Value funds have rocketed to the top of the FE fundinfo Crown Ratings as smaller companies portfolios and those focusing on growth have fallen out of favour.

Funds run by M&G, Schroders and Artemis were among those gaining the top rating as their value disciplines return to favour over the past three years following a decade of dominance for growth stocks.

Charles Younes, head of manager selection at FE Investments, said: “This trend towards a value style differs from that of six months ago. Funds such as LF Morant Wright Japan or Schroder Global Recovery have done well and been upgraded to a four or five crown rating because of their strong outperformance over the past three years.

“Despite the style being in favour for so long, they have maintained their valuation discipline approach which has finally paid off recently. This trend towards value is worth keeping an eye on and it will be interesting to see if it persists if we reach the peak of the interest rate cycle.”

Conversely, funds with a growth bias have suffered. Baillie Gifford has no five-crown rated funds left after the latest reshuffle, with the asset management group struggling in the current market environment of high inflation and interest rates. On average, funds run by the Edinburgh-based asset management group hold a crown rating of two.

Similarly, 7IM saw the largest downturn dropping from five fund with crown rating of five to zero, while Fidelity lost four.

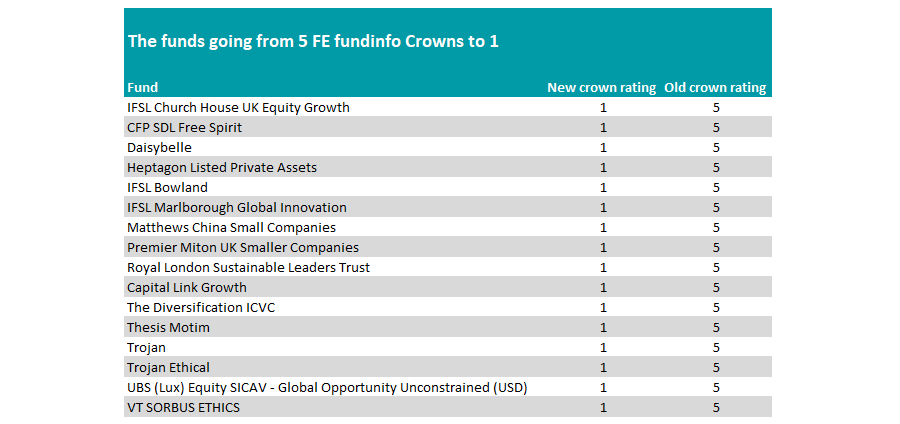

There was also a clear shift away from smaller companies in the rankings, with the likes of Premier Miton UK Smaller Companies and CFP SDL Free Spirit both dropping from five crowns to one.

Source: FE fundinfo

There was also a fall for the popular Trojan and Trojan Ethical portfolios, which are designed to protect investors during market downturns. Both have lagged peers in the IA Flexible Investment over three years.

The FE fundinfo Crown Rating is made up of three parts, each with a reference to a benchmark – an alpha-based test, a volatility score and a consistency score, calculated over a three-year period.

In the latest rebalance, almost half (163) of the 340 five-crown rated funds gained the top rating, with value funds benefitting.

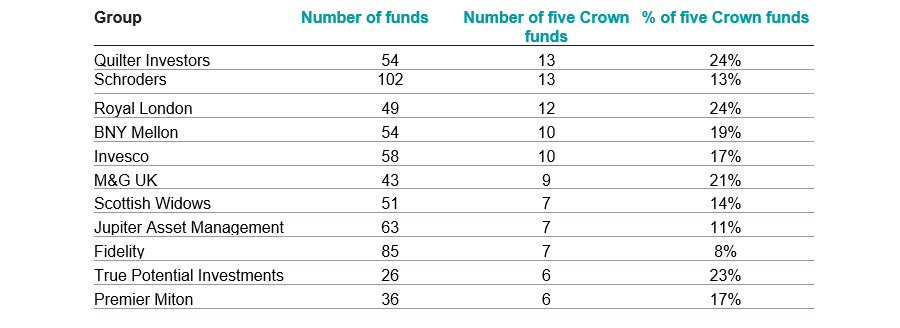

Quilter Investors, Schroders and Royal London now house the most five-crown rated funds, as the below table shows.

Source: FE fundinfo

At a sector level, investors have the most chance of picking up a five-crown rated fund in the IA Infrastructure sector, with seven of the 23 funds in the peer group getting the top rating (30.4%).

IA Healthcare and IA Sterling Strategic Bond were the other two Investment Association sectors with more than a quarter of funds to gain the top rating (30% each).

“In very challenging conditions for fixed income markets, active bond managers have shown their capacity to protect from downside by decreasing their interest rate sensitivity,” the report said.