On the face of it, events in 2023 seemed radically at odds with the notion that successful investing demands balance. Seven mega-cap technology stocks produced 60% of the S&P 500’s total return and accounted for almost a fifth of the MSCI World index in terms of size.

However, as recently as 2022, a different narrative dominated. Big tech giants such as Meta, Nvidia and Tesla experienced significant share price declines, highlighting the volatility that is typically inherent in concentrated investments.

This two-year contrast underscores the timeless adage: ‘Never put all your eggs in one basket’. Even today, with artificial intelligence cementing its status as a go-to theme, there is much to be said for diversification.

Particularly for global investors, who have the widest opportunity set to choose from, portfolio construction should still be a question of both quantity and quality. But amidst unprecedented market concentration, how do we get the balance right?

In search of a golden mean

The debate over diversification has raged for decades, with advocates on both ends of the spectrum.

On one side, we find proponents of the ‘all your eggs in one basket’ philosophy. This is currently en vogue in some circles, with advocates of the ‘Magnificent Seven’, or even a dynamic duo of only Microsoft and Nvidia, championing an unusually narrow focus.

At the other end would be a super-diversified portfolio of hundreds of stocks. Several studies have supported such an approach through the years, most notably in the early 2000s.

As with so many things in life, the ideal very likely lies somewhere between the two poles. It was originally outlined by ‘the father of value investing’, Benjamin Graham, in his two books, ‘Security Analysis’ and ‘The Intelligent Investor’, published in the 1930s and 1940s.

Graham advocated what is sometimes called 'concentrated diversification', which he described in The Intelligent Investor as “adequate, though not excessive”. This, he said, should translate into a portfolio of up to 30 holdings.

This argument is still relevant today. Too little diversification can invite unpleasant surprises, whereas too much can take investors into index fund territory, where the concept of beating the market surrenders to the concept of being the market.

Yet numerical balance is only half the story. Diversification within those holdings is just as crucial.

Casting a wide net

Graham’s stock-picking process was rooted in his defensive tests. He looked for companies characterised by adequate size, financial strength, earnings stability and growth, an established dividends record and moderate price-to-earnings and price-to-assets ratios.

Crucially, the ability to withstand rigorous scrutiny extends beyond the realm of big tech or even the technology sector as a whole. A company does not need to boast a trillion-dollar market capitalisation to be a solid investment.

Consider Tractor Supply Company: founded in 1938, it is a US retail chain specialising in agriculture, gardening and home improvement products, boasting a market capitalisation of around $25bn.

Or take Azelis: established in 2001 and based in Belgium, it has a market cap of around $4.6bn. It provides innovation services in the specialty chemicals and food ingredients industry.

We initiated or strengthened positions in both these holdings in late 2023. Why? Ultimately, we search for good businesses capable of contributing to a portfolio that is not reliant on any given theme, factor or macroenvironment.

In essence, balance in this context comes from giving due thought to different sectors, geographies, market caps and other considerations.

The proof is in the pudding

Of course, the argument for balance would seem lacking if a select group of theme-centric stocks were to constantly outperform. However, the events of 2022 dispelled that notion.

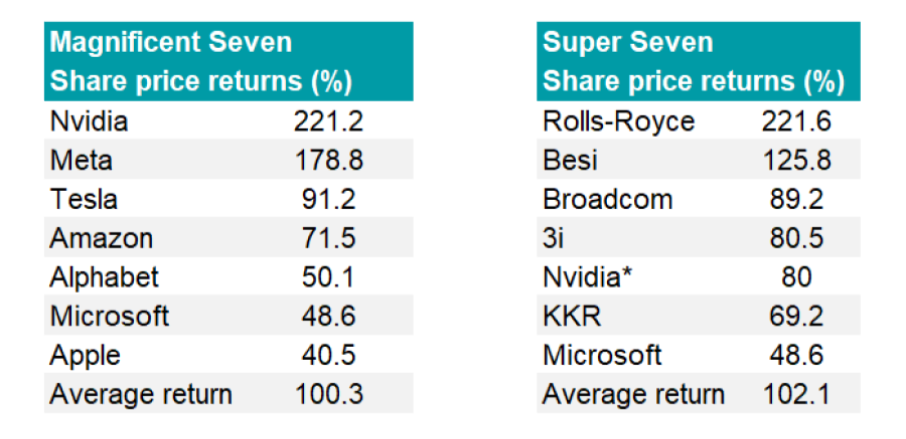

Perhaps it’s time for reflection. Collectively, the seven best-performing holdings in the Invesco Select Trust plc Global Equity Income share portfolio in 2023 – our very own ‘Super Seven’ – more than kept pace with the Magnificent Seven in terms of total shareholder return, as the tables below shows.

Naturally, big tech was represented in our line-up. Yet it was just one element among a much broader – and, in our opinion, much healthier – mix of industries, regions, capitalisations and investment styles.

Magnificent Seven versus Super Seven in 2023

Source: Bloomberg, data to 31 Dec 2023 in sterling terms

Source: Bloomberg, data to 31 Dec 2023 in sterling terms

* Nvidia was held in the portfolio from the summer of 2022 to April 2023

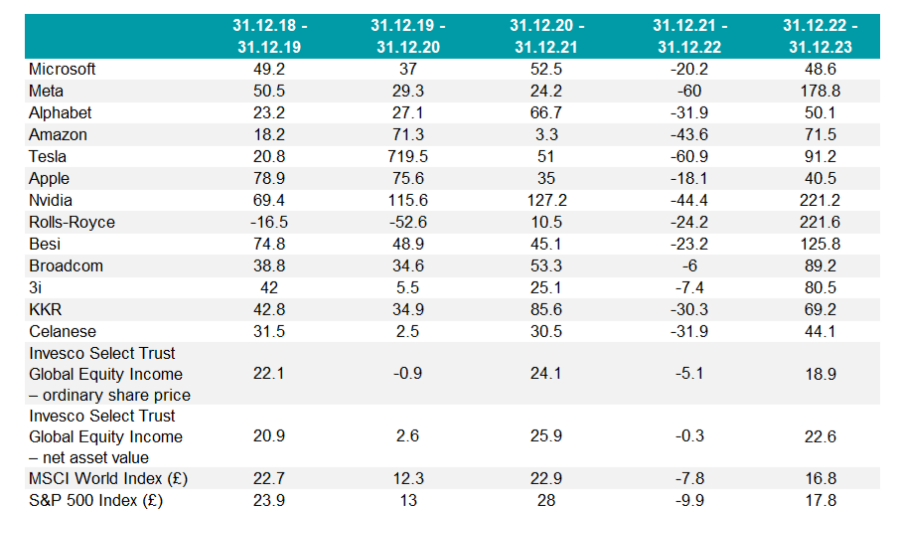

Magnificent Seven versus Super Seven – rolling 12-month performance

Source: Bloomberg, data to 31 Dec 2023

Source: Bloomberg, data to 31 Dec 2023

Stephen Anness is lead manager of the Invesco Select Trust plc Global Equity Income share portfolio. The views expressed above should not be taken as investment advice.