The popular Vanguard Lifestrategy range is a favourite among investors, but there are areas of the market that they don’t cover that can be added through satellite funds, according to experts.

Funds in the passive range offer mixed-asset allocation at a cheap price and come with different weightings to equities and bonds to cater for different types of investors.

The Lifestrategy 60% Equity fund is the largest fund in the IA Mixed Investment 40-85% Shares sector, with £13.8bn assets under management (AUM). Offering investors a 60% equity and 40% bonds portfolio, the vehicle is considered suitable for investors who are seeking to smooth investment returns over time, as this combination of assets provides some diversification from equity risk – although, on occasion, this strategy can fail, as it did last year when both stocks and bonds experienced significant losses.

While other asset management companies such as Blackrock have therefore called time on the 60/40 portfolio, Vanguard has continued to back this classic model.

For investors who agree with Vanguard but are looking to expand their strategy beyond the Lifestrategy fund, we asked three experts what fund they would buy that would blend well with it.

Small-caps

Tom Sparke, investment director at GDIM, said Vanguard LifeStrategy 60% Equity “will cover a lot of what an investor requires for this level of risk” and at low cost too, so he decided to add something alongside that would complement this allocation but with a similarly attractive price point.

“As the portfolio’s equity component is based solely on market capitalisation, it misses an element of smaller company exposure – one of the most powerful factors over the long term,” he said.

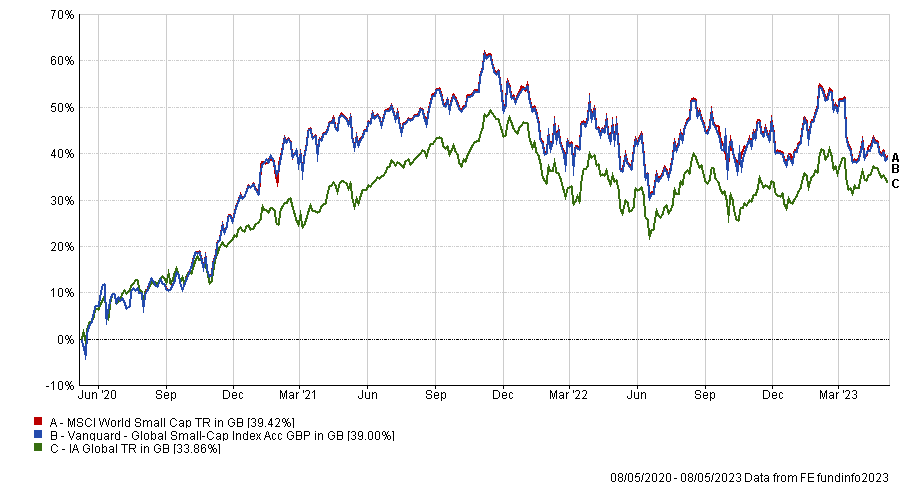

As such, he suggested adding the Vanguard Global Small Cap tracker, whose performance is illustrated in the chart below.

Performance of fund over 3yrs against sector and index

Source: FE Analytics

Source: FE Analytics

“This fund will give a portfolio the smaller companies exposure that it lacks at just 0.3%. Over the longer term, this should raise the performance of the portfolio whilst providing some further diversification too,” Sparke concluded.

Gold

Sheridan Admans, head of fund selection at Tillit, said gold would make “a suitable satellite investment” and chose the Hanetf The Royal Mint Responsibly Sourced Physical Gold ETC (exchange-traded commodity).

The precious metal is often used as a diversifier for investors who covet its safe haven qualities during times of market stress.

Performance of fund over 3yrs against sector

Source: FE Analytics

The ETC is a passive alternative asset fund providing exposure to gold, without having to physically own the precious metal directly.

“It has a low correlation to the Vanguard strategy, providing diversification from both the equity and bond components. It should, at times like 2022 when the 60/40 equity/bond model breaks down, provide some downside protection and lower the volatility of the overall portfolio,” he said.

“The gold contained within the fund is responsibly sourced, boasting a lower carbon footprint compared to its peers, held in the allocated accounts in the vaults at the Royal Mint. An additional feature of this ETC over its peers is that the physical gold is held outside of the commercial banking system, providing some security to investors against a systemic failure.

More bonds

John MacTaggart, senior fund analyst at FE Investments, was the only one to choose an actively managed strategy, the $2.6bn Nomura Global Dynamic Bond fund, managed by FE fundinfo Alpha Manager Richard Hodges, who has 36 years of investment experience and has been with Nomura since 2014.

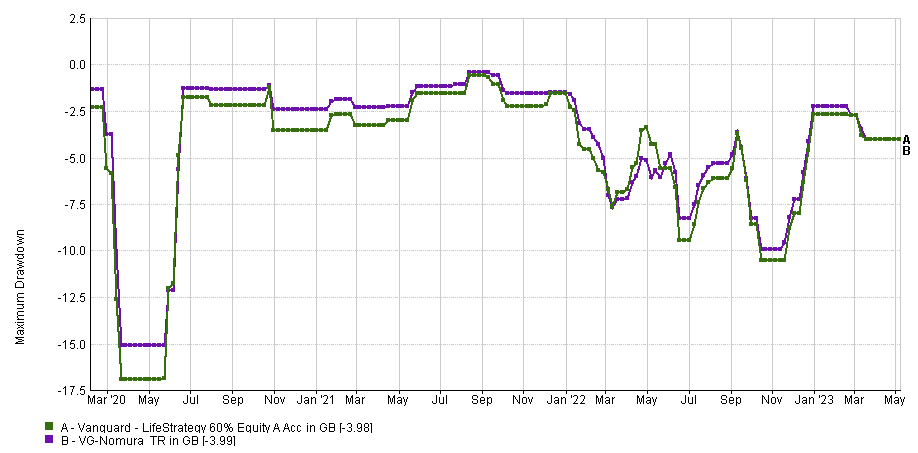

Maximum drawdown of the Vanguard and Nomura funds over 3yrs

Source: FE Analytics

“If the focus is to be risk-averse, a blend with the Nomura fund would work well,” said MacTaggart.

“The additional bond exposure helps to protect from downside more consistently [as displayed by the chart above] but Nomura targets more credit risk than other bond managers, taking opportunistic investments across high-yield corporates and subordinated financials, therefore not giving away a lot of upside.”