Vaccines, value and inflation were the dominating themes in the opening half of 2021 as markets began building on the idea of life beyond Covid.

Hope of an end to the pandemic was catalysed back in November 2020 on ‘Vaccine Monday’ when several effective Covid vaccines were announced in quick succession.

Almost immediately markets reacted with a shift into the value sectors, or areas which typically do well during recovery periods, and market experts have been forecasting these conditions will remain in place for most of the year.

Looking just at the UK and the economic recovery from Covid seems apparent, with GDP increasing throughout 2021 – although GDP overall is still lower by 8.8 per cent than pre-pandemic, according to the Office for National Statistics (ONS).

This rotation into value was the most significant equity markets have seen for several years and has had several consequences. The most obvious of these is a flare up in inflation concerns, which Fairview Consulting director Ben Yearsley called a “key concern for policymakers with house prices running rampant with the fastest price rises since 2004”.

He added: “Inflation is running just above the Bank of England’s target with the latest figure of 2.1 per cent - however clearly as this is a year on year increase the current comparison is against an economy that was still essentially closed last year.”

The opening quarter of 2021 saw a significant inflation-linked sell-off in bonds as investors started to worry about the prospect of higher inflation and lower levels of monetary stimulus should the coronavirus vaccine rollout spark a strong economic rebound.

Later this was enacted in a heavy tech sell-off mid-May, which saw the Nasdaq 100 index lose 3.74 per cent in one day.

The US has witnessed an even bigger spike in inflation as its latest consumer price index (CPI) saw a 5 per cent increase in the 12 months through May, making it the largest yearly increase since August 2008.

Rising prices, pent up consumer demand and increased savings (for those that could) have largely driven this spike in inflation, as the reopening of markets and economies has mirrored more social freedoms and reopening of non-essential retail.

Central banks have continued to communicate that they see this as a transitory period and they will not be raising interest rates immediately. These reassurances have done little to quell investors’ concerns about inflation.

The second major event which has shaped performance in H1 was the UK finally leaving the EU.

Dragging Brexit concerns were compounded by the pandemic and initial poor handling of cases made the UK even more unpopular.

But with the resolution of a trade deal late December 2020 and the official exit on 31 January 2021, combined with an effective vaccine rollout, the UK has seen a return of international investors. All this was complimented by the overall rotation into value and cyclical sectors, which is well represented in the UK market.

This has manifested itself in the H1 performance tables as IA UK Smaller Companies, IA UK Equity Income and IA UK All Companies all feature at the top end of the table. IA UK Smaller Companies was the best performing sector during that time, returning 19.97 per cent.

Source: FE Analytics

On the IA UK Equity Income sector, this part of the market has seen a significant turnaround from the massive hit it took in the initial Covid sell-off with businesses now restarting dividends.

IA North America and IA Property Other broke up the top of table, returning 13.14 per cent and 12.26 per cent respectively.

Source: FE Analytics

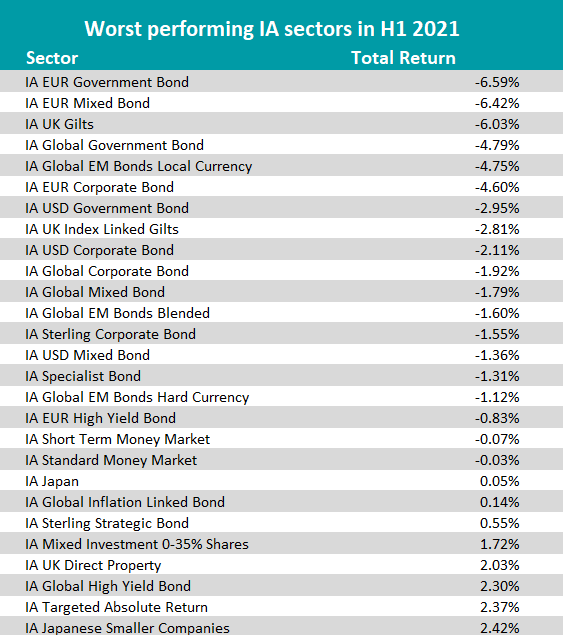

At the other end the IA EUR Government Bond sector was the worst performer with a loss of 6.59 per cent.

Bond sectors dominated the bottom of the performance table. This reflected the higher inflation environment investors are projecting onto markets currently.

It’s a similar story on the funds side with the top dominated by energy and UK small-caps, both beneficiaries of the value rotation.

Source: FE Analytics

At the top of the table were three energy ETFs (exchange-traded funds); iShares Oil & Gas Exploration & Production UCITS ETF, iShares S&P 500 Energy Sector UCITS ETF and Xtrackers MSCI USA Energy UCITS ETF.

The best performing active equity fund was the Schroder ISF Global Energy fund, which made 37.79 per cent.

Run by Mark Lacey, the $413.5m fund has a mid-cap bias, investing in oil and gas companies. This makes it intrinsically linked to the oil price, which has seen a strong recovery in 2021. An important part of the process, however, is the operating leverage against the underlying commodity price, which Lacey previously told Trustnet had been a big driver in performance this year.

In this conversation with Trustnet Lacey also explained how the rising oil price could have higher to go as the aviation industry – which makes up around 10 per cent of the global oil demand – is yet to reach pre-Covid capacity yet; something which will ultimately benefit the fund further.

Other well-known energy funds populating the top of the performance table include Guinness Global Energy, BlackRock GF World Energy and GS North America Energy & Energy Infrastructure Equity Portfolio.

Among the top performers were UK equity funds, specifically small-caps mirroring the sector’s outperformance.

The best UK small-cap fund in H1 was Aberforth UK Small Companies, making a total return of 32.03 per cent.

It is run by a seven strong management team made up of Alistair Whyte, Euan MacDonald, Keith Muir, Christopher Watt, Peter Shaw, Jeremy Hall and Sam Ford, who use a value process. The managers select stocks based on detailed financial and industrial analysis along with a valuation approach which focuses on both stock market and corporate worth.

In the latest monthly commentary, the team said: “Overseas interest in the UK has continued to build, in response to reduced Brexit uncertainty and to the vaccine roll-out’s impetus on economic recovery.” All major themes which have culminated in positively shifting the performance of UK equity funds and sectors generally.”

One of the other notable funds to outperform was the Premier Miton UK Smaller Companies, run by Gervais Williams and Martin Turner.

Investing in companies where the managers feel there are information gaps and have the potential for mispricing and great returns, the fund made a total return of 27 per cent in H1.

The £186.9m fund is currently soft-closed following a large influx of investors this year replenishing the significant outflows it saw in 2020.

Other well performing UK funds include, Liontrust UK Micro Cap, Aviva Inv UK Smaller Companies, Consistent Opportunities Unit Trust and Slater Artorius.

Source: FE Analytics

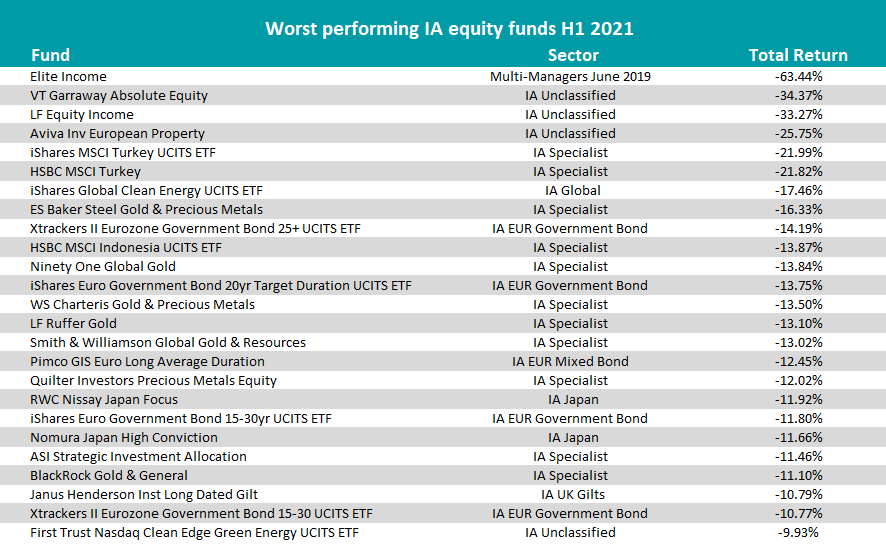

The other end of the table is a mixed bag of but government bonds, particularly the IA EUR Government Bond funds, make up the bottom of the table.

The worst performing fund overall was the Elite Income Trust with a loss of 63.44 per cent. The fund aims to achieve a competitive level of income with capital growth investing in a collection of investment schemes whose underlying investments are principally in UK fixed interest securities and UK equities, though it can take some global investments.