Airlines have had a tough time, with the world shutting down in 2020 and tentatively reopening over the past few years. Then throw in a cost-of-living crisis causing consumers to count the pennies and rising inflation hitting costs – it has been a far from perfect environment for the sector.

However, there is room for optimism, with airline carriers expected to make a comeback over the next few years, according to experts.

Fidelity fund manager Marcel Stötzel said the industry is already back to around 5% below pre-pandemic levels, but noted that this is still some way from where it should be once growth from the missed years is factored in.

“The industry is back on its feet but within that there are some very interesting buckets. Leisure travel has almost fully recovered. But corporate travel is still only around 60-70% of where it was,” he said.

While some of this lack of business expenditure is due to fears of an economic recession, there is also a structural reason for the lack of demand as online meetings have become more commonplace.

“It’s consumers who have stepped in and filled that gap of business class travel. That’s thanks to a combination of things: largely consumers not having travelled for a while. People were sitting on vouchers, which they viewed as a sunk cost; and then really just the effects of the bull market, the stimulus, and all of these things meant that a lot of middle-class consumers have said ‘let’s treat ourselves’.”

He warned that the industry is likely to be more cyclical, with low-cost airliners taking the bulk of the market share in the future.

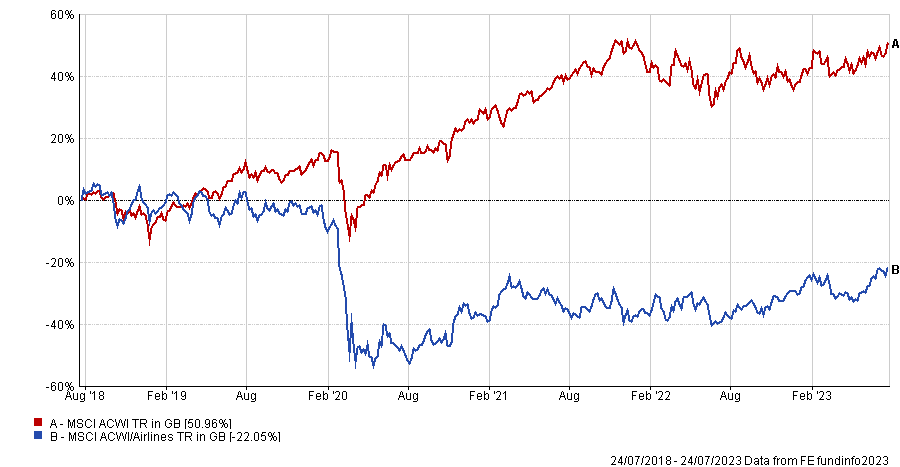

Performance of global airlines vs MSCI AC World index over 5yrs

Source: FE Analytics

After big events such as 9/11, the financial crisis and now the pandemic, these firms ramp up capacity at a time when others are cutting, coming out any difficult periods with lower cost bases, higher market shares than before and much better supply-demand dynamics.

There are already signs of this after low-cost airline easyJet produced a sold set of results last week. Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: “easyJet is enjoying the spoils that come with a Covid-restriction-free summer. Trips abroad are so important to the group’s core customers, easyJet’s been able to pump up its ticket prices and passengers are still pouring on board.”

Ryanair, another budget airline favourite, also produced a good set of results earlier this week.

Ed Legget, manager of Artemis UK select and Artemis High Income, said there are others in a good place for the expansion of travel over the next few years.

He highlighted International Consolidated Airlines (IAG) – the parent company of British Airways, Iberia, Aer Lingus and Vueling – and Jet2, both of which he owns in his UK Select fund.

“We view IAG as a landlord sitting on valuable real estate – in the case of British Airways, its slots at Heathrow. The airline has a set of joint ventures which together control 83% of connections to the highly profitable North Atlantic region. British Airways’ market share of these routes has grown since the onset of Covid,” he said.

The manager noted that a lower cost base through the retirement of older, more expensive planes, should lead to a quicker recovery for the stock than some are pricing in.

Owning an airline doesn’t come without risks – recessions, terrorism and pandemics being the main ones – but he said a price-to-earnings ratio of 7.5x, falling to 5.8x next year and 5.1x the year after, “more than compensates for these risks”.

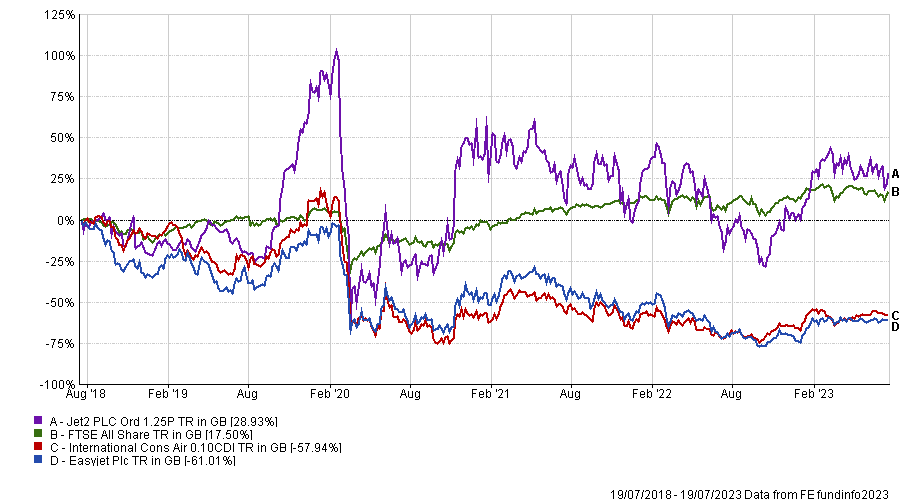

Performance of stocks vs FTSE All Share over 5yrs

Source: FE Analytics

More akin to easyJet, Jet2 is also “exceeding expectations, delivering impressive growth in what was once seen as a mature industry”.

“Prospects for the year ahead look strong, with all indicators suggesting that bookings in the key post-Christmas period have been good. Jet2 recently increased the number of holidays in its ATOL licence. On that basis, it is likely to be the UK’s number-one tour operator this summer,” said Legget.

Stötzel doesn’t own any airlines in his Fidelity European Fund and Fidelity European Trust as none currently pay a dividend, but said he expected Ryanair to “hopefully commence paying a dividend” within the next year and could therefore become eligible for inclusion.