Europe seems to have resurged in 2023 after having spent the previous year in the doldrums, but the recovery might have encouraged consensus forecasts to be too optimistic.

The holdings of the Carmignac Portfolio Grande Europe fund might not be representative of the whole European market, but FE fundinfo Alpha Manager Mark Denham will be "particularly cautious" about earnings estimates this year, as economic indicators remain conservative. This cautiousness also translates into an equities underweight in the mixed-asset fund Carmignac Portfolio Patrimoine Europe that he co-manages.

There is one sector however where he has been increasing his exposure – technology and semiconductors, which he thinks still have a long way to go.

Below, he discusses what he sold to fund his allocation to technology, other areas on his watch list, and his cautiousness around earnings estimates.

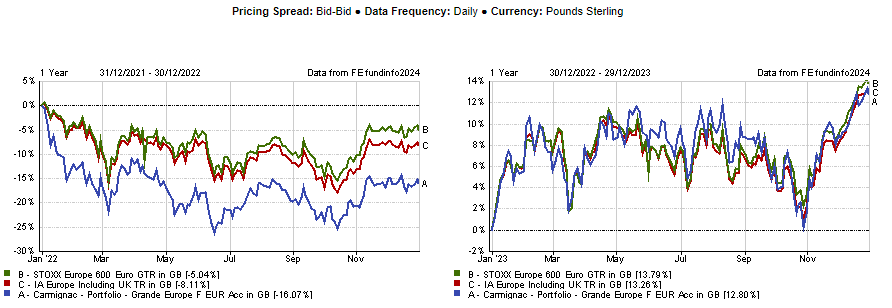

Performance of fund vs sector and index in 2022 and 2023

Source: FE Analytics

What is your investment philosophy and process?

Carmignac Portfolio Grande Europe is a bottom-up fund investing in high-quality companies with at least a five-year time horizon. We like companies with a high return on capital that at the same time reinvest a high proportion of their profits to grow their business.

Up to 8% of the portfolio can be invested in ‘underappreciated innovation’, meaning stocks that have yet to reach profitability. They tend to be only in the biotech sector.

Finally, the fund is Article 9, so we are targeting low carbon through companies aligned with the United Nations’ Sustainable Development Goals.

The portfolio is concentrated in 36 names. How do you select them?

It’s an ongoing process where we monitor the stocks we have and keep a watch list of around 10 stocks that meet our criteria and might be good entrants. But at the start of any given year, I would anticipate adding or changing no more than five ideas in the fund.

It's a glacial process in terms of looking for brand new stock ideas. Most of the activity in the fund is tweaking the weightings of the existing holdings. We don't see any gaps and we're quite happy with the stocks as they are, so there's no urgency looking for new ideas.

What’s on your watchlist at the moment?

Despite already having high exposure to software, we are doing some work on a company specialising in providing software for the banking sector.

There are a number of drivers, one of them being that banks have got their finances onto a more solid footing because of higher interest margins, and their need to update their IT systems. We would expect high single-digit organic and sustainable growth for the medium term at least.

What have been the best of worst calls of the past 12 months?

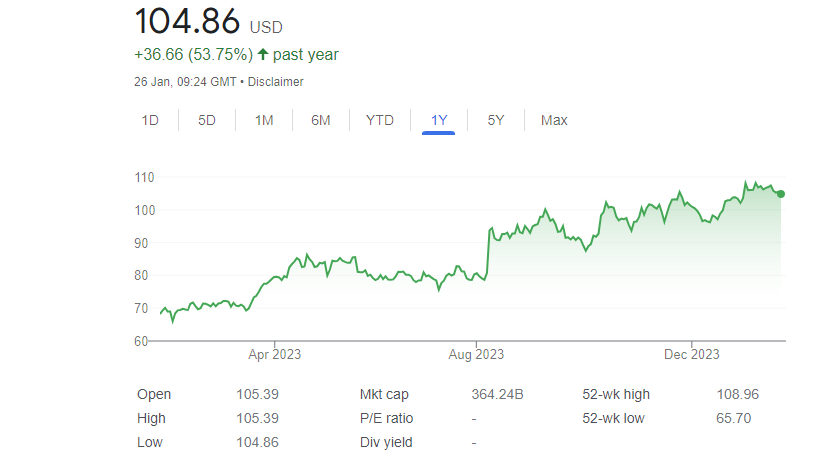

Novo Nordisk, the Danish supplier of drugs for diabetes and obesity, stood out head and shoulders, contributing 370 basis points to our relative performance over the past 12 months, with the stock price up 50%.

Performance of stock over 1yr

Source: Google Finance

With the ongoing penetration of the drug, we expect sales and profit growth to continue, so we are sticking with it into 2024.

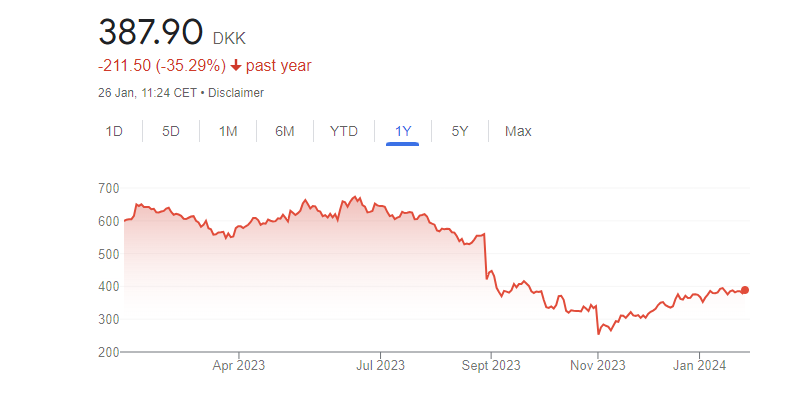

On the flip side, offshore wind farm developer Orsted has cost us 120 basis points, with the stock price falling 35%. The company is in a hiatus where a lot of projects are no longer profitable due to Covid and supply chain disruptions, so they had to take a lot of write-downs and other operational issues.

Having guided us initially in the second quarter of 2023 that these issues were stabilising, they then had another profit warning in the following quarter and we sold out of the position, so at least we minimised the damage.

Performance of stock over 1yr

Source: Google Finance

What recent changes have you made to the portfolio?

We cut a lot of our cyclical exposure at the end of 2023, businesses like electronic engineering company Schneider Electric, Swedish lock maker Assa Abloy and Swedish engineering company Atlas Copco. Those stock prices participated in the year-end rally, as the market anticipated rate cuts and these economically sensitive stocks were very strong, particularly in October, November and December.

We redeployed that capital mainly in the technology sector, for example by increasing semiconductor exposure through the likes of ASML and ASM International. For ASML, the stock hasn't been anything like as strong as the US chip names and we also anticipate evidence of orders in advance of sales, which should indicate a pickup into the second half of this year. We may see signs of that in either the full-year results or the first quarter results.

Are you worried about earnings in Europe?

The European market overall isn't representative of what we would consider the best investments over the next five years, because our screenings reject 75% of it.

Currently, consensus expects 6% to 7% earnings growth across the market in Europe. I suspect that's probably a couple of percent too high. Economic indicators are still in contractionary mode, including the Purchasing Managers' Index (PMI), sentiment indicators and monetary growth. This doesn't bode well for economic growth in the near term and companies which have exposure to the local economy wouldn’t certainly be strong. I'll be cautious about consensus earnings estimates.

What’s your weighting to equities in the mixed-asset fund?

In the Carmignac Portfolio Patrimoine Europe, the final decision on the asset allocation is not mine, it’s down to my co-manager Jacques Hirsch.

We're currently at about 35% equity exposure, with the maximum allowed being 50%. We might be cautious on earnings estimates, but we do think interest rates will fall and bond yields will continue trending downwards, which should be supportive for equities.

On bonds, they had a huge rally at the end of last year and that looked too optimistic to us, so we were slightly short duration. They have pulled back over the past two or three weeks, so we're less short duration than we were.

What do you do outside of fund management?

Outside of being a husband and a father, I play the guitar. I'm doing my grade exams, so that keeps me plenty occupied.