Despite making strong returns last year, the IA UK All Companies sector was the most sold fund group of 2022, according to data from FE Analytics.

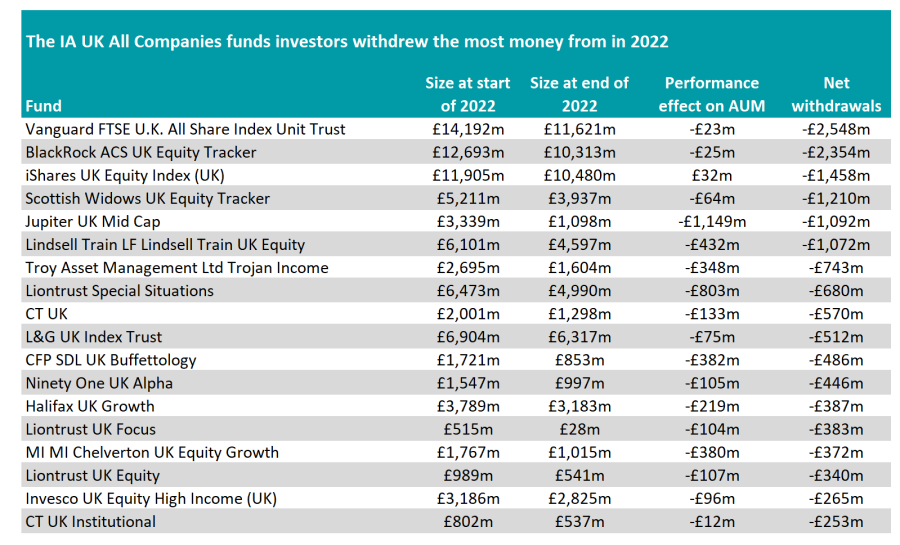

In this study looking into the most bought and sold funds of the year, we have typically looked at the portfolios where investors added to or withdrew more than £100m. In total there were 43 funds in the IA UK All Companies sector where investors took out more than £100m in 2022, so in the below table we chose to focus on the 18 where investors took out £250m or more. Had we kept the initial parameter, it would have expanded by a further 25 funds.

Active funds struggled last year and the average vehicle made a 9% loss, but it was passives that topped the list of most sold.

Investors took around £2.5bn from the Vanguard FTSE U.K. All Share Index Unit Trust over the course of the year as they moved away from the UK market in general.

Four of the six funds from which investors withdrew £1bn were passive funds. This was despite the FTSE All Share index making a 0.3% gain in 2022 – one of the view markets to end the year in positive territory.

Source: FE Analytics

Jupiter UK Mid Cap was one of the active funds where investors took out more than £1bn. The FTSE 250 index did not perform as well as the large-cap index, which may explain the move. Other notable funds on the list to be caught up in the same theme were CFP SDL UK Buffettology and MI Chelverton UK Equity Growth, which both have a mid- and small-cap bias.

LF Lindsell Train UK Equity was the other active fund of the six. It joins a number of other top-performing funds over the past decade such as Liontrust Special Situations that were caught out by last year’s rotation.

The funds tend to invest in quality-growth stocks that have dependable franchises and will be around for a long time, but last year the market was more interested in oil and other value sectors.

Source: FE Analytics

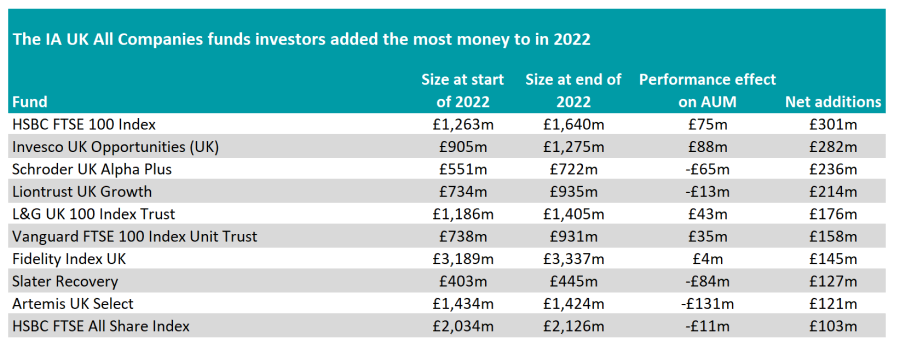

On the other side of the coin, HSBC FTSE 100 Index took in the most money last year, another example of investors’ move towards the large-cap end of the market.

It was one of three FTSE 100 trackers to take in a net of £100m or more of new money from investors in 2022, while large-cap active strategy Artemis UK Select also made the list.

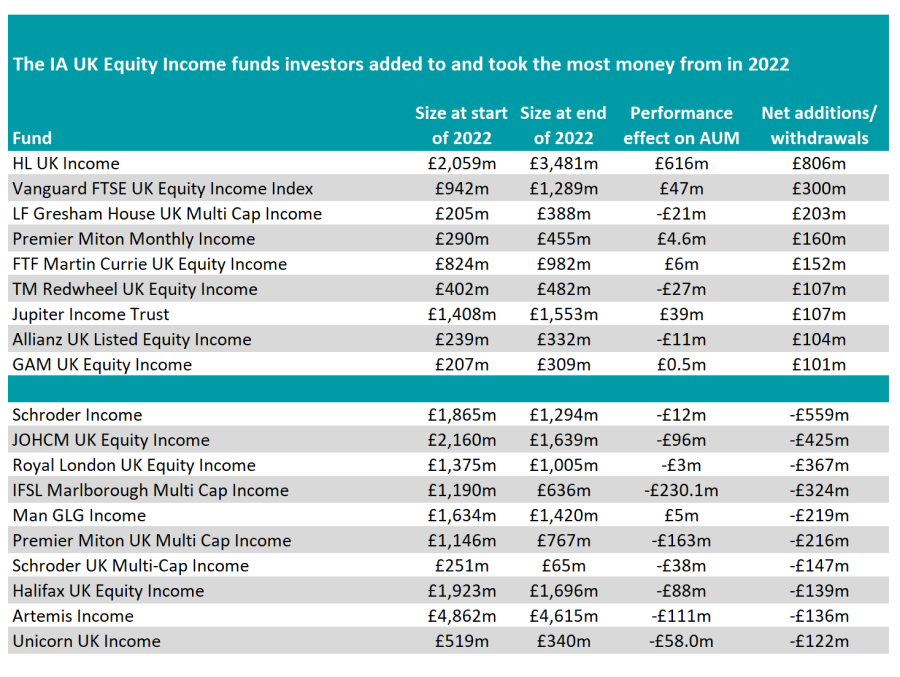

Although the IA UK All Companies sector was unable to capitalise on the strength of the overall market in 2022, perhaps the biggest beneficiary from the rotation to value was the IA UK Equity Income sector, where the average fund made a loss of just 1.7%.

Funds in this sector tend to own the likes of oil, mining and financials stocks as they tend to be big dividend payers. The sectors were all winners from rising inflation and/or interest rates and the general economic backdrop of 2022, which also included the war in Ukraine causing a supply problem in the oil market, as well as the post-Covid recovery in most developed markets.

HL UK Income was the UK fund that took in the most capital from investors, with £806m added to the fund in 2022.

Source: FE Analytics

Another eight funds took in more than £100m of net new money from investors, including LF Gresham House UK Multi Cap Income, Premier Miton Monthly Income and FTF Martin Currie UK Equity Income.

Conversely, Schroder Income was the most sold fund in the sector, with £559m withdrawn by investors in 2022. It was joined by other well-known income funds such as JOHCM UK Equity Income and Royal London UK Equity Income. Overall there were 10 funds from which investors took more than £100m from last year.

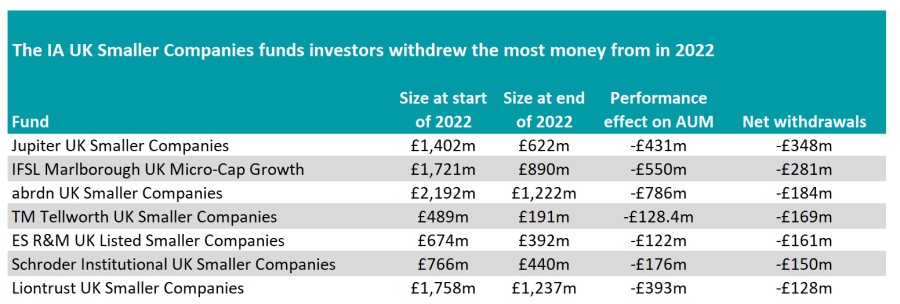

Lastly, there were no funds in the IA UK Smaller Companies sector that investors allocated a net £100m to in 2022, while there were seven that lost that amount last year. It was by far the worst performer of the three UK equity sectors, with the average fund making a loss of 25.2%.

Source: FE Analytics

Jupiter UK Smaller Companies, IFSL Marlborough UK Micro-Cap Growth and abrdn UK Smaller Companies were the three most sold funds, with investors taking a combined £800m from the portfolios.