Companies can no longer rely on economic growth, which is expected to slow down in the US and Europe, to boost their profit margins. Instead, companies need to have a strategic competitive edge to thrive, such as a talented management team or technological advantage.

This is the view of FE fundinfo Alpha Manager Gerrit Smit, who said he is having to hunt for “jewels” – quality companies that can keep growing organically and which are also attractively valued.

“The challenge is to find those jewels where we have the conviction that we can hold them indefinitely,” said Smit, who is head of global equity management at Stonehage Fleming Investment Management UK. “I have to hunt for companies that can keep growing on an organic basis.”

High quality companies should be able to bounce back from a recession faster than their competitors, he added.

“The peak of interest rates is behind us and that is only the case because inflation is under control. That’s quite a benign environment for risk assets if you can be comfortable on those two points, so people should be willing to take risk on that basis. The challenging bit is that the world economy is slowing,” he explained.

“Although rates and the inflation backdrop are constructive, we have to be careful what type of companies we buy because economic growth won’t be on their side.”

The six companies that have the strongest growth prospects within his £3.6bn Stonehage Fleming Global Best Ideas Equity fund are insurance broker Arthur J. Gallagher & Co. and technology businesses Adobe, Alphabet, Amazon, Cadence Design Systems and Microsoft, Smit said.

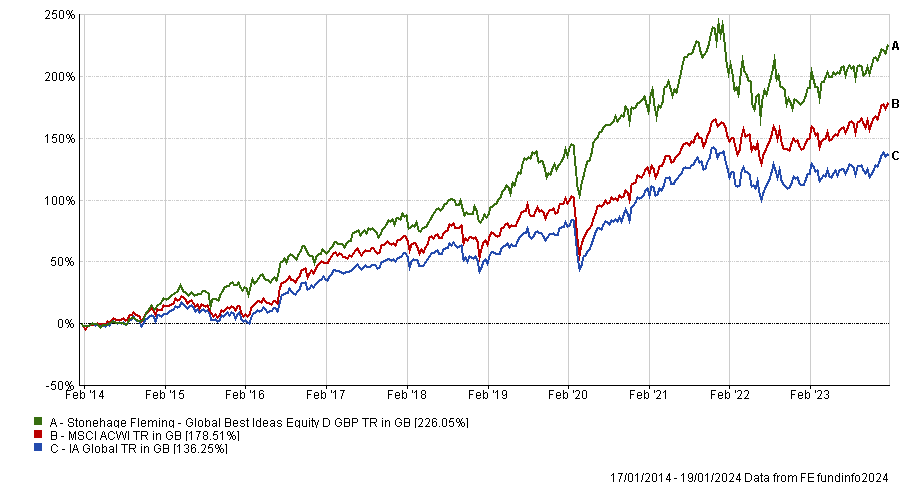

Performance of fund versus benchmark and sector over 10yrs

Source: FE Analytics

Other high conviction holdings include tech consultancy Accenture, which the fund has held since inception, and cardiovascular specialist Edwards Lifesciences. Smit added Arthur J. Gallagher & Co industrial gas company Linde to his portfolio in the third quarter of last year.

Below, Trustnet reveals why these stocks have the potential to keep growing even if the broader economy slows.

Accenture

Smit perceives cash-generative Accenture as a tech stock without the volatility. Three-quarters of Accenture’s business involves advising clients on technology, so the company needs to stay at the forefront of innovation. “It’s a very conservative way of getting exposure to the fourth industrial revolution,” he explained. Accenture’s share price is up 30.3% for one year to 19 January 2024.

Adobe

Smit described Adobe as one of the best early adopters and implementers of artificial intelligence (AI), which it has been using to develop attractive, creative products such as Firefly. Adobe’s share price has risen 71.6% over 12 months to 19 January 2024.

Alphabet

In a higher rate environment, Smit favours cash-generative companies with strong balance sheets such as Alphabet, which has more than $100bn of cash on its balance sheet.

While other companies have struggled with rising borrowing costs, Alphabet earned almost $1.1bn of interest on its cash holdings in the third quarter of last year, he noted.

Smit said his best investment decision last year was to hold his nerve and “do nothing when something was perceived to have gone awry”. He resisted pressure to sell Alphabet in February when its share price fell on fears that Microsoft would work with OpenAI to turn Bing into a fierce competitor to Google.

In February, Alphabet had its highest volumes of trading in more than three years which was “precisely the wrong time to sell”, Smit said. Alphabet’s share price has gone up 50% since then.

Alphabet’s share price over 1yr

Source: Google Finance

Other market participants did not appreciate the extent to which Google was already involved in AI; Google DeepMind has building AI systems since 2010. Google also has the third largest cloud business (behind Amazon Web Services and Microsoft’s Azure) and has been investing heavily to become a fierce force in cloud computing.

Beyond Google, Alphabet is quite a diverse group. Smit thinks that people tend to underestimate how big YouTube is, for instance.

Amazon

Amazon Web Services (AWS), the firm’s cloud computing division, is “by far and away the most profitable business within Amazon and why we own it,” Smit explained. AWS provides the cashflow to develop Amazon’s retail business, he added. Amazon’s share price rose 59.3% during the year ended 19 January 2024.

Arthur J. Gallagher & Co.

Casualty insurance is a strong growth area due to climate change and more extreme weather, as well as cybersecurity concerns. Insurance broker Gallagher earns commissions on transactions (which are usually three to five-year contracts) so it will benefit as demand for insurance increases and it has no underwriting risk. The business model is strongly cash generative and the company has very low capital intensity.

The insurance industry is still fragmented and Gallagher has built up significant scale through small bolt-on acquisitions, giving it the ability to negotiate competitive package deals for its clients. The company is family controlled and has an entrepreneurial culture.

Even if the economic outlook softens, people and companies will still need to buy insurance so this investment is a good hedge against a potential recession, Smit explained.

Cadence Design Systems

Smit spoke to Trustnet in September about the investment case for computational software specialist Cadence Design Systems. “The business has cemented strong partnerships with industry leading semiconductor companies such as NVIDIA and Taiwan Semiconductor Manufacturing, with more than 85% of its revenue recurring, delivering strong double-digit compounded cash flow growth,” he said.

The share price has climbed rose 59.3% over 12 months to 19 January 2024 (the same as Amazon).

Edwards Lifesciences

Edwards Lifesciences is a world leader in treating and preventing cardiovascular disease by providing heart values and heart pumps.

The market overreacted to the initial success of the GLP-1 (glucagon-like peptide) diabetes drugs after Walmart released data showing that people’s shopping baskets were getting smaller as medication impacted their appetite. The conclusion was that people would eat and drink less and used fewer medical services, so several healthcare names sold off.

Smit took the opportunity to increase his exposure to Edwards Lifesciences, which is now his 11th largest position. The company’s second largest market is Japan where lifestyles and eating habits are healthier but where the population still suffers the same levels of heart attacks as the US, he noted.

A move towards healthier eating habits and lifestyles might happen over many years but is unlikely to have a huge immediate effect on healthcare companies, especially as the GLP-1 drugs are too expensive for large numbers of people to use them, he added.

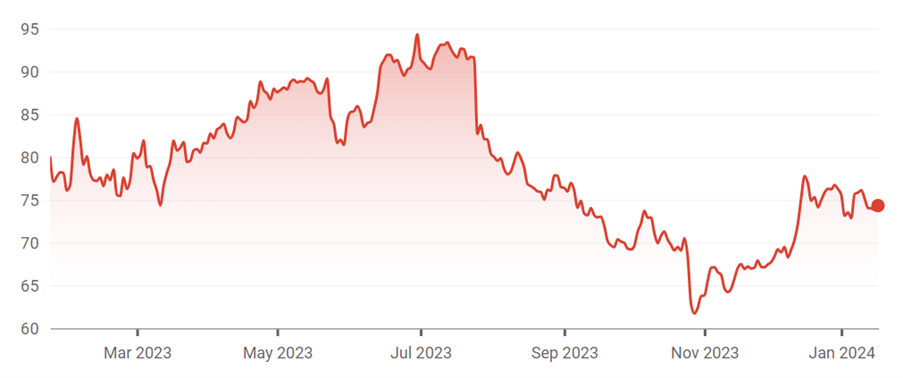

Edwards Lifesciences’ share price over 1yr

Source: Google Finance

Linde

Linde is the world’s largest industrial gases company, providing essential gases to a wide range of companies and industries globally, from refining to food production to medical uses. It is profitable and cash generative with a stable business model based on long-term contracts, according to Smit.

Linde could easily scale its hydrogen production business to meet growing demand for alternative fuel sources, which would provide Linde with a strong tailwind for growth that would be resilient against any potential global slowdown.

Microsoft

Microsoft has become ingrained in our working lives and is “one of the staples of the modern world,” Smit said. Whether there is a recession or not, companies will still need Microsoft Office, which gives the company tremendous pricing power.

Microsoft acquired Activision Blizzard in October, the gaming company behind Call of Duty. Smit described the acquisition as “ideal” for Microsoft because it possesses the software to develop this business further.

Microsoft shareholders have made a 64.4% return over one year to last Friday.