A focus on the long term, willingness to go against the crowd and genuine stock picking are three qualities that Vanguard is looking for when selecting active managers.

Vanguard might be best known for its passive funds but the company also has more than 40 years of experience in active fund management, either through running them with its own active teams or appointing third-party companies to access to their particular area of expertise.

When seeking out active talent, the investment house has a long checklist that they have to tick, looking at areas such as culture, people and process. Below, we find out more about what investing philosophies Vanguard finds attractive when assessing active managers.

The first attribute that Vanguard is looking for is a long-term focus.

The explosion in computing power and data proliferation means that outperforming on the back of short-term data points such as quarterly earnings and analyst revisions has become increasingly challenging. Therefore, Vanguard wants to work with active managers who have a resolutely long-term approach, rather than a preference for short-term trading.

“Both our own experience in selecting managers over decades and numerous academic studies suggest that fundamental active managers are better served by taking a long-term, low-turnover approach,” the group said.

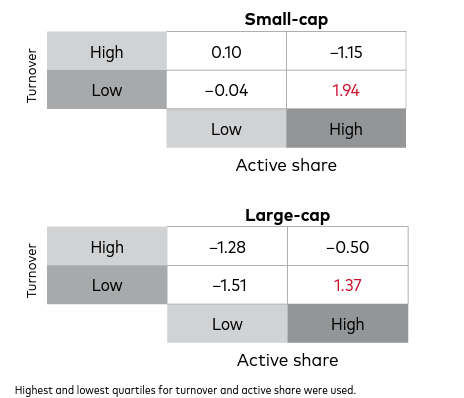

High active share and low turnover correlated with higher alpha (average factor-adjusted alpha in percentages)

Source: Vanguard illustration using data from Cremers, 2017

There are two compelling reasons for this, according to Vanguard. The first is that lower turnover incurs less trading costs, which is particularly beneficial for larger funds.

Secondly, such strategies allow managers to focus on long-term success drivers that might not affect near-term results but are crucial for a company's future performance. These include factors such as industry dynamics, competitive advantages, environmental, social, and governance (ESG) considerations, as well as culture and intangible assets.

“When everyone else is hyper-focused on the near term, extrapolating recent trends or assuming mean reversion, skilled stock pickers can add alpha by getting the long-term trajectory right,” it added.

Vanguard also values active managers who go against the grain. The firm highlighted the importance of proprietary research, rather than following the crowd or adhering to Wall Street consensus.

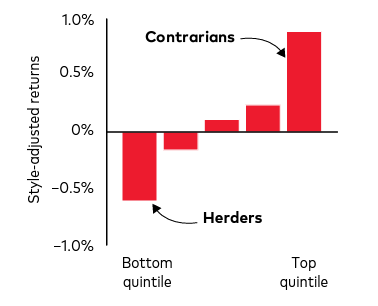

Funds with contrarian trading patterns did better than those who followed the herd

Source: Vanguard illustration using data from Wei et al, 2014

“Research has shown that fund managers who ‘herd’ with their peers or follow sell-side ratings underperform those with a contrarian streak who buy when others are selling,” it said.

This principle, according to Vanguard, is applicable to both value and growth managers. The example of Amazon demonstrates this – a decade ago, those who bet on Amazon were going against the popular tide but have been handsomely rewarded since.

Finally, Vanguard is looking for active managers who undertake “true stock picking” over factor bets

Common metrics such as active share and tracking error, which gauge a fund manager’s ‘activeness’ or deviation from their benchmark, can be misleading when used in isolation. They can be heavily influenced by the choice of benchmark and don’t necessarily indicate true active management.

For instance, a small-cap bias can create the impression of a highly active approach. Not owning the largest constituents in the index can inflate active share and tracking error.

“This, however, is not true fundamental active management worth paying a premium fee for,” Vanguard said. “Recent research has shown that it is not the level of tracking error that matters but rather the proportion of tracking error coming from stock-specific risk and not factor tilts.”