Savers do not have much time to make the most of their £20,000 annual ISA allowance with around six weeks to go before the end of the tax year.

One option is to consider the investment companies market, with several trusts trading on a discount, giving investors the chance to get in cheap before 5 April deadline.

Yet, it may be difficult for investors to choose between the more than 300 investment trusts on offer, which is why the Association of Investment Companies (AIC) asked financial advisers and wealth managers to name those they would recommend for younger, middle-aged and retired investors.

Young investors

Younger investors benefit from a longer-term horizon, which means they can afford to take more risks as they have enough time to recover from troughs.

As such, they might want to benefit from the development of long-term megatrends such as the development artificial intelligence (AI).

Both Dr Tomiko Evans, chief investment officer at Crossing Point Investment Management and Philippa Maffioli, senior investment manager at Blyth-Richmond Investment Managers, pointed to Polar Capital Technology Trust, which is currently trading at a discount to net asset value (NAV) of 11%.

The trust is managed by a team of dedicated technology specialists describing themselves as AI maximalists.

Maffioli said: “Technology will remain integral as we face the post-pandemic world and the young people of today have been greatly affected by this accelerated reliance and development of technology. Its impact is being felt across every industry with new opportunities arising from artificial intelligence.”

Evans also named, Allianz Technology Trust, as another option to tap into the AI thematic. Broker Numis recently switched Polar Capital Technology Trust for Allianz Technology Trust in its recommendation list, highlighting that manager Mike Seidenberg has demonstrated his capacity to successfully execute a highly active approach in a volatile sector.

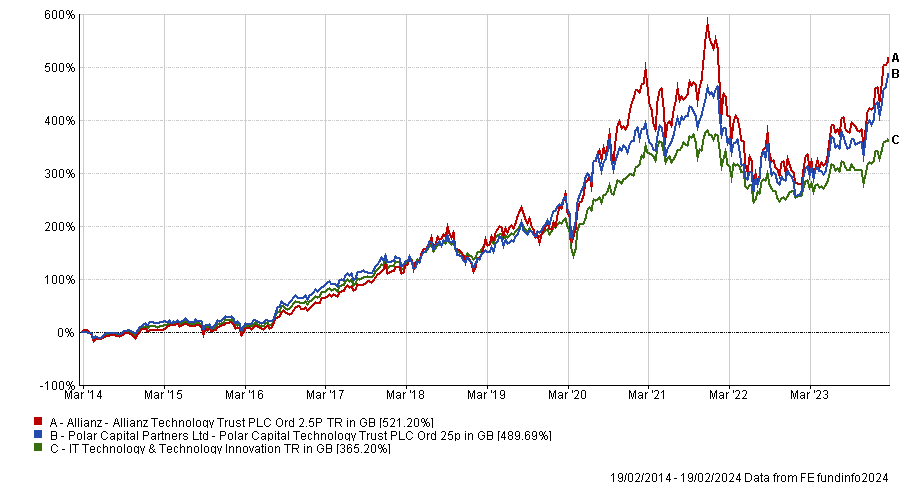

Performance of trusts over 10yrs vs sector

Source: FE Analytics

For younger investors looking to tap into several megatrends at once, Saftar Sarwar, chief investment officer at Binary Capital Investment Management, suggested Scottish Mortgage Investment Trust.

He said: “If one is prepared to take a long-term view, as younger investors should, then Scottish Mortgage is well placed for a number of reasons. It has genuine global innovative investments, many of which could be long-term winners in their respective areas of technology, healthcare and even biotechnology.

“In addition, unusually for a generalist investment trust Scottish Mortgage has a large allocation to private companies, an area of the market that can be difficult for many investors to get proper access to.”

Performance of trusts over 10yrs vs sector and benchmark

Source: FE Analytics

In addition (or alternatively) to megatrends, younger investors can try to capture the long-term growth potential of smaller companies.

Mick Gilligan, partner and head of managed portfolio services at Killik & Co, named The Global Smaller Companies Trust as a “great way” to get access to “good quality” small- and mid-sized companies from across the globe.

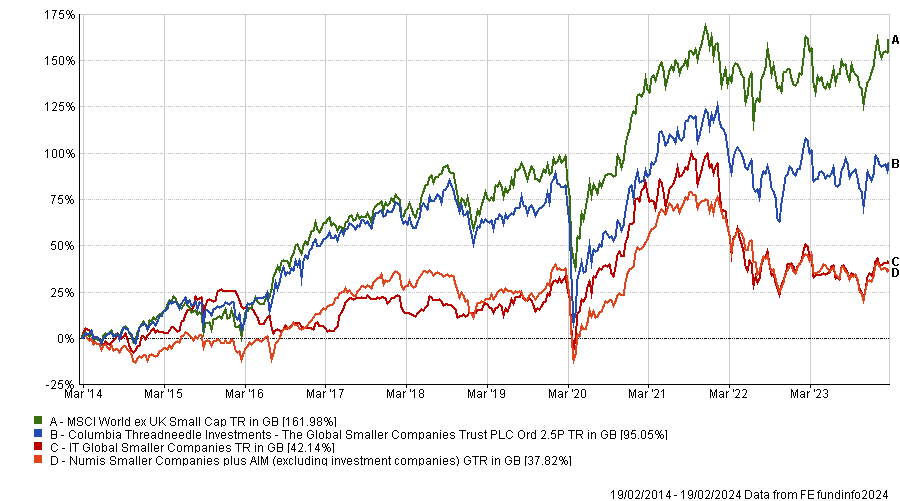

Performance of trust over 10yrs vs sector and benchmarks

Source: FE Analytics

Maffioli had a preference for Odyssean Investment Trust, which gives shareholders exposure to approximately 25 UK smaller companies from the TMT (technology, media, and telecom), services, industrials and healthcare sectors.

Middle-aged investors

While middle-aged investors still have a decent time-horizon ahead of them, they may also need a stream of income.

To kill two birds with one stone, Maffioli tipped JPMorgan Global Growth & Income, which provides both capital growth and an income stream via global equities. In addition, a quarterly dividend is set at the beginning of each financial year.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

Gilligan meanwhile highlighted Utilico Emerging Markets, which he said could be of interest for middle-aged investors looking for a source of income. It yields 3.7%.

Gilligan said: “The trust offers exposure to essential infrastructure in emerging markets. Underlying companies have very strong market positions in areas such as airports, ports and power provision.

Performance of trust over 10yrs vs sector

Source: FE Analytics

For capital growth, Evans recommended JPMorgan American, highlighting its high conviction portfolio of growth and value stocks that has led to good returns and helped to weather different market conditions.

The US market has benefited from the extra fiscal and Covid stimulus packages provided in recent years, boosting the trust. Moving forward, if interest rates fall this year the growth and real estate companies in this trust’s portfolio should be further supported, while an economic slowdown may support its value positions such as those in consumer staples, he said.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

Away from the US, Maffioli suggested India is well positioned to fulfil the growth role in a middle-aged person’s portfolio, as the South Asian giant benefits from positive demographic trends, growing direct foreign investment and a rising middle class.

Her pick to back the growth of the most populated country in the world is Ashoka India Equity, which benefits from an India-based team of analysts who cover a full range of Indian equity opportunities.

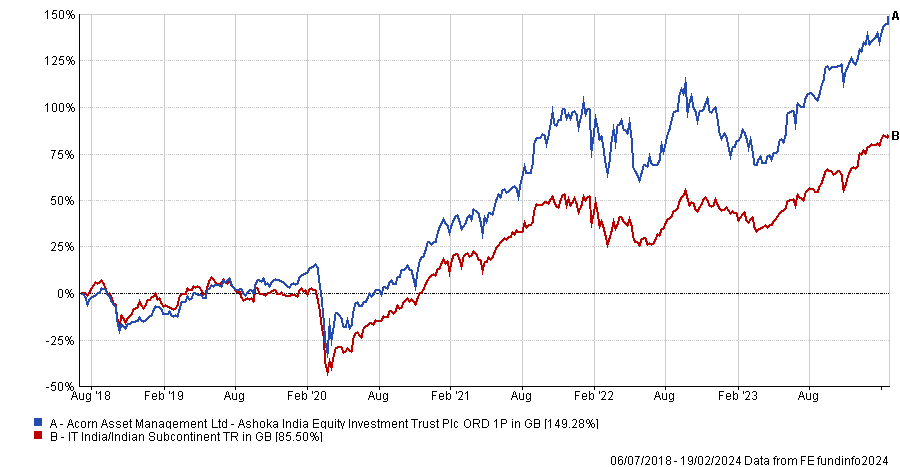

Performance of trust since launch vs sector

Source: FE Analytics

For more thematic investors Sarwar suggested healthcare, where he recommended Polar Capital Global Healthcare Trust.

“The trust is well managed by an experienced team who invest with high conviction. The top 10 positions account for around 50% of the trust with 40 to 50 investments held overall,” he said.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

Retired investors

Retirees often look for an investment that can provide them with a consistent level of income that can complement their pension money. They will also typically prefer steady performance and relatively low volatility.

Therefore, Sarwar believes that Personal Assets Trust is a compelling offer for older investors.

He said: “The trust has a consistent track record of returns and invests broadly, for example using physical gold typically as a large position, alongside a cluster of high conviction global equity holdings. UK and US bonds make up the rest of the portfolio.

“For inflation protection, and exposure to various investment assets in a risk-controlled manner, this is a very good trust for retired investors or indeed any investor.”

Retirees looking for a trust offering a high yield might be interested in Gilligan’s pick – Atrato Onsite Energy – which yields 7.7%.

Gilligan said: “The company is the largest owner of commercial rooftop solar in the UK. It builds solar panel systems and supplies the power to large corporates.”

However, he also stressed that Atrato Onsite Energy is one of several high-yielding alternative income providers that has been hit by a sharp fall in share prices in recent years. As a result, the trust is trading at a 22% discount to NAV. Yet, the dividend was raised 10% last year and has forward cover of 1.3x.

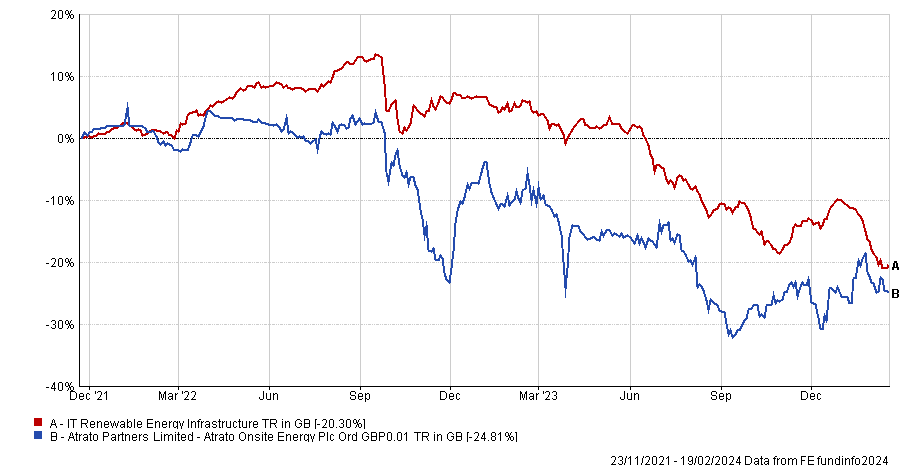

Performance of trust since launch vs sector

Source: FE Analytics

Maffioli pointed to Murray International and Schroder UK Mid Cap Fund for retirees looking for attractive yields via conventional assets such as equities.

The former is a large global investment trust yielding 4.6%, which has been managed by veteran fund manager Bruce Stout who will retire later this year as well as Martin Connaghan and Samantha Fitzpatrick.

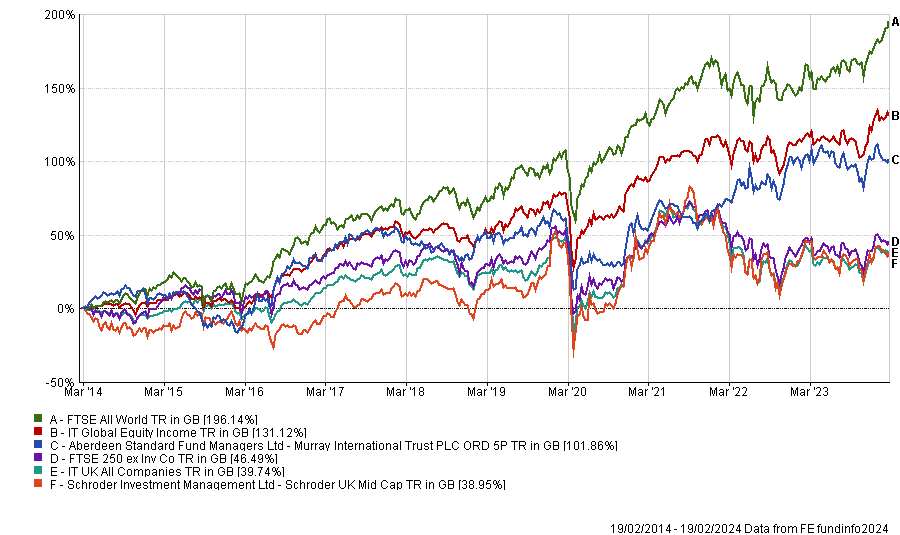

Performance of trusts over 10yrs vs sectors and benchmarks

Source: FE Analytics

The latter is a domestic play, which she said “provides my retired clients with exposure to an index which has a proven track record for breeding successful disrupters”. The trust yields 3.7% and is trading at a discount of 13%.

Finally, Evans tipped Alliance Trust for retirees looking for an investment providing a consistent level of income with steady performance and relatively low volatility.

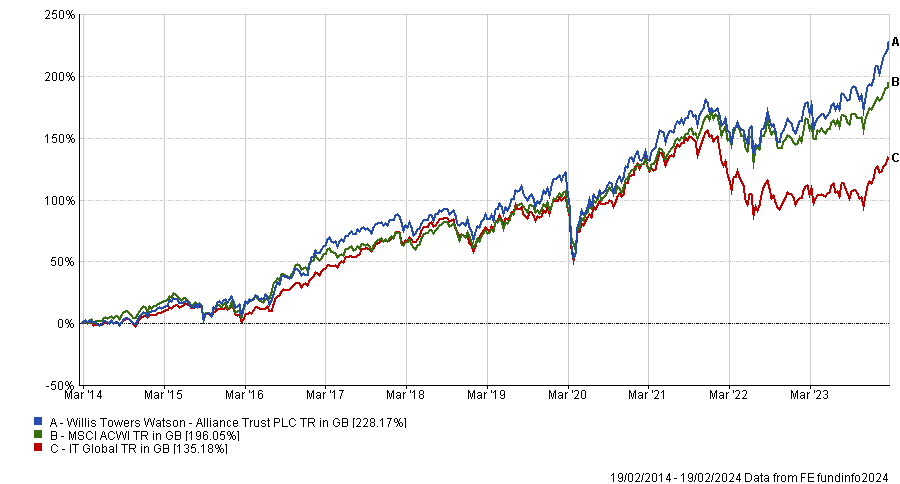

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

He said: “It is one of the oldest and largest UK investment trusts and invests primarily in global equities. Alliance Trust has been one of the top dividend heroes amongst investment trusts with dividends increasing for 56 consecutive years with an annualised five-year dividend growth rate of 12.8%. It is also currently trading at a discount so would provide exceptional value.”