Last year was one that investors won’t think back to fondly but going through it again now might shine a light on how trends started and developed. Below, we recap a year that put an end to the era of “easy money” by going through it quarter by quarter.

The first quarter of 2022 set the expectations for the rest of the year, with the trends that would continue to shape the following months already emerging.

One of the key events to shake up the investment world was the end of the easy-money era that had been in place since the end of the global financial crisis, as central banks had kept interest rates artificially low until the end of 2022.

The Bank of England’s first interest rate hike of the year happened in February, when the base rate was raised by 25 basis points, but the seed for quantitative tightening had already been sown in December, when it had grown from 0.1% to 0.25%. By the end of the quarter, the rate would reach 0.75%, while the Fed was still dovish in comparison, at 0.2% in March.

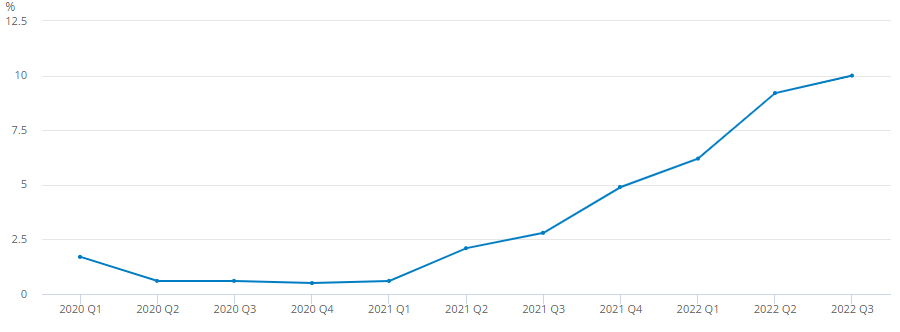

CPI rate over 2yrs

Source: Office for National Statistic

The rate-hiking cycle was initiated in an effort to tackle inflation, as the UK consumer prices index (CPI) had risen from 0.7% in January 2021 to 5.4% in December, causing hardship for consumers and headwinds for fixed-income assets.

At the same time, equities were struggling too, as markets were startled by the Russian invasion of Ukraine. The main effect that the conflict had on markets was the almost 100% fall in the MSCI Russia and the surge in commodities prices, as the West imposed sanctions on the commodities-exporting Russia.

This spurred growth in exporter countries such as Brazil, which surged 40%, and caused energy prices to soar too, with the MSCI AC World Energy index jumping close to 25%, while the rest of the equity market capitulated.

This environment penalised growth stocks and tech stocks in particular, which had a meteoric rise when interest rates were at historical lows. Then, investors were more willing to pay a premium for future earnings, but these stocks tumbled as they started to look more at present earnings.

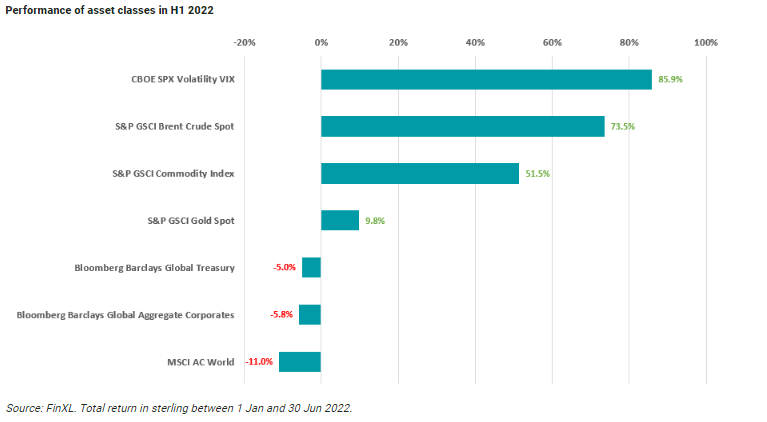

In the second quarter, as these trends consolidated, we experienced a period of high volatility, with the VIX index spiking 85% in the first half of the year. It was at this point that recession worries started to spiral, as the Bank rate had now reached 1.25% but prices hadn’t shown any sign of deflating.

In a broad-based, panic-driven sell-off, the MSCI AC World index, which was down -2.6% in the first quarter, lost 8.4 additional percentage points, reaching -11% at the end of June since year start, as shown in the graph below.

Brazil continued to be the only area to generate a positive return, while Europe and China were hit the most. The UK held up relatively well thanks to its overweight to sectors such as oil and gas and mining.

Not all commodities ended the period higher, as industrial metals such as copper and lead fell, as investors started to worry about the global growth outlooks.

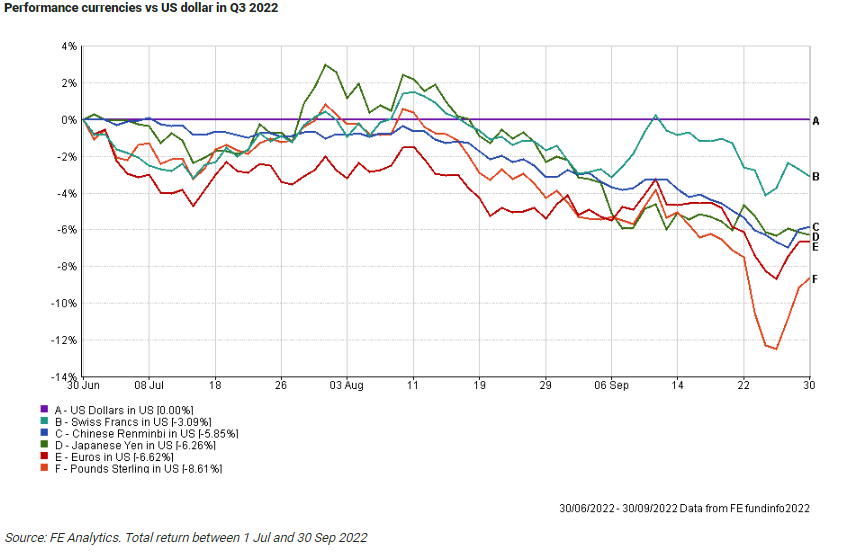

In the third quarter of the year, the UK was set apart from the rest of the world. Continuous interest rate hikes by the Fed caused other currencies to depreciate, an effect that was particularly strong in the UK, where sterling was losing ground at a faster pace due to political instability and especially after Kwasi Kwarteng’s mini-Budget of 23 September. But UK investors could benefit from a weaker pound, as overseas holdings performed better in sterling terms than in their local currencies.

However, stocks and bonds continued to sell off globally, with all asset classes returning negative results in the period. The quarter was particularly brutal for emerging markets, Asia and European equities, while Brazil continued to be the top performer, followed by India.

The rotation away from growth stocks and into value remained in play, but momentum and growth assets had a rebound in the third quarter, losing 3% and 4% respectively, compared to a 5.7% and 6.4% loss for value and quality shares. Another partial trend inversion was achieved by smaller companies, which beat large companies that had fared better until that point. The IA India/Indian Subcontinent sector surpassed IA Latin America by 2.4 percentage points.

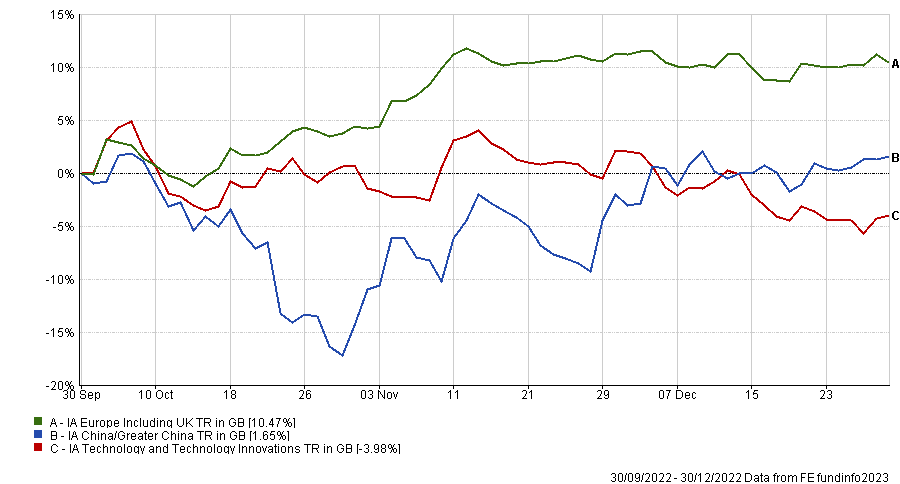

Finally, the last quarter delivered some hope in November, before returning to the status quo in the last month of the year, with glimmers of hope for a Santa rally remaining unfulfilled.

The quarter opened with Rishi Sunak stepping in as Prime Minister, awarding a boost to sterling, which rallied 3% against the dollar and allowing 10-year gilt yields to reach 3.5%. The situation improved on the Continent too, with the MSCI Europe index growing 10.7% in the period.

The main news in the quarter came from China, with the abrupt ending of zero-Covid policies. The geography moved from the foot to the very top of performance tables, with a recovery from a -19.3% trough in late October to a 5.3% gain at the end of December since the start of the quarter.

Performance of sectors in October to December 2022

Source: FE Analytics

In the US, positive sentiment was initially encouraged by Jerome Powell, who said in November that the US central bank could start to slow down its hawkish stance. Equities bounced, but the enthusiasm didn’t last long: by the following month, it had already become clear that further hikes were needed for the foreseeable future.

This realisation battered tech stocks once again, which fell 4% since the beginning of the quarter, despite the November rally and taking markets back to the same dynamics seen at the beginning of the year.