Fidelity and Invesco funds were among the most popular with investors seeking overseas exposure last year, according to FE Analytics, while those from Bailie Gifford and JP Morgan funds were heavily sold.

Most asset classes struggled in 2022, but some funds were trusted by investors more than others. Below, Trustnet looks at portfolios in the US, Europe, Asia, Japan and emerging markets that attracted at least £100m of net new money, or where a net £100m was withdrawn by investors.

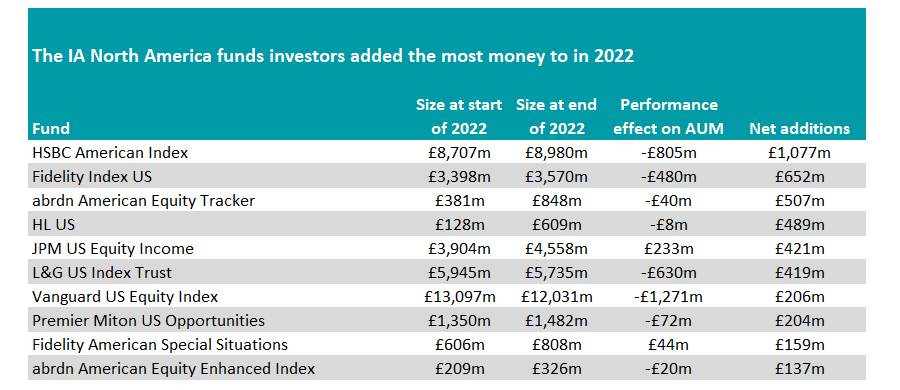

US funds

Investors that did want to buy into the downtrodden US market chose predominantly to do so via a tracker. Indeed, of the 10 funds that had net inflows over the course of the year of more than £100m, six were passive vehicles.

Source: FE Analytics

Top of the heap was the £9bn HSBC American Index, which may have caught investors’ eyes thanks to its low 0.06% ongoing charges figure. The fund took in £1bn in new money over the year, almost the same as the next two fund combined. Fidelity Index US and abrdn American Equity Tracker took in £652m and £507m respectively.

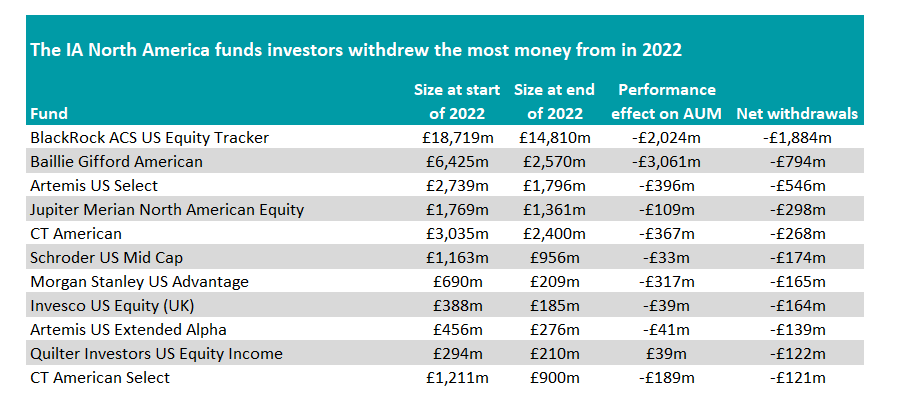

At the other end of the scale, active funds were the ones that ditched with 10 of the 11 most-sold funds taking an active approach. The likes of Baillie Gifford American and Artemis US Select lost around £794m and £546m respectively from investors selling.

However, the fund investors took the most cash from was the BlackRock ACS US Equity Tracker, an environmental, social and governance (ESG) passive fund. Its £1.9bn net outflow and poor performance meant that its assets under management (AUM) dropped from £18.bn at the start of 2022 to £14.8bn by the end of the year.

Source: FE Analytics

Three funds in the IA North American Smaller Companies sector also lost more than £100m from net outflows last year: Artemis US Smaller Companies (£220m); JPM US Small Cap Growth (£119m) and Schroder US Smaller Companies (£102m).

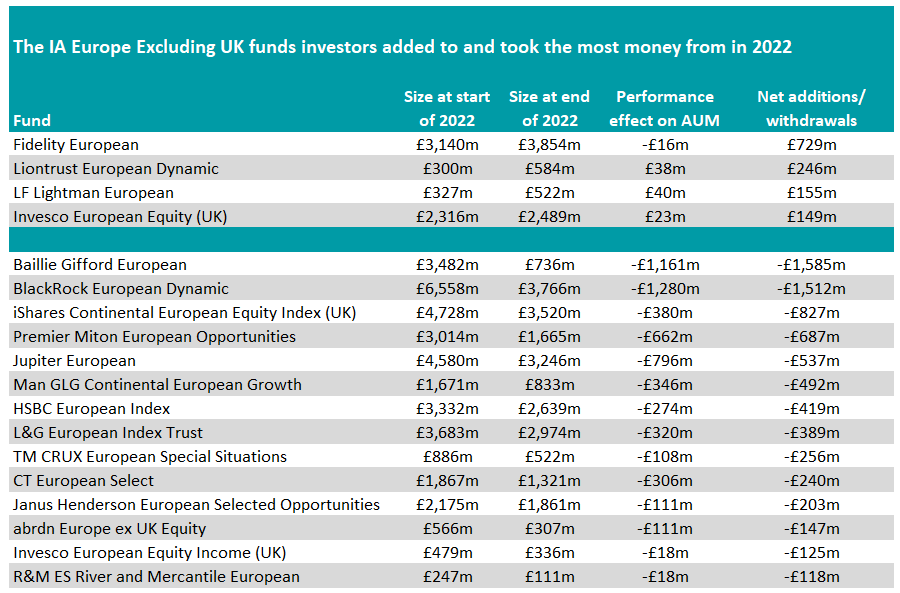

European funds

Turning to the continent, there were just four European equity funds that achieved net inflows of £100m or more, with Fidelity European coming out in top spot after attracting £729m of new money despite being the only portfolio on the list to make a loss.

The 1.6% fall in 2022 was still a top-quartile effort, however, among its IA Europe Excluding UK peers.

Source: FE Analytics

Conversely, much like in the US, Baillie Gifford European was the most sold portfolio as investors soured on the growth style of investing. Tech firms and other companies synonymous with the Edinburgh-based asset management house’s investment style struggled as rates rose and investors took money out as these funds suffered their worst performance in years.

BlackRock European Dynamic was the next-most sold. Both funds’ AUM were around £1.5bn lower due to net outflows. There were several trackers on the list as well, suggesting investors cooled on the region in 2022, a year in which there was war on continent and a severe cost-of-living crisis brought about by rising energy prices.

All portfolios on the list are from the IA Europe Excluding UK sector. There were no funds in the IA Europe Including UK with either £100m of net inflows or outflows over the year.

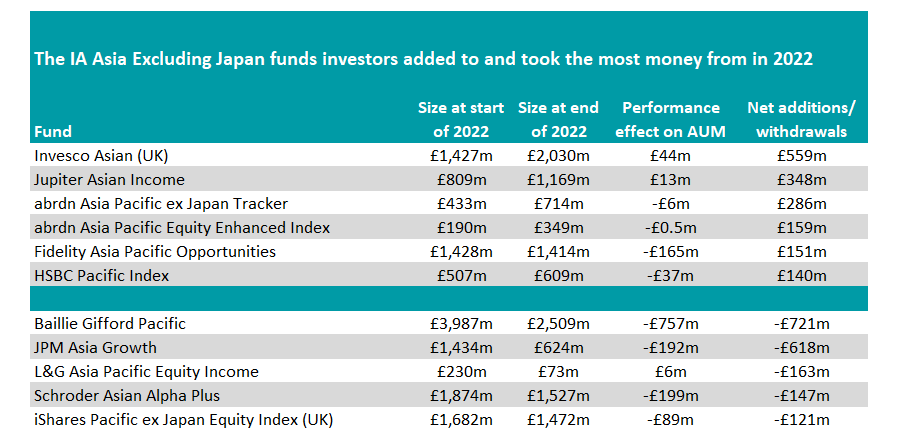

Asia Pacific funds

Turning east, there were more funds in the IA Asia Pacific Excluding Japan sector that took in more than £100m than there were to lose £100m – the only sector where this occurred.

Invesco Asian and Jupiter Asian Income were the main beneficiaries, winning £558m and £348m respectively. Both were in the top quartile of the sector last year and were among just 23 Asia portfolios to make a positive return in 2022.

Source: FE Analytics

At the other end, once again a Baillie Gifford fund is at the top, with the Baillie Gifford Pacific fund losing around £721m in net outflows – around the same amount that it lost to performance. It was the second worst performer in the sector in 2022, down 20.2%.

JPM Asia Growth was a close second on the list, losing £618m. It was also a bottom-quartile performer, although the 14.5% loss was better than the Baillie Gifford portfolio.

Like in Europe, all portfolios on the list are from the IA Asia Pacific Excluding Japan sector. There were no funds in the IA Asia Pacific Including Japan sector with either £100m of net inflows or outflows over the year.

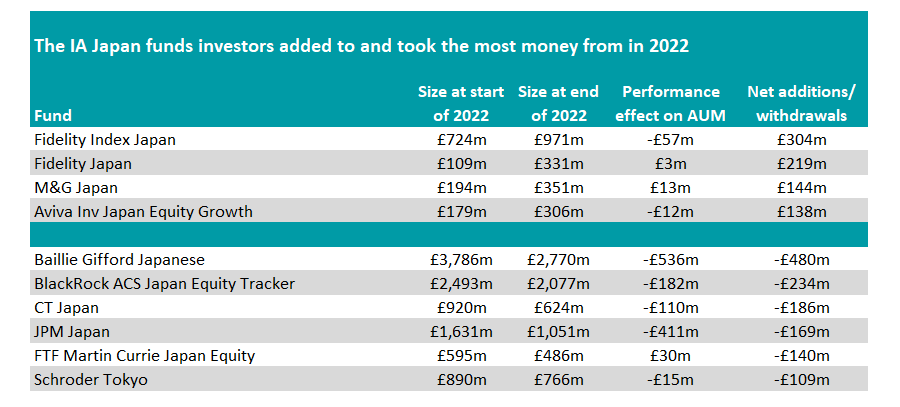

Japanese funds

Focusing on Japan, Fidelity was the clear winner among fund, with the Fidelity Index Japan and Fidelity Japan the top two funds to rake in the most new money last year.

The passive and active options took in £304m and £219m respectively, although the flows into and out of the funds on the below list were more muted than in other areas.

Source: FE Analytics

Baillie Gifford Japanese (£480m), CT Japan (£186m) and JPM Japan (£169m) were among the most sold, as was FTF Martin Currie Japan Equity, which was the third-worst performer in the sector. The portfolio has been a boom or bust proposition and is now under new management after Hideo Shiozumi retired in 2022.

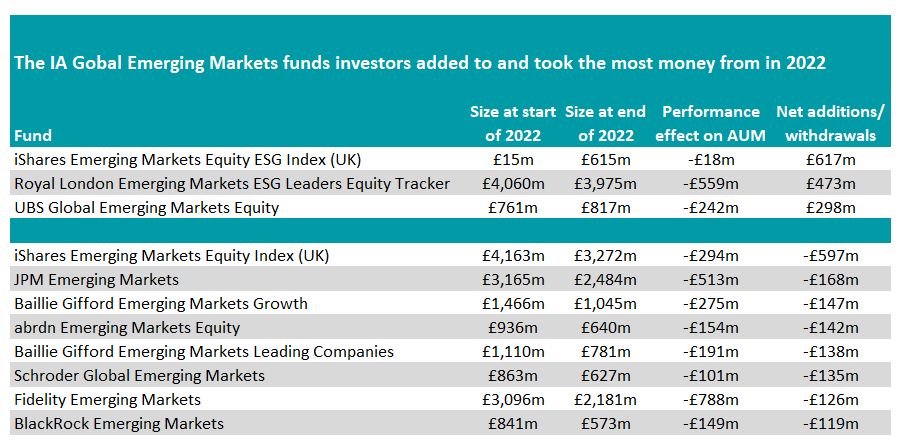

Emerging market funds

Lastly, in the emerging markets there were only three funds to make the list of funds attracting more than £100m in new money last year, with iShares Emerging Markets Equity ESG Index (UK) topping the bill.

Investors looked for sustainable passive options, with the Royal London Emerging Markets ESG Leaders Equity Tracker in second place. Between them, the pair took in more than £1bn last year.

Source: FE Analytics

Traditional emerging market portfolios were on the chopping block however, with iShares Emerging Markets Equity Index (UK) the most sold (£597m in net outflows).

There were two Baillie Gifford funds on the list in this sector, with JPM Emerging Markets also making an appearance. However, the pace of selling was less than in other regions as investors increasingly looked further afield in search of returns.