In the investment trusts universe wide discounts are often linked to higher long-term returns – and the data backs up this hypothesis.

Since 2018, investing in trusts with a double-digit discount have returned an annualised 13.6% in the following five years, a recent study by the Association of Investment Companies (AIC) showed. That is 4.3 percentage points higher than trusts that traded at a discount of less than 5%.

Currently, some 31% of trusts with at least a five-year track record are now trading at double digit discounts, according to data from QuotedData.

But just betting on a big discount may not be the most prudent strategy. For example, some trusts always trade on wide share prices relative to their net asset value (NAV) – meaning there is little catalyst for change.

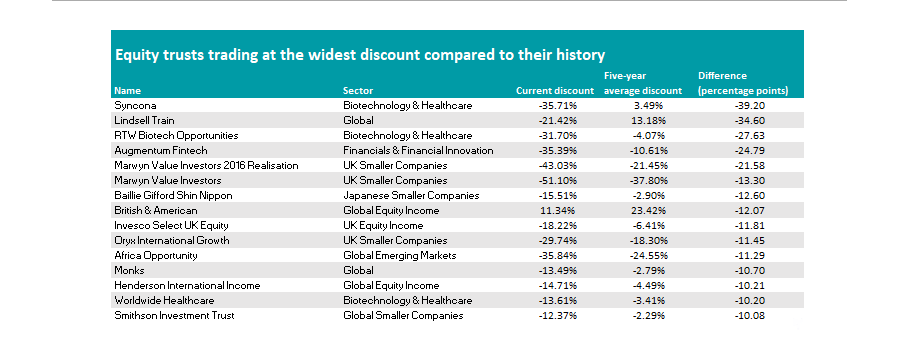

As such, Trustnet looks at those trading at the widest discounts relative to their five-year average, suggesting they are cheaper than usual. The data spans from 31 January 2019 to 22 February 2024.

We begin with equity sectors, where there are 15 trusts whose net asset value has dropped by two digits against their five-year average.

The first up is Syncona, whose current 35.7% discount compares against an average five-year premium of 3.5%. The drop is attributed to a fall in some of its holdings and the recent unpopularity of the life sciences industry.

Yet at the beginning of the year the trust was featured both in Numis' alternatives trusts to snap up at a bargain price and in Peel Hunt’s list of trusts to invest in growing businesses, whereby analysts highlighted “lack of operational explanations behind the current discount”.

Other highlights in the same sector are RTW Biotech Opportunities and Worldwide Healthcare.

Source: Quoted Data

In a very close second position, the Lindsell Train investment trust trades 34.6 percentage points below its usual premium. The portfolio, run by veteran manager Nick Train, includes other Lindsell Train funds, the unlisted security Lindsell Train Limited and single stocks in the consumer, financials and media sectors. The largest stock holding is Nintendo (8.9%).

The trust’s share price has been volatile, trading at almost double the net asset value during the period, but has dropped to a 21.4% discount today.

Still in the IT Global sector, Baillie Gifford’s Monks is 10.7 percentage points cheaper than it has been historically. It is usually referred to as Scottish Mortgage’s cousin and was recently chosen by head of fund research at Quilter Cheviot Nick Wood for being a more tempered and diversified way to gain access to global growth equities.

For income seekers on a budget, Henderson International Income might be an option to consider, given the discount is 10.2 percentage points greater than usual.

Designed as a complementary diversifier for investors who already own a UK income fund, this strategy seeks income globally avoiding the domestic market.

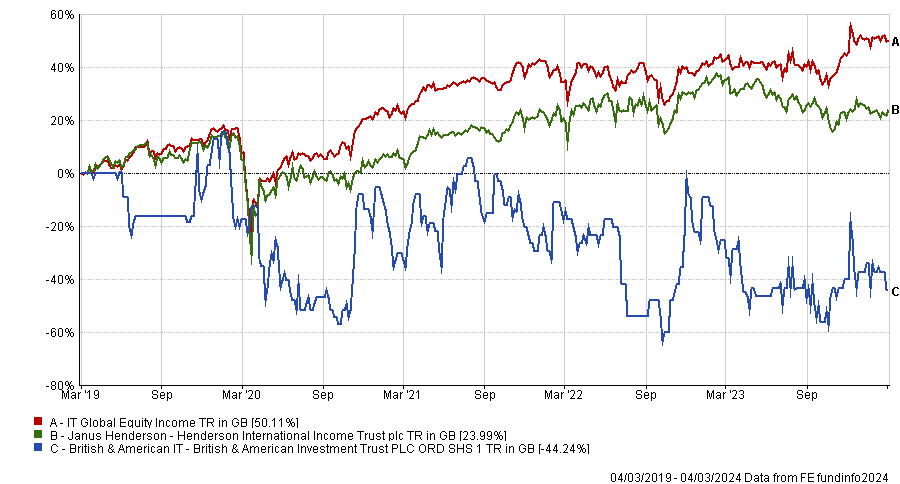

It has underperformed the seven-strong sector over the past five years, but not as spectacularly as British & American, which is also on the list.

It has a UK focus and has been the bottom performer of the whole sector over 10, five and three years, as well as 12 months.

Performance of funds against sector over 5yrs

Source: FE Analytics

In the bargain basket of smaller companies, the UK is particularly cheap, with three trusts on the list – Marwyn Value Investors, Marwyn Value Investors 2016 Realisation, and Oryx International Growth.

Oryx principally invests in small and mid-size quoted and unquoted companies in the UK and US. Its interim results as at 30 November 2023 showed several takeover bids to spur its performance.

Global and Japanese smaller companies were also present. Baillie Gifford Shin Nippon stood out as a FundCalibre elite-rated fund which, according to managing director Darius McDermott, has “ample opportunity to uncover hidden gems”.

With a global remit, the Smithson Investment Trust has bounced back strongly in 2023 after a difficult 2022.

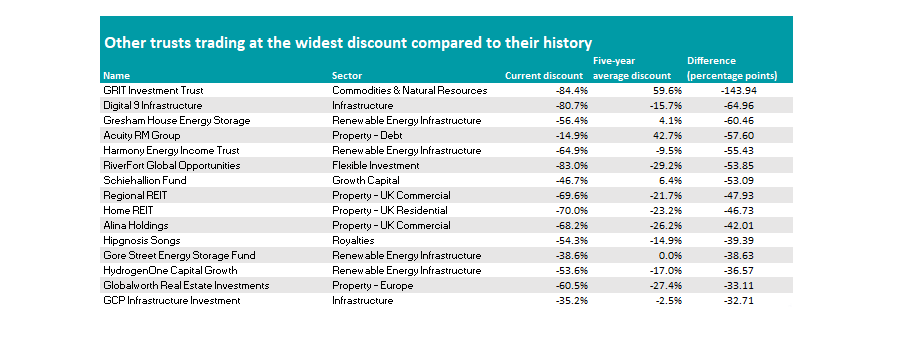

Turning to alternative trusts, investors can find the widest discount of the whole universe relative to history here, led by the 143.9 percentage points gap for GRIT Investment Trust.

It focuses on small and mid-cap companies in the natural resources and mining sectors and is currently seeking a reverse takeover in order to list on a public market. In the past five years, it lost 94.6% against the 51.5% return of the average peer.

The sector most hit by wider-than-normal discounts were IT Renewable Energy Infrastructure and IT Property, with the full list below.

These funds can be much smaller, meaning their share price is more volatile, as sell trades have more impact than in larger portfolios.

Source: Quoted Data