Investors shunned low-risk multi-asset funds in favour of those with higher allocations to stock markets in 2022, according to the latest FE Analytics flows data.

Although most assets fell last year, bonds underperformed equities, meaning portfolios with a higher allocation to these assets struggled.

IA Flexible Investment – which allows funds to invest wherever they like, with most tending to be almost fully invested in equities – was the best-performing multi-asset sector in the Investment Association universe last year, down 9%.

The IA Mixed Investment 20-60% Shares was next (down 9.5%) and IA Mixed Investment 40-85% Shares (-10%) was third, while the supposedly lowest-risk IA Mixed Investment 0-35% Shares sector lost 10.9%.

Below, Trustnet looks at where among these sectors investors moved their money in 2022. We have stripped out performance effects to focus on those portfolios that attracted at least £100m of net new money, or where a net £100m was withdrawn by savers.

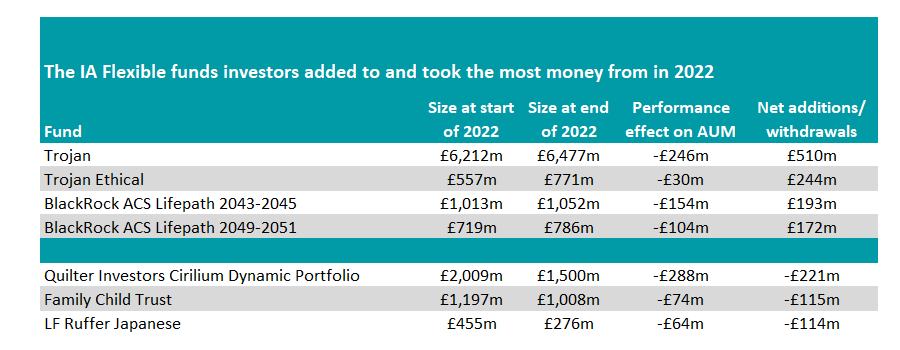

IA Flexible

Starting with the best-performing multi-asset sector, investors turned to the safer end by putting money in Trojan and Trojan Ethical – two funds run by Troy Asset Management.

The former is headed by FE fundinfo Alpha Manager Sebastian Lyon with Charlotte Yonge as deputy, while Yonge helms the latter.

The priority across all of the asset manager's funds is to protect investors’ capital, and to some extent they delivered on this aim in 2022: both made top-quartile returns, down just 3.8% and 4.4% respectively. They were among four funds to take in more than £100m of new money over the course of the year, as the below chart shows.

Source: FE Analytics

On the other side, there were three funds that investors moved on from in 2022, with Quilter Investors Cirilium Dynamic Portfolio losing the most. Investors withdrew a net £221m out of the formerly £2bn portfolio, which lost around a quarter of its assets under management (AUM) once performance was also taken into account.

LF Ruffer Japanese was also among the trio. The £276m fund was one of the worst performers in the sector, down 14.4%. The portfolio invests mainly in Japanese equities, but can invest in bonds as well as international stocks where appropriate.

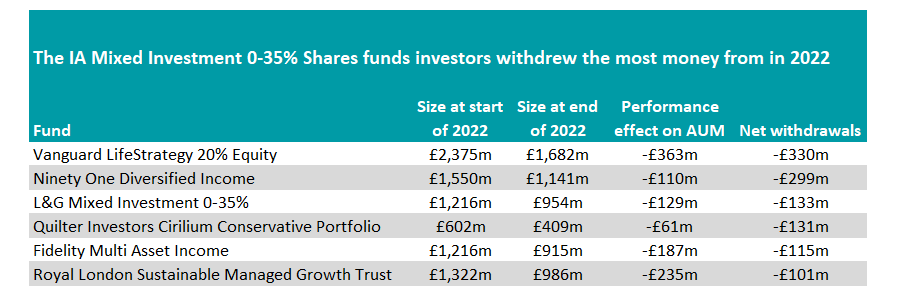

IA Mixed Investment 20-60% Shares and IA Mixed Investment 0-35% Shares

At the other end of the performance scale, investors pulled money from the two risk-averse sectors. Not a single fund in the IA Mixed Investment 0-35% Shares or IA Mixed Investment 20-60% Shares sectors took in a net £100m last year.

Source: FE Analytics

Vanguard LifeStrategy 20% Equity haemorrhaged the most money in the former sector, losing £303m in net withdrawals.

The fund-of-funds invests in Vanguard’s range of index trackers, which means it follows broad asset classes and was buffeted around by markets last year. In all, the fund lost 15.8%.

Ninety One Diversified Income, Fidelity Multi Asset Income and Royal London Sustainable Managed Growth Trust were among the others in the sector that investors moved away from.

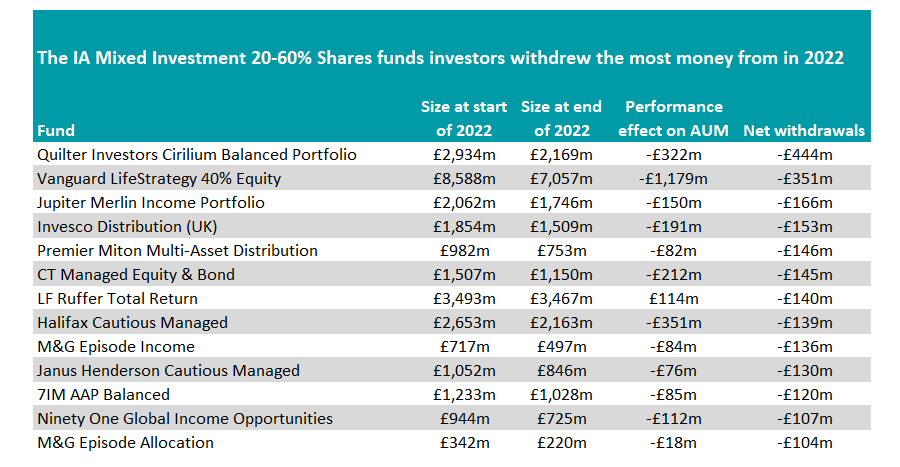

In the IA Mixed Investment 20-60% Shares sector, Vanguard found itself near the bottom again, with Vanguard LifeStrategy 40% Equity among the most-sold after a fourth-quartile year in which it made a 13.6% loss. It started the year as the second-largest in the range, but is now in third place.

Source: FE Analytics

Other well-known funds were also on the chopping block, such as LF Ruffer Total Return, which investors ditched even though it made a net gain on the year. It was up 4.3%, the third-best figure in the sector, but investors still moved £140m out of it on average.

Jupiter Merlin Income Portfolio, Janus Henderson Cautious Managed and CT Managed Equity & Bond are other prominent names to make the list.

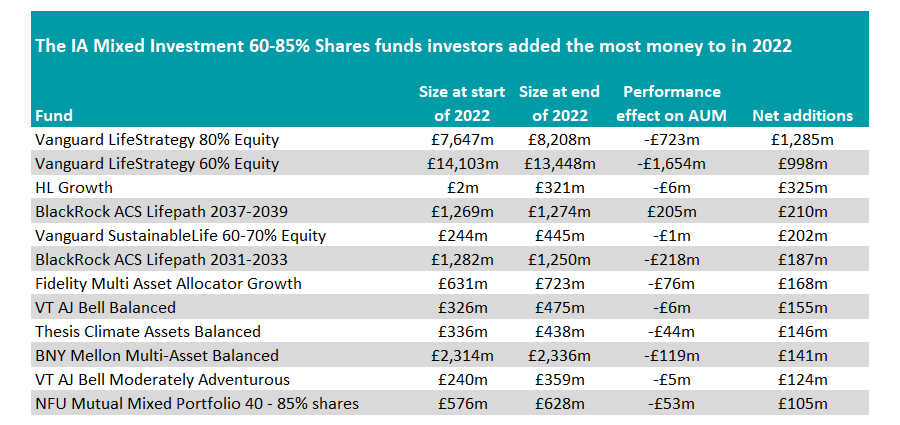

IA Mixed Investment 40-85% Shares

While investors ditched funds in sectors with lower stock weightings, there was more positive news for those in the equity-heavy IA Mixed Investment 40-85% Shares sector, with some 12 funds seeing net inflows of more than £100m.

The clear winner was Vanguard, with both the Vanguard LifeStrategy 80% Equity and Vanguard LifeStrategy 60% Equity funds taking in the most money.

The former added a net £1.2bn, while the latter added around £1bn, despite both making losses. The 80% portfolio was down 8.8%, which was above average for the sector, while the 60% fund dropped 11.2%, a below-average return.

Source: FE Analytics

The smaller Vanguard SustainableLife 60-70% Equity, which invests with an environmental, social and governance (ESG) mandate, also made the list.

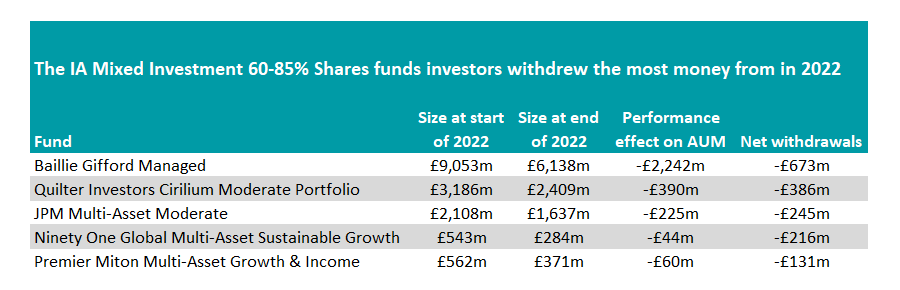

On the other hand, Baillie Gifford Managed was the most sold fund, although its performance was the main driver of assets.

The fund lost more than £2.2bn over the course of the year as the growth style of investing struggled and technology stocks bore the brunt of higher interest rates. It formerly had £9.1bn, but ended the year with £6.1bn of assets, even though only £673m was withdrawn by investors.

Source: FE Analytics

JPM Multi-Asset Moderate, Ninety One Global Multi-Asset Sustainable Growth and Premier Miton Multi-Asset Growth & Income were among the other funds in the sector to lose more than £100m to investor withdrawals.