Columbia Threadneedle has claimed its latest PassiveWatch study shows that active funds have beaten passives in every market over the past 20 years.

However, critics have accused it of misleading investors through the selective use of data.

In a release issued by Columbia Threadneedle to publicise its ninth annual PassiveWatch study, it said that “performance of active funds beat passive in every market in the UK over a 20-year period”.

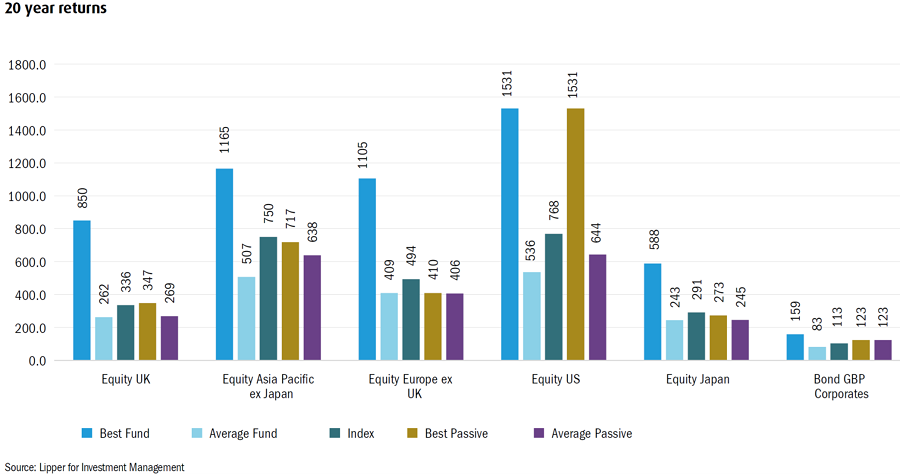

It based this on research comparing the performance of the best fund in seven popular sectors within the Lipper Global universe against the average fund (both active and passive), the index, the average passive return and the best passive return.

It removed Global Emerging Markets as there were no passive funds in this sector 20 years ago.

“The most striking observation is the scale of the outperformance of the best-performing fund,” said the report.

“In the UK sector, the best-performing active fund outperformed the average passive fund by a large multiple of 2.5x. In fact, in the weakest market observed, Asian equities, the best active still beat the average fund by 1.6x.

“In summary, in every market it would have been worthwhile identifying the best active fund in the market, rather than passive.”

However, Alan Miller (pictured), chief investment officer and founding partner at SCM Direct, claimed that presenting such research in this way may have violated FCA rules about communications being ‘clear, fair and not misleading’.

“Obviously, it is not meaningful to compare the top fund with the average fund as you could never have known in advance which fund was going to be top,” he said.

“It's a bit like saying you're better off buying a lottery ticket than putting your money in the bank because had you won the lottery each year, you'd have done much better. Or even like saying, ‘it’s worthwhile picking the right share in each sector’.”

The data presented by Columbia Threadneedle prominently highlights the performance of the best fund in the sector but doesn’t show that of the worst.

While the group claimed the data shows that “active funds beat passive in every market in the UK over a 20-year period”, it actually shows that the average fund underperformed the average passive vehicle in all but one sector – Equity Europe ex UK. Here the average fund made 409%, compared with 406% from the average passive. However, the index used for the purposes of the study made 494%.

Even in the Equity UK sector, where Columbia Threadneedle highlighted the largest outperformance of the best fund, the study showed the average fund made 262% over the 20-year period, compared with 299% from the average passive. The index made 336%.

“To draw conclusions from such an amateurish and wholly biased analysis is astonishing,” Miller added. “I thought we'd gone past this nonsense about 10 or 15 years ago.”

Robin Powell of the Evidence-Based Investor agreed with Miller, saying: “Fund management companies like Columbia Threadneedle come up with these misleading studies from time to time. Once they are investigated by people who understand this subject, they usually have basic flaws.

“If you’re looking for an objective assessment on the value (or otherwise) of active management, never ask a company whose business model is built on selling actively managed funds.”

However, Columbia Threadneedle’s PassiveWatch study finished by saying that the group does use passive funds – for example, they make up between 16 and 23% of the CT Multi-Manager Lifestyle portfolios.

“We do believe that passives can have an important role to play as part of an overall portfolio (primarily as a means of reducing overall cost and adding diversification),” it said.

“[But] we also recognise that they are destined to underperform the index they are designed to track – a function of fees levied over time and tracking error.”

When questioned about its PassiveWatch study and the way its findings were presented, a spokesperson from Columbia Threadneedle said: “Following feedback, we are reviewing this latest report before being shared with our clients.”