The rise of artificial intelligence (AI) dominated the market last year, underpinned by the outperformance of the ‘Magnificent Seven’, but FE fundinfo Alpha Manager Terry Smith, manager of Fundsmith Equity, was more circumspect on this frenzy in his latest annual letter to shareholders.

Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla accounted for 68% of the Nasdaq Composite’s gains in 2023, with Nvidia alone making up 11%.

Yet Smith stressed that AI is nothing new and predates the rise in interest in the stock market last year spurred by Microsoft’s investment in OpenAI and the adoption of its ChatGPT large language model.

He also reminded that IBM launched an AI model called Watson in 2011, while Alphabet (formerly Google) acquired AI developer DeepMind in 2014.

The Alpha Manager also warned that it may not be possible to identify the future winners of the development of AI at this point in time.

He mentioned the examples of early leaders of previous major technology developments such as Nokia in mobile phones, Myspace in social media or AOL in internet service providers.

Smith said: “Where are they now? Does this experience suggest that we can predict a winner in the area of AI at the outset?”

A difficulty in predicting future winners of AI development he highlighted is the number of contenders in, among others, the large language models space.

He said: “There are numerous large language models in development and deployment by the major tech companies: such as Alphabet’s Gemini, Meta’s Llama 2 (stands for Large Language Model) and Microsoft’s ChatGPT, as well as stock market excitement about the deployment of such models by Adobe, Intuit and Fortinet amongst just the companies that we follow.”

Therefore, Smith suggested that there could be no winner at all, either in the provision of large language models or their use.

There is also a risk that AI-related stocks may have become overcrowded as a result of investors’ enthusiasm, leading to a situation where nobody has an edge anymore.

Smith explained: “The adoption of AI may lead to a situation where everyone has it, so no one has any advantage. The analogy I would offer (with acknowledgement to Warren Buffett) is a football stadium.

“As the game becomes exciting and the striker runs into the penalty area with the ball, the second row of spectators stands up to get a better view. This blocks the view of those in the third row who follow suit. Pretty soon all the spectators are standing but no one has a better view than before, but they are all less comfortable.”

Although Smith does not own all the Magnificent Seven in his fund, two of them – Meta Platforms and Microsoft – were his top performers in 2023.

He said: “Meta Platforms’ performance makes me wonder whether I should have a fund which invests solely in the one stock in our portfolio each year for which we have received the most critical comments.

“Meta makes its third appearance in this list of top contributors while Microsoft appears for the eighth time having attracted strident criticism when we started buying at about $25 a share in 2011 (2023 year end price $354).”

Danish healthcare company Novo Nordisk also features among the fund’s top performers, as it benefited from the success of its weight loss drug Wegovy. Smith stressed, however, that Novo Nordisk was a successful investment prior to Wegovy as the company has been among the fund’s top five contributors on four occasions.

L’Oréal and IDEXX were the fourth and fifth best performing holdings of 2023 respectively.

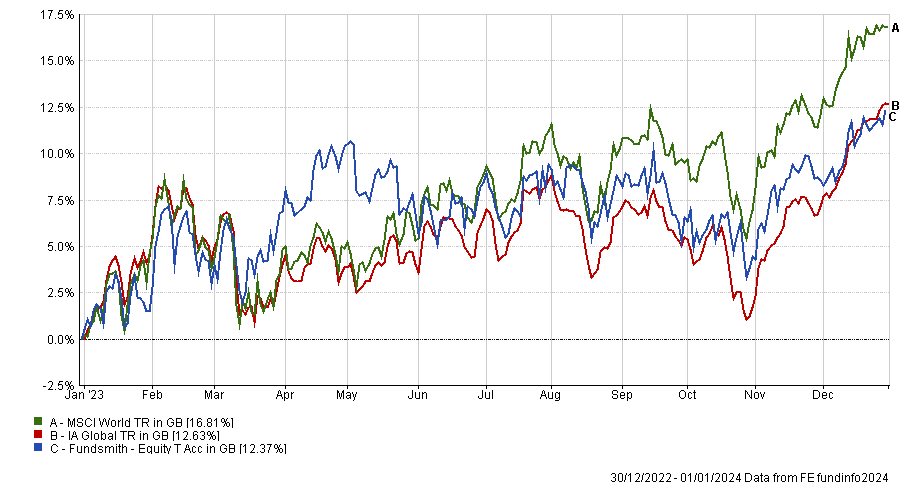

In spite of this, Fundsmith Equity underperformed both the IA Global sector and the MSCI World last year.

Performance of fund in 2023 vs sector and index

Source: FE Analytics

Smith explained that outperforming the market in 2023 was more challenging than usual and that investors should not expect it to beat the market or even make a positive return every year.

He said: “A longer-term perspective may be useful and is certainly more consistent with our investment aims and strategy. Since inception, the fund has returned nearly 4% per annum more than the MSCI World index and has done so with significantly less downside price volatility as shown by the Sortino Ratio of 0.83 versus 0.51 for the Index. This simply means that the fund has returned about 63%, ((0.83÷0.51)-1)x100, more than the index for each unit of price volatility.”

The worst detractor to performance in 2023 was Estée Lauder, which Smith has now sold. He explained that the company mishandled the demand/supply situation in China following the post Covid reopening, while it revealed “serious inadequacies” in its supply chain in the travel retail market. Other detractors include McCormick, Diageo, Mettler-Toledo and Brown-Forman.