With the rise of passive investing, active fund managers have needed to justify their higher fees through superior stock picking, giving investors returns that are above benchmark levels. This excess return, or an investment strategy's ability to beat the market, is measured by the level of alpha.

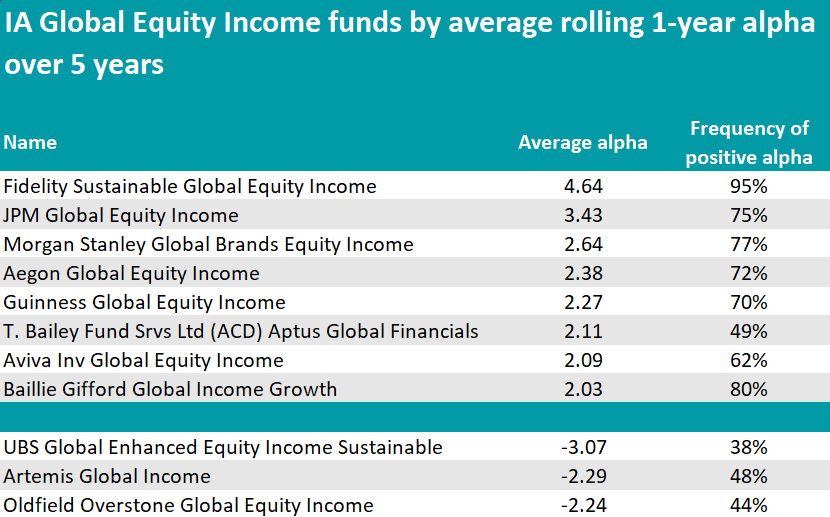

In this series, Trustnet uses FinXL data to single out funds that achieved the greatest average alpha in their sectors across 61 year-long periods calculated each month over the past five years. Today, we look at the IA Global Equity Income sector.

The main stand-out performer in the sector was Fidelity Sustainable Global Equity Income, which not only achieved the highest average alpha of 4.64, but also maintained a positive alpha 95% of the time over the period.

The fund has been managed by Aditya Shivram since July 2021 and boefre that, Amit Lodha. Since the manager change, it distanced both the sector and its benchmark by approximately six percentage points, as the chart below shows.

Performance of fund against sector and index since Shivram’s tenure Source: FE Analytics

Source: FE Analytics

The manager invests in better-quality companies than the market (measured by higher earnings persistence and lower debt levels) without overpaying for them.

In 2023, performance was driven by stock selection in the industrials and financials sectors, with insurance companies Admiral Group and Progressive Corp adding the most value. It is the only sustainable strategy to make the list.

More than one point below, JPM Global Equity Income is the second fund on the list, with an average alpha of 3.43.

Managed by a team that includes FE fundinfo Alpha Manager Helge Skibeli, the fund amalgamates the highest conviction ideas from the extensive pool of analysts into a portfolio of (currently) 66 holdings.

The strategy was one of the latest additions to AJ Bell’s favourites list, which recognised the merits of its “tried and tested investment approach” that maintains a “pragmatic balance between income yield and capital growth”.

It’s another wide step down the list to reach the third place, where the £61m Morgan Stanley Global Brands Equity Income fund sits with 2.64 of average alpha. Alpha Manager William Lock and his team spun off the process of the Global Brands fund focusing on income-generating stocks, achieving a yield on the portfolio of 3.7% without giving up on capital growth.

The top holding is Microsoft (8.3%), followed by SAP (6.5%) and Accenture (6.1%).

In a close fourth place, Aegon Global Equity Income is an Irish-domiciled FE fundinfo five-Crown rated strategy focused on US-based mega-caps, paying a 2.43% yield.

Source: FinXL

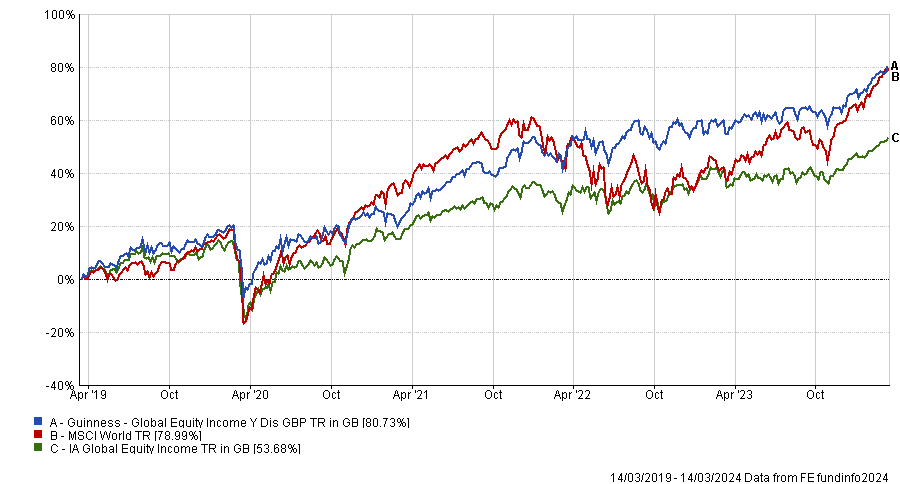

Next came the £4.3bn Guinness Global Equity Income stood out to FE Investments analysts for its “best-in-class performance” and “stellar” track record over the long period against its peers. They also praised Matthew Page and Ian Mortimer’s “considerable intellectual heft” and their “well-defined, robust and repeatable process”.

“The concentrated, equal-weighted approach to portfolio construction is the result of extensive research and differentiates the fund from peers. The ability to protect capital in downturns – but crucially to also keep up and sometimes outperform in upswings – is highly appealing,” they said. “The fund also has a below-average cost relative to peers.”

Performance of fund against sector and index over 5yrs

Source: FE Analytics

We continue with Alpha Manager Richard Saldanha, who is in charge of the Aviva Inv Global Equity Income fund – a long-term focused concentrated strategy with just 40 holdings in companies that have a strong competitive advantage, earnings and cash flow durability, and strong moats.

Speaking with Trustnet, the manager recently defended the merits of an equity income portfolio that yields 2.6% even if cash is yielding north of 5%.

Finally, the £646.4m Baillie Gifford Global Income Growth fund, managed by Alpha Manager James Dow, is recognised by RSMR analysts for offering “dependable income stream, delivering growth in real terms, and capital growth”.

“This fund’s philosophy is different from many in the sector, with the belief that over time a growing income stream will deliver a higher overall income to investors than investing in a high-yielding strategy,” they said.

“The overall strength of Baillie Gifford as an investment house and the experience of the two lead managers for the fund entitle it to be used as a core holding within its sector.”

The worst performers, with a negative alpha greater than 2, were UBS Global Enhanced Equity Income Sustainable, Artemis Global Income and Oldfield Overstone Global Equity Income.

IA Sectors previously in this series: UK Equity Income, UK All Companies, Global.