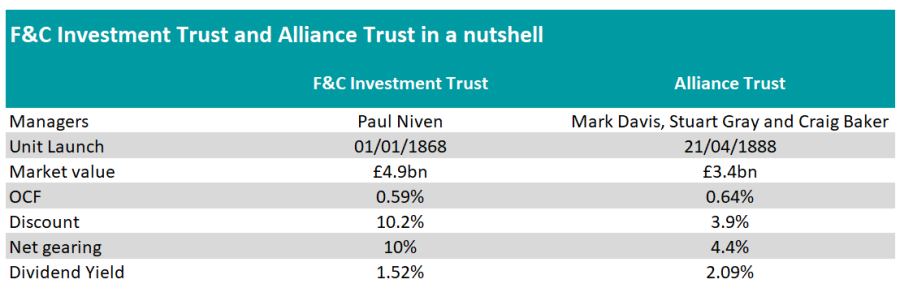

F&C Investment Trust and Alliance Trust are among the largest investment trusts in the IT Global sector and have a long history dating back to the 19th century, making them popular choices as one-stop-shops for core exposure to global equities.

Investors might have a hard time choosing between the two, as they seem very similar at first glance. Both take a multi-manager approach, are well diversified and are aligned with global benchmarks from a country and sector perspective.

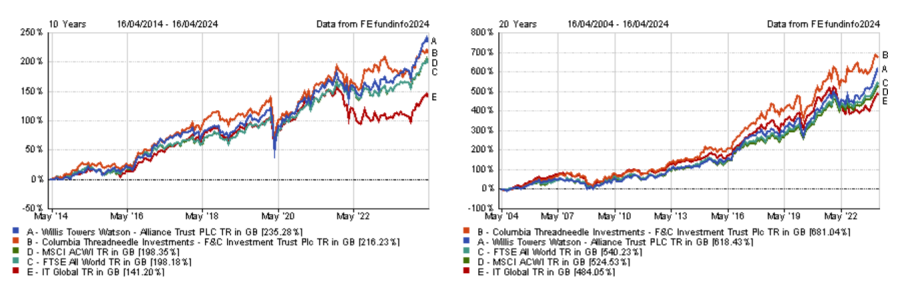

Historical performance may not help investors distinguish between the trusts, either. Alliance has had the upper hand over the past decade, but F&C has performed better over 20 years.

Performance of trusts over 10yrs and 20yrs vs sector and benchmarks

Source: FE Analytics

Trustnet asked experts to explain the differences between the two portfolios, to share which one they favour and to suggest other trusts to complement them.

How do Alliance Trust and F&C differ from each other?

Although both funds use a multi-manager structure, there are nuances. F&C invests in funds run by 13 managers, resulting in a portfolio comprising approximately 400 stocks, whereas Alliance Trust uses segregated mandates to get access to its 10 managers’ top 20 holdings.

Aidan Moyle, investment analyst at Hargreaves Lansdown, said: “This gives Alliance a higher conviction approach in their managers’ best ideas and results in a portfolio of 200 stocks from 10 managers. The use of segregated mandates also gives them access to managers that aren’t available to UK retail clients.”

Nicholas Todd, investment trust research analyst at Kepler Partners, countered that using funds makes it easier for F&C’s manager Paul Niven to adjust the portfolio tactically, depending on his outlook.

As a result, F&C has a greater style bias at times, which may impact short-term performance based on whether Niven makes the right call or not.

For instance, the trust significantly underperformed its benchmark over the past 12 months. Niven positioned the portfolio towards value stocks at the beginning of 2023 and missed the ‘Magnificent Seven’ rally as a result, although he shifted to a more balanced exposure during the year.

Performance of trusts over 1yr vs sector and benchmarks

Source: FE Analytics

Another difference is F&C’s exposure to unquoted investments, which has been a “valuable source of alpha” for four out of the last five financial years and offered “good diversification”, according to Todd.

Dan Coatsworth, investment analyst at AJ Bell, pointed out that private companies are less liquid, which may explain why F&C trades on a deeper discount of 10.2% versus 3.9% for Alliance Trust.

Both trusts are ‘dividend heroes’; Alliance Trust has raised its dividend for 57 consecutive years, while F&C has done so for 53 successive years. Yet, Alliance Trust has a bigger dividend yield at 2.05% versus 1.48% for F&C.

Coatsworth said: “Alliance Trust made a strategic decision in 2021 to boost its dividend payments and make the investment trust more attractive to a bigger pool of investors.

“This level of yield is still small versus what’s on offer from equity income-specific trusts but the combination of income and growth is why certain investors want to own the shares.”

Which trust do experts favour?

James Carthew, head of research at QuotedData, said Alliance Trust changed its strategy seven years ago, which was a turning point. The board appointed Willis Towers Watson to run the trust in 2017 and became more aggressive about tackling the discount. Around £1bn worth of shares have been bought back since then.

“Even though Alliance Trust’s new investment strategy is only seven years old, the trust’s returns have already made up the underperformance earlier in the decade. Its 10-year returns have now pulled ahead of F&C’s (12.6% per annum on average to F&C’s 12.0%),” Carthew said.

“It feels to me as though the gap will only get wider. If I had to choose between the two, Alliance Trust is the obvious favourite.”

Mick Gilligan, head of managed portfolio services at Killik & Co, prefers F&C due to its wider discount.

Meanwhile, Moyle believes F&C may be better positioned if central banks cut interest rates due to its 10% allocation to unlisted equities.

“If rates were to start falling, there could be a change in sentiment and investors could start moving more risk-on and increasing exposure to private companies,” he said.

Source: FE Analytics

How to complement them?

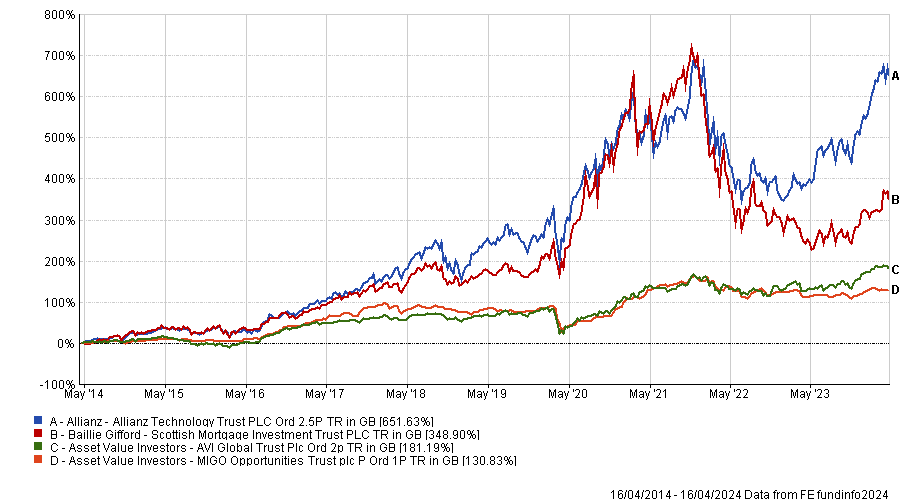

As both trusts are highly correlated to global equity benchmarks, Todd suggested complementing them with specialist exposures, such as Allianz Technology Trust.

He said: “It focuses on the tech sector, specifically at the lower end of the market cap spectrum, targeting the ‘picks and shovels’ companies which portfolio manager Mike Seidenburg believes have longer pathways for growth.

“However, there is an allocation to the Magnificent Seven which investors should be aware of as it may limit the diversification benefits. That said, it trades on a discount of 11.6%, which in a notoriously expensive sector looks attractive.”

Performance of trusts over 10yrs vs sector and benchmarks

Source: FE Analytics

Alternatively, Todd would consider Scottish Mortgage, AVI Global Trust or MIGO Opportunities.

“The high allocation to private markets in Scottish Mortgage would likely provide a diversifying source of returns and, despite its high volatility, a small allocation of an investor’s risk bucket may be warranted,” he explained.

“Similarly, something like AVI Global Trust or even MIGO Opportunities would offer a good source of diversification and at this juncture look attractive ways to benefit from an easing macro environment given their focus on discounted opportunities.”

As F&C and Alliance Trust are large-cap core portfolio, Todd also suggested adding The Global Smaller Companies Trust, which offers a balanced and core exposure to small-caps.

Performance of trusts over 10yrs vs sector and benchmarks

Source: FE Analytics

He said: “There is an 18% allocation to collective investment vehicles to utilise the expertise of managers in Asian and emerging markets, and a 25% allocation to UK smaller-cap equities which have been particularly hard hit.

“The focus is on quality and identifying growth at a reasonable price, which means the managers avoid more speculative areas of the market.

“The trust offers a yield of 1.5% which is rare to see across smaller companies’ strategies and may provide a source of diversification away from typically large-cap focused global equity strategies. A discount of -12.3% may provide an added licker to returns over the long term.”