Even the best managers sometimes have to tread through a rough patch.

This is something Simon Gergel, manager of Merchants Trust, has experienced in 2023, as sentiment has been particularly poor towards UK equities, with investors withdrawing their money en masse from the market.

Moreover, Gergel decided to reposition his portfolio in the mid-cap space and added cyclical names to take advantage of the dislocation in the UK equity market.

Those contrarian choices have led to short-term underperformance, which contrasts with the income trust’s long-term track record.

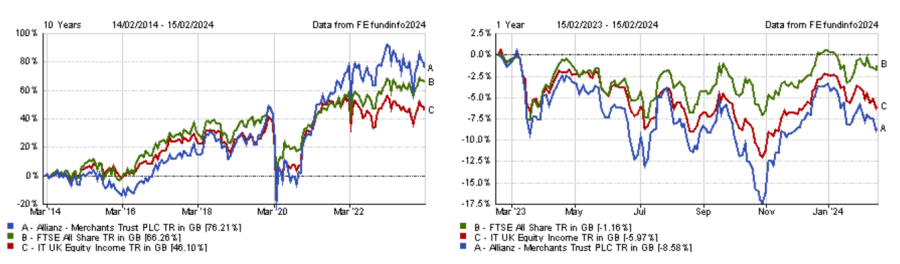

While Merchants Trust sits in the top quartile of the IT UK Equity Income sector over 10, five and three years, it fell into the third quartile for performance during the past 12 months.

Performance of trust over 10yrs and 1yr vs sector and benchmark

Source: FE Analytics

Below, Gergel explains how he was wrong about St James’ Place, why the trust will keep increasing its dividend payout, and why he is tilting to mid-caps.

Could you explain your investment process?

We try to deliver a high and rising income stream and good total return from investing in predominantly large-cap UK equities.

Our investee companies should have strong fundamentals, which includes things such as strong competitive positions, robust balance sheets, good governance, etc.

We also look for companies that are lowly priced compared to what we think is fair value or to their history or to other businesses we could buy and, ideally, they should benefit from supportive market dynamics.

What market dynamics are you aiming to capture in the portfolio?

We don't start with a theme and work our way down. We start with individual companies and then think about what they are exposed to in terms of market themes.

At the moment, we have quite a lot of exposure to house building and construction, because there's an undersupply of housing in the UK. The country’s ageing infrastructure needs a lot of repair, maintenance and improvements.

We also have good exposure to electrification. We've got companies that benefit from the need to build more electricity transmission networks. We also hold copper producers because you need a lot of copper for the electrification theme.

How is the portfolio currently positioned?

Merchants Trust has a stated objective of being predominantly large-cap, so we still have about 55% in the FTSE 100.

However, we're currently overweight mid-cap businesses. We have always had exposure to this part of the market, but we have definitely increased it in the past two years as we're seeing more and more value opportunities.

There have been structural outflows from the UK stock market over many years. Investors have been selling UK companies quite indiscriminately, particularly in the mid-cap area. That’s why we're finding the most compelling opportunities in that space because many companies look oversold.

Could you give an example of a mid-cap company you’ve bought recently?

We’ve bought Inchcape, which is a car distribution business. It is a global company, with most of its sales in emerging markets.

It has a defendable position in a market with high barriers to entry. For example, Toyota has had a long relationship with Inchcape and it’s not going to give that franchise to anyone who wants it. Those strong partnerships generate high returns, because there's not that much capital invested in distribution.

In terms of themes, it’s exposed to emerging markets where car penetration is quite low but car usage is growing.

We actually used to own it but sold out a couple of years ago, as the shares were relatively highly priced. They came back a long way because of challenges in the Latin American market, where they made a big acquisition. Investors didn’t like it, but we see a very diversified company with good growth prospects on a really attractive valuation.

Performance of stock and index over 10yrs

Source: FE Analytics

The trust has suffered over the past 12 months. How do you explain this short-term underperformance?

The past 12 months have been challenging because inflation was quite high, interest rates were rising and bond yields were going up. Investors got quite nervous about more cyclical companies and businesses that are exposed to interest rates.

Many of the businesses we've been buying into are more cyclical and smaller on average than the overall market, so we have been impacted by this high rate environment.

However, we've been through a number of difficult periods in the past seven or eight years. They've usually been followed by very strong returns because you then get dislocations in the market, which provide investment opportunities. We've seen a bit of that in the past 12 months.

What have been the main contributors to and detractors from performance in that period?

The poor performance of value-type companies and of some of the more cyclical areas has been a big driver of short-term underperformance.

There were also one or two individual companies that we've got wrong, such as St. James’s Place. There has been a significant change in the regulatory environment and the company has made some big changes to its business model, including lowering its fees. We don't have a positive investment view at the moment, so we sold it and reinvested elsewhere.

Performance of stock and index over 10yrs

Source: FE Analytics

There have not been many winners in the past 12 months. There haven't been enough individual companies that are on the positive side.

Having said that, we faced those situations before when you get a wide dispersion of valuations and a lot of opportunities in the market. We're very excited about the potential we see going forward from here.

Merchants Trust has raised its dividend for 41 years. Will you be able to keep increasing your payout and what reserves do you have?

The key objective of the trust is to keep growing its dividend every year and the board looks at this very closely. We've done it for 41 years, coming up 42 years.

We have significant reserves, which were worth 16.3p per share in January 2023 (the trust’s year end is January). It compares to a dividend of 27.6p last year. So, we have about half a year's dividend in reserves, which gives us a significant buffer.

It is worth noting the dividend was covered by earnings last year, so we could increase our reserves. We are in a strong position to keep raising our dividend.

What do you do outside of fund management?

I spend time with my family, I play five-a-side football and I occasionally go skiing or golfing. I also play the violin, but I'm not very good at it.