Investors were reminded about the benefits of diversification this week after the S&P 500 index of America’s largest stocks plunged 1.5% on Monday, triggered by the collapse of Silicon Valley Bank.

What this means for the banking and technology sectors in the US and Europe over the medium term remains to be seen but, in the meantime, those who are invested in the index will have experienced losses.

Investors whose portfolios are lowly correlated to the S&P 500 index will have suffered less, as their holdings won’t have dipped as much as the index (when two securities are lowly correlated, they are unlikely to be exposed to the same market forces and their performances, therefore, tend to move independently).

This is an example of the importance of correlation as a way to make sure that your portfolio (in this case, your exposure to the US market) is sufficiently diversified – but it’s not always easy to achieve.

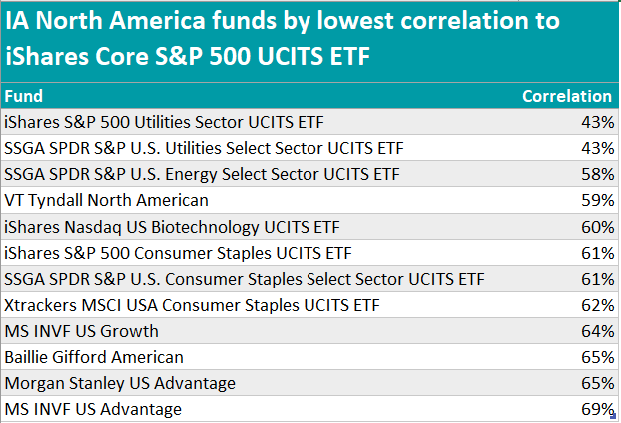

In the IA North America sector, only 12 funds have had a low correlation (below 70%) to the S&P 500 index over the past five years – we used the popular iShares Core S&P 500 UCITS exchange-traded fund (ETF) as a proxy.

Only five of these were actively managed, suggesting those who already own the iShares Core S&P 500 UCITS ETF may wish to be careful of how they match it with other funds in the IA North America sector.

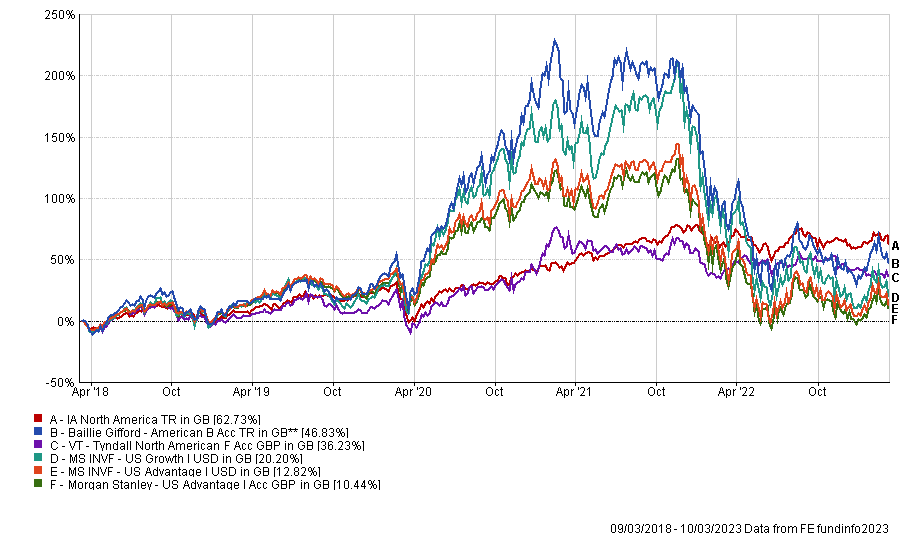

At the bottom of the list of funds with lowest correlation to the benchmark ETF are three Morgan Stanley funds. The last place is taken up by MS INVF US Advantage, with a 69% correlation, while its twin MS INVF US Growth is in third-last position at 64%. Both are sizable vehicles with $4.3bn and $2.5bn of assets under management respectively, but were much larger before January 2022, when they fell from their $18bn and $9bn peaks. They are run by the same management team headed by manager Dennis Lynch.

The much nimbler Morgan Stanley US Advantage suffered a similar fate, going from £1.2bn in February 2021 to the current £97m, and displays a correlation of 65% to the iShares Core S&P 500 UCITS ETF.

It shares the penultimate position with Baillie Gifford American, which also suffered lately. The investment house’s growth-focused style fell out of favour and the majority of its funds lost money over 2022, as recently reported by Trustnet.

Performance of funds over 5yr against sector

Source: FE Analytics

Baillie Gifford American’s low correlation to the iShares ETF can mainly be attributed to the fund’s benchmark-agnostic approach, which, according to analysts at FE Investments, “suggests that the fund may behave nothing like the S&P 500”.

“Rather, it will be a case of the underlying stocks being heavily skewed towards those that use disruptive technologies,” they said.

An even lower correlation (59%) was highlighted by Felix Wintle’s VT Tyndall North American, a concentrated (43 stocks), thematic long-only portfolio, “which does not mimic any index”, according to its factsheet.

The other vehicles in the list are passive, alternative investments, with the lowest level of correlation achieved by portfolios in the utility and consumer staples sectors. At 43%, the iShares S&P 500 Utilities Sector UCITS ETF has the lowest correlation to the wider index. The iShares Nasdaq US Biotechnology UCITS ETF has a 60% correlation.