Canaccord Genuity Wealth Management has increased its weighting to quality stocks with the addition of Fundsmith Equity and Evenlode Global Income.

Kamal Warraich, head of equity fund research at Canaccord, explained that the stressed economic environment, recent technical recessions and the slowdown in global economic growth have led the wealth management firm to seek refuge in the quality factor.

He said: “Quality gives you meaningfully consistent and good risk-adjusted returns, decent upside capture and the best in terms of drawdown.

“We think quality is the place to be, not just for the next few years, but for the foreseeable future. We are willing to pay more for the quality bias.”

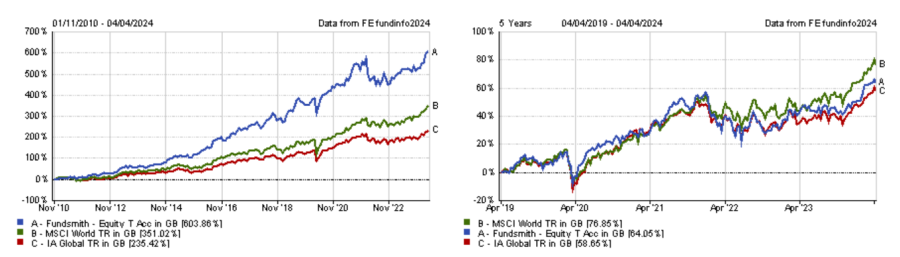

Performance of fund vs sector and index since launch and over 5yrs

Source: FE Analytics

The funds Canaccord chose to beef up its exposure to the quality factor are Fundsmith Equity and Evenlode Global Income.

Warraich said: “We've introduced some high quality global fund managers into the portfolio to improve the profitability characteristics.

“Fundsmith is quite an obvious candidate for quality growth on a global scale, whereas Evenlode Global Income provides us with a dividend growth factor and gets us quality in a different way.”

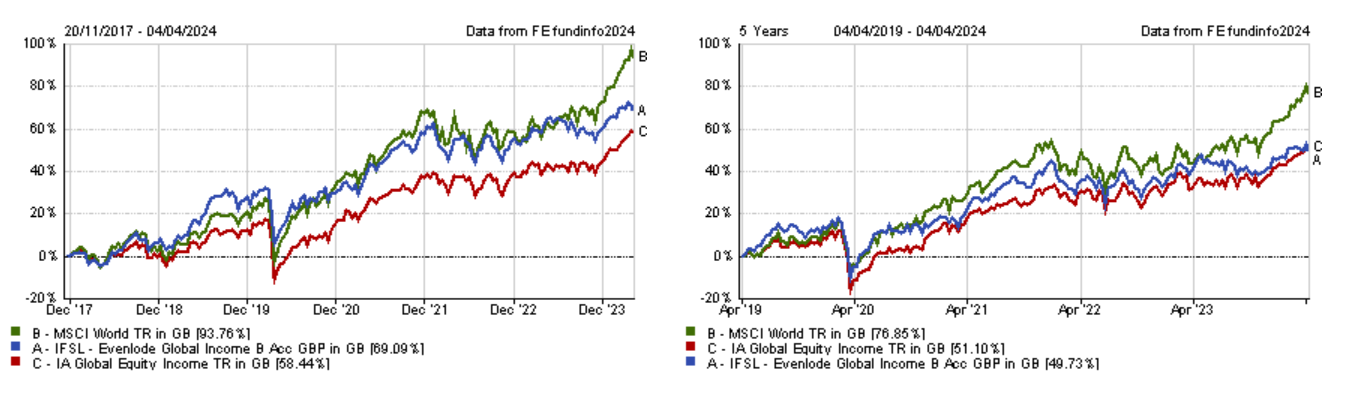

Performance of fund vs sector and index since launch and over 5yrs

Source: FE Analytics

Among the sectors traditionally associated with the quality factor, Warraich particularly likes consumer staples in Europe but even more in the UK.

He said: “In the UK, they're trading on much cheaper valuations than their like-for-like international peers, because of the Brexit effect, the government issues, Liz Truss’s mini-Budget, etc.

“We would broad brush consumer staples and say that, notwithstanding issues, Diageo still looks attractively valued on certain metrics.”

However, Warraich highlighted that some of Europe’s biggest companies, known as the ‘Granolas’ (GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP and Sanofi), look fully valued.

For instance, Nestle recently disclosed a revenue slowdown as inflation has hurt the demand for some of its products.

Luxury products and alcohol – which are sub-sectors often associated with the quality factor – have also suffered in recent months, but these are more short-term issues, he said.

For instance, Burberry issued a profit warning at the beginning of the year as the demand for its products has diminished due to the rise in the cost of living and the surge in interest rates.

Diageo also recently had a profit warning, as it faced overstocking problems in Latin America.

Warraich added: “It's not perfect across the board and sometimes these companies are priced a little too perfectly or are fully valued. You have to be quite careful and minded that there are still some pressures.

“But the key is to look at the long term. When you look at the short term, there are a lot of problems, medium term less so and long term, fewer problems still.”

Another sector associated with the quality factor that Warraich finds compelling is healthcare, as it has had a few difficult years after the Covid rally.

It is, in fact, one of the few ‘unloved’ areas Canaccord has recently gone overweight alongside UK small- and mid-caps, China and infrastructure.

In addition to quality, Canaccord has some exposure to the value factor, but uses it more as a satellite play.

Warraich said: “Value can be prone to big bouts of cyclicality. It's highly correlated to interest rates and the yield curve. You can have big cycles where commodities and banks do quite well.

“We don't mind having some of that exposure, but we're minded that it's more of a secondary component.”