklin Clearbridge, who, having worked together to establish the RARE franchise nearly two decades ago, have a long history in investing in the infrastructure space.

“Unapologetically focused on core infrastructure businesses that operate in markets that are governed by strict regulation, they are looking for stable cashflows on longer-term contracts,” said Prior.

“In more exciting times such discipline could see them lag more aggressive operators in the space, but much like the business that make up their universe, they are assessing the long-term prospects and assessing what is missed in the price.”

FTF ClearBridge Global Infrastructure Income was also picked by GDMI investment manager and director Tom Sparke and Charles Stanley Direct chief analyst Rob Morgan.

What made it popular was its structural tilt towards income-generating regulated utilities (minimum 50%) combined with the flexibility to invest in more growth-oriented infrastructure assets, and its yield, which is over 4% and derives from a “truly international” portfolio of holdings including energy facilitators, toll roads, renewables and airports.

Prior did point out that the ClearBridge management team decided to move in and out of areas. This happened with airports through Covid and with UK utilities, which were traded when the threat of nationalisation caused a significant drop in their prices.

“A thorough and disciplined process always brings the team back to company fundamentals however, and marrying this up with a solid top-down strategy has bought impressive results over the life of the fund,” she said.

KBI Global Sustainable Infrastructure

Sparke also highlighted a second fund, KBI Global Sustainable Infrastructure, whose performance is outlined below.

Performance of fund vs sector over 1yr

Source: FE Analytics

“This vehicle is attentive to environmental, social and governance aspects and has performed very well over the last few years. It has a focused portfolio of around 35-55 securities with exposure to water, waste, recycling, food, clean energy and farmland,” he said.

The €1.4bn fund is managed by Colm O'Connor and its approach is built around the idea that infrastructure and its sustainability is an issue that is only going to grow in importance to investors and society as a whole.

“State plans such as the Biden climate and infrastructure plan in the US, the carbon neutrality plans of the EU, China, Japan or the transition to wind farms in the UK show that spending on infrastructure and sustainable development will continue to increase,” Amundi, the fund’s management group, said.

International Public Partnerships

Moving on to investment companies, Rob Morgan’s pick was International Public Partnerships.

The trust invests directly and indirectly in public or social infrastructure assets and related businesses located in the UK, Australia, Europe and North America and outperformed its sector over the past year.

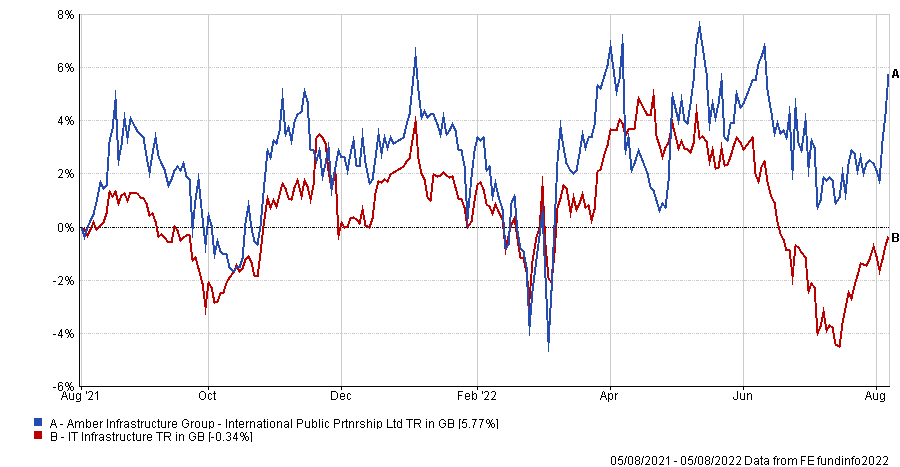

Performance of trust vs sector over 1yr

Source: FE Analytics

“An attraction is the quality of its cash flows, which benefit from a high degree of inflation linkage and are very long-term in nature,” said Morgan.

“Unlike many of its peers, International Public Partnerships invests almost exclusively in availability-based projects, which have more predictable revenues than demand-based assets. As such, there is a higher degree of regulated activities and greater visibility in terms of cash flows.”

Further differentiating characteristics include a willingness to take some construction risk and a history of taking big stakes in very large-scale projects such as Thames Tideway, known as London’s ‘super sewer’.

HICL Infrastructure

Lastly, Hollands also chose a trust, despite noting that in the infrastructure sector, they tend to trade at hefty premiums to net asset value (NAV). His vote went to the £3.5bn HICL Infrastructure.

Performance of trust over 1yr against sector

Source: FE Analytics

It is overweight in UK transport and healthcare and was able to distance its peer by five percentage points in the past 12 months, as the graph above shows.

“HICL Infrastructure looks one of the better picks currently as it is ‘only’ at a 5% premium – below the sector average of 9.5% and its 12-month average of 9.7%”, he said.

A potential investor might also be interested in its “relatively attractive” 4.8% yield.