The latest data from Calastone this week was a depressing reminder for UK businesses and fund managers of just how truly despised they really are.

It seems investors have been willing to plough their cash into anything else over the past three months, with £7bn added to equity funds since January and £2.3bn added in March alone.

US funds raked in the most net cash (shockingly), with their highest cash injection over a three-month period on record. The £5.7bn added to these funds eclipsed the previous quarter high of £1.8bn set in the final three months of 2020. In fact, that amount was added in just the month of March.

Every other equity market fund group (pretty much) was also in the plus column. But there was one glaring exception – the good old UK.

That’s right, UK funds suffered another month of outflows in March, the 34th consecutive month of net selling. Not only this – but outflows actually picked up pace, with some £823m taken out of these portfolios (the most since February last year). It took the net withdrawals for the quarter to £2.1bn.

It is not for a lack of trying, however. The government’s new British ISA is one of a number of measures mooted to encourage UK investors to put their cash back into the domestic economy and to bring foreign investors on board, but this will take time.

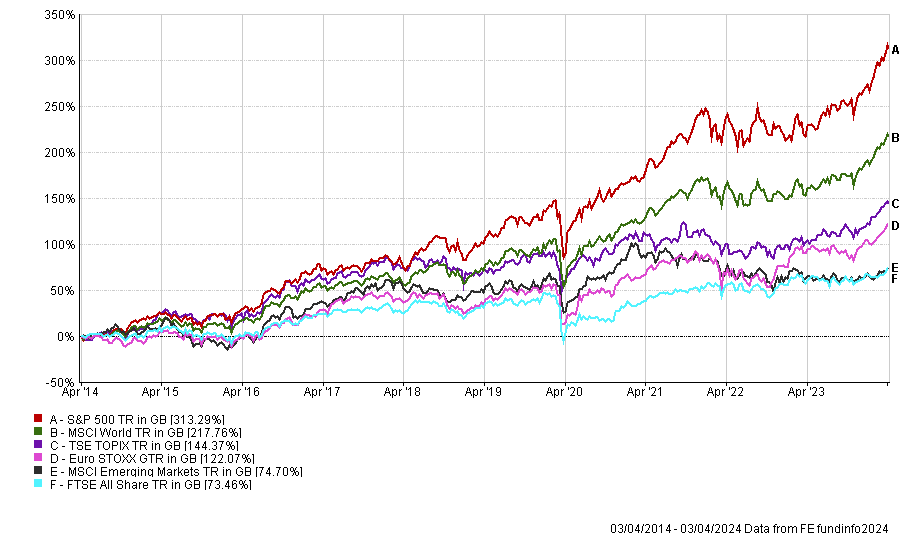

Perhaps the biggest thing that could happen to transform the UK’s fortunes would be if the market outperforms. When looking at the performance of the six main equity indices – the S&P 500, MSCI World, Euro STOXX, TSE Topix and MSCI Emerging Markets – the FTSE All-Share index pales in comparison.

It has been the second worst over one and five years – ahead of only the emerging markets index, and is dead last over the decade.

There have been bright spots – it was the top index in 2022, but has only appeared in the top half in one other year (2021) since 2014.

Yet this should by all accounts be a good time for the UK. Oil giants, which dominate the index, have benefited from rising oil prices on the back of Covid supply problems and the ongoing war in Ukraine, with sanctions placed on Russian oil exports.

Financials – another large part of the index – should also be thriving in the higher interest rate environment.

Yet this has not been enough to arrest investors’ concerns that the UK market is too old, too slow to adapt to change and has a dearth of interesting or exciting companies coming to the market.

Just this week, analysts at Peel Hunt suggested the FTSE Small Cap index will “cease to exist” by 2028 if the current pace of initial public offerings (IPOs) continues alongside the rise of mergers and acquisitions (M&A).

Yet there are reasons to believe that the UK will be back. As mentioned, oil and financial stocks should be in a period of making strong returns – even if they have failed to deliver versus other markets so far.

Additionally, the tech bull run in the US may not last forever. This is not a prognostication that it will end abruptly, but experts warned this week that the momentum trade – which led markets in the first quarter of 2024 – is often followed by a pullback.

But until investors see the benefits of the UK – which at present they are having to look extremely hard for – it could be several more months, if not years, before investors start to reverse their UK fund selling spree.