Pushing their money to work harder is one of the main concerns of investors who seek to preserve their purchasing power over time. For almost two decades, funds and trusts have been the place to be, as these vehicles haven’t had to worry much about the competition of savings accounts, which have offered low returns in the era of low interest rates.

This has changed now to some extent, as high interest rates are allowing savers to generate risk-free returns. The best-paying one-year fixed-term savings account today is offered by SmartSave and yields 4.3%, according to data from Moneyfacts.

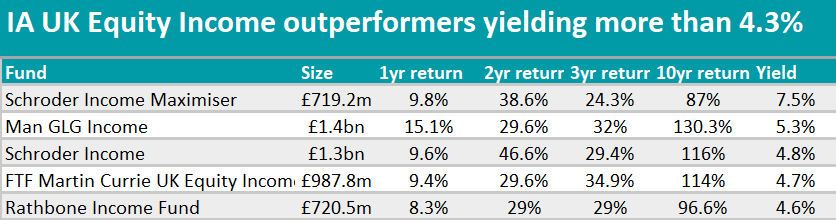

Using this value as a threshold, Trustnet has scanned the IA UK Equity Income sector to find out which funds currently beat that level of yield. Speaking to Trustnet last week, however, experts have suggested investors avoid chasing higher yields only and look at other parameters as well, as some portfolios aim at maximising income at the expense of capital growth, and ultimately, investors need both.

As such, we have then narrowed the list down even further by filtering out the portfolios that have failed to beat their average peer over one, three, five and 10 years. This has left us with the five top-yielding funds that consistently outperformed their sector, which are presented below.

The highest yielder to consistently outperformed its sector was the £719.2m Schroder Income Maximiser, which sets out as its objective to generate an income of 7%. It achieves that by maintaining the lowest exposure to the UK market among all the funds in the list (still, that amounts to 72.9%). Setting it apart from the other strategies are also its exposures to South Africa (3.2%) North America and the money market, which, at 9.5% and 3.3% respectively, are the highest within the list.

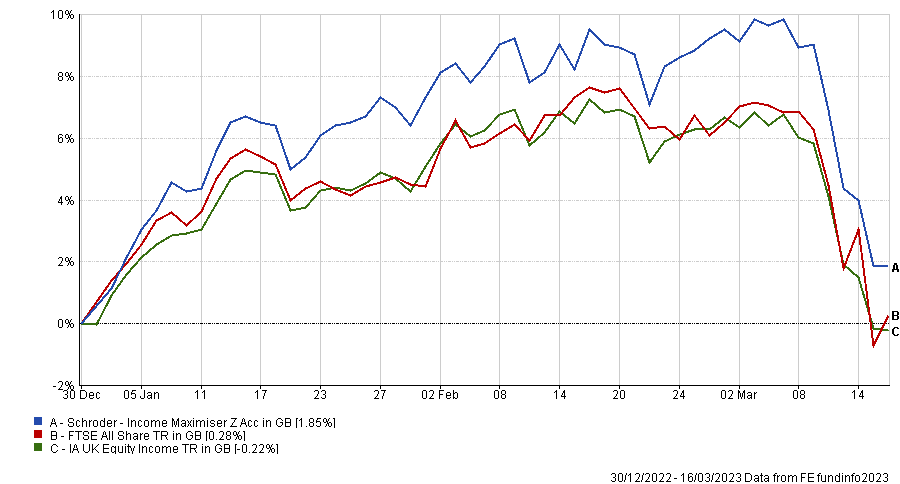

Performance of fund over the year to date against sector and index

Source: FE Analytics

Square Mile analysts are aware that what one gains by receiving income in the present, may result in losing out on capital growth in the future, but despite this, believe that “the underlying equity income strategy deployed by the fund's managers, Kevin Murphy and Andrew Evans, is a credible one that should outperform the FTSE All Share index over the long term”.

Investors should note, however, that the managers' contrarian approach does tend to be more volatile than other equity income strategies.

“The central tenet of their philosophy is that share prices move more than the changes in companies' fundamentals justify. When markets are low and falling, the managers are likely to be more aggressively positioned as they see such short-term volatility as an opportunity. This may be painful in the short term, but these times may mark the periods when the strategy has the greatest opportunities ahead of it,” they concluded.

Also on the list in third position was Schroder Income, which has traits in common with the Schroder fund above.

Performance of fund over the year to date against sector and index

-9.png)

Source: FE Analytics

The FE Investment team praised the managers’ long-term, successful track record in value investing and their “thorough and ongoing” company analysis skills.

“This allows them to move into positions quickly when stocks sell off aggressively. They can sometimes be too early into positions, which can cause short-term underperformance, but their contrarian positions have tended to pay off well over the long term,” they said.

“This is also one of the few UK funds managed by Schroders’ Global Value team that does not have liquidity concerns due to the fund’s focus on large companies.”

Splitting the two Schroder funds was Man GLG Income, which yields 5.3% and is run by FE fundinfo Alpha Manager Henry Dixon. Its sector weightings look different to those of the other funds in the list, as it has the highest exposure to basic materials (18.8%), financials (38.3%) and utilities (7.2%). It also invests a significant 14% of the fund’s value in Europe excluding the UK.

Performance of fund over the year to date against sector and index

-6.png)

Source: FE Analytics

According to FE Investments analysts, the metrics used to assess the valuation of a company, as well as the fund’s exposure to bonds as a means of generating income, are key differentiating factors for the fund, as they are not widely used by other investors.

“Dixon is committed to the strategy and has always managed money in a similar way. He is very disciplined in his approach, which has meant that, despite being often out of favour, he has generated strong capital appreciation, as well as delivering high levels of income,” they said.

Achieving a yield of 4.7%, the next fund is FTF Martin Currie UK Equity Income, which has a higher weighting to consumer products (32.6%) when compared to the other strategies and is also the cheapest, with an ongoing charge figure (OCF) of only 0.52%. It is run by FE fundinfo Alpha Manager Ben Russon and was the best performer over five years within the list, with a total return of 34.9%.

Performance of fund over the year to date against sector and index

-2.png)

Source: FE Analytics

Finally, with a yield of 4.6%, Rathbone Income focuses on “supported long-term dividend growth”, as the factsheet reports. Managers Carl Stick and Alan Dobbie look for businesses “that offer good value and make strong and consistent profits with high-quality earnings”.

Experts at FundCalibre awarded this mandate their Elite rating and described it as a “solid core equity income fund run by an extremely experienced and long-standing manager.”

Performance of fund over the year to date against sector and index

-2.png)

Source: FE Analytics

“It has one of the best track records in the sector for raising dividends annually over a period of more than 20 years. Stick's process is well defined without being overly constrictive, and the heavy emphasis on risk management is particularly pleasing,” they said.

Its high exposure to the healthcare and industrials sectors, at 7.9% and 16.2% respectively, set it apart from the rest of the group, together with its slight tilt to smaller companies.