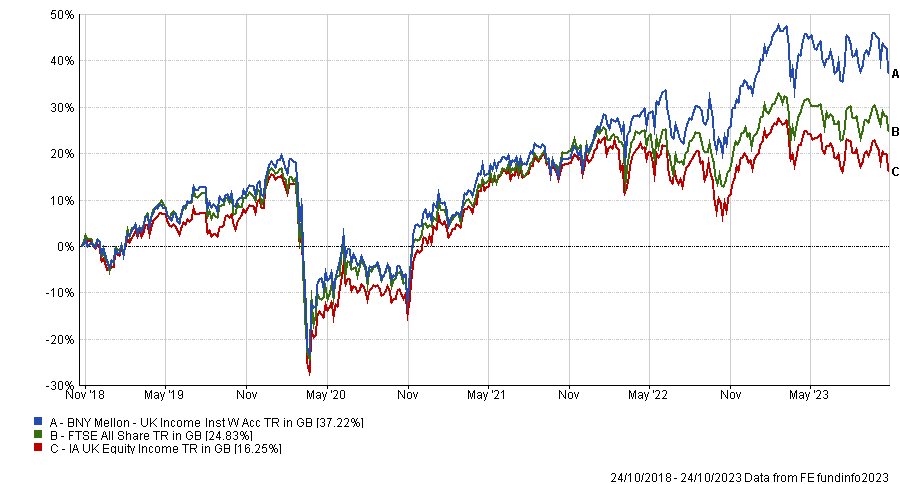

BNY Mellon UK Income is one of just 30 UK funds that has successfully beat inflation over the past five years, making a total return of 37.2%, placing it in the top 8.8% of UK funds over the period.

It is something manager David Cumming credits to the fund’s ability to partly invest abroad – as concerns over a shrinking UK market are real and well-earned.

Here, he tells Trustnet why having overseas exposure could help if the UK market continues to shrink and how Shell is “extremely cheap” despite shares soaring.

Total return of fund vs benchmark and sector over the past five years

Source: FE Analytics

What is the objective of the fund?

It is a UK equity income fund that targets a yield of at least 10% above that of the index. We’re a bit higher than that at the moment. The main objective is obviously to outperform the index on capital, which it has over the long term, but it has significantly outperformed on income too. On a total return basis, it is the latter that has delivered the numbers.

You were one of 30 UK funds to beat inflation over the past five years – how did you do that when so many others failed?

In terms of differentiators, we can invest up to 20% of the fund overseas. We currently have about 16% overseas at the moment, which is all in Europe because we think the US market is quite expensive.

It's almost like an escape valve in that it means we don't have to dive down too low in the mid-cap area for ideas. We can either buy the best stocks globally if we think the option outside the UK is more attractive, or occasionally play themes that you simply can't in the UK.

Which European companies are outshining their UK counterparts?

A good example would be Publicis, which is a French agency company. WPP is the UK equivalent, but that is losing market share and is still really suffering from departure of [former chief executive] Martin Sorrell.

Publicis has got better data, software design and stronger management, so we prefer that over WPP and decided to buy that in France instead, which has done extremely well for us.

It’s a bit of a coincidence that most of our non-UK holdings are in France, but it's a good way of playing better stocks with a cheaper valuation.

Share price of Publicis vs WPP over the past five years

Source: Google Finance

Is overseas exposure helpful if the UK market continues to shrink?

I think it offsets that risk. There is a ‘darkest before the dawn’ element to the UK because the market is cheap relative to history and compared with other markets – it is certainly very cheap relative to the US. I think there is a risk longer term that the UK market gets narrower but it's not a major concern right now.

What does the UK lack that you can only buy overseas?

The most obvious one is technology. Those companies tend not to yield very much so it's no great loss and they’re also pretty overpriced at the moment.

That does mean that if tech gets cheap for whatever reason – and we do keep an eye on things like Samsung – we could buy it, which we wouldn't be able to do if we only had UK options.

What has been your best performer over the past year?

Owning SCOR, which is a French insurance company, has been really good for us. We bought it at the end of last year for about €18 and it now trades at €29, so we have sold that down a bit.

It was very cheap against other reinsurers when we bought it and the rate cycle was picking up as well. People were worried about the quality of its reserves but the news flow has been a lot more positive over the past 12 months, which has driven a re-rating in the share price.

Domestically, we own Shell, which was also very good, but SCOR was the best performer.

Shell accounts for almost 10% of the portfolio – were you tempted to trim that after its strong performance?

That’s the problem we've got with Shell – we're right bang on the limit we can invest in it. Our rules don’t allow us to have above 10% in a particular stock, so we have been trimming that position recently because it's been drifting above on a passive basis.

But the thing with Shell is it’s a lot cheaper than the US equivalents like Chevron and Exxon. Although it is back to its all-time highs we saw in 2019, it’s actually doubled its earnings since then, so it's massively de-rated and a very cheap stock.

The UK market is roughly back to where it was five years ago, but most stocks have had pretty flat earnings profiles over that time. Yet Shell’s earnings have gone up a lot, so it’s extremely cheap.

Share price of SCOR and Shell over the past year

Source: Google Finance

Shell is the UK’s largest company and already takes up a large chunk of the market – are you worried about concentration risk?

We’ve got around 45 stocks in the fund and we’re ultimately trying to beat the index, so we have to take risks. It’s 7.5% of the index, so we’re only 2.5 percentage points overweight.

In smaller markets such as the UK, the top 20 stocks are worth more than 55% of the index, so you've always going to have that issue. The fact we can invest overseas allows us to broaden out a bit.

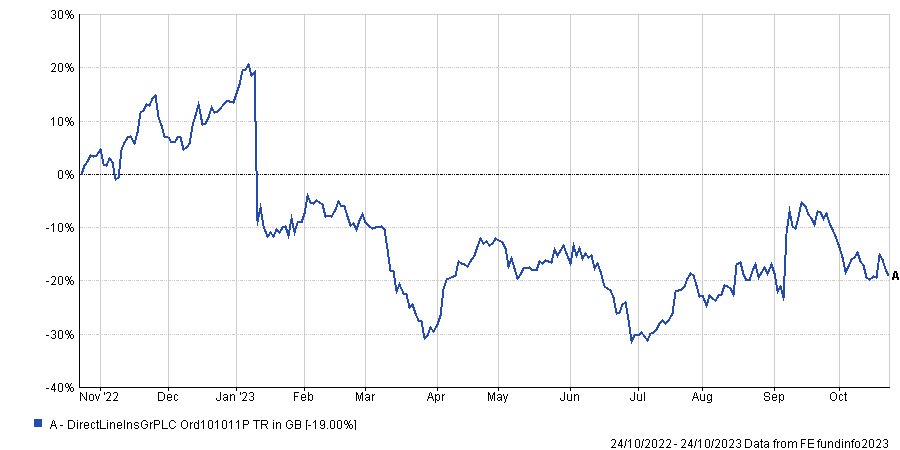

What was your worst performing stock over the past year?

Direct Line was our biggest detractor at a stock level. What the company said in outcomes didn't correlate, which is always disconcerting.

We were already a bit worried and the fact the company had a higher loss ratio than it had expected meant the balance sheet was weaker. Even though we thought rates would probably pick up eventually, management didn't have a grip on what was going on, so we sold out.

Without a positive angle, we didn’t see much point in owning it. It was in the portfolio for about four or five months, so we didn’t lose a huge amount of money in it.

Share price of Direct Line over the past year

Source: FE Analytics

What are your interests outside of stock picking?

I'm interested in history and current affairs, which is useful in stock markets sometimes because history repeats itself. I also play piano, chess, badminton and climb hills.