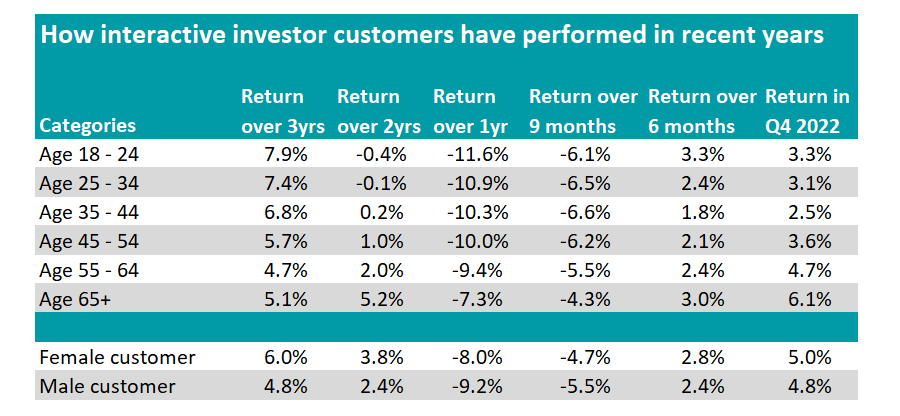

The past 12 months have been dire for investors with most major asset classes dropping in 2022. With nowhere to hide, the average customer using fund platform interactive investor (ii) made an 8.8% loss over the year, research from the firm shows.

In its latest Private Investor Performance Index, the investment supermarket found that the average 8% fall posted by female investors was slightly better than men, who lost 9.2% on average.

Yet the do-it-yourself investor outperformed the average professional in the IA Mixed Investment 40-85% Shares sector, which was used as a comparable benchmark as it has a mix of bonds, cash and equities “not dissimilar to those which might be found in private investor portfolios”. These funds, on average, were down 10.2%.

Turning to age, experienced heads were rewarded, while younger investors that have not faced a year as tough as 2022 suffered.

Those aged between 18 and 24 made the biggest losses, down 11.6% on average, while the over-65s were down 7.3%.

“This may well be down to the fact that 18–24-year-olds have the highest investment trust exposure (28.7% compared to an average customer allocation of 20.9%) – and the steep falls of widely held Scottish Mortgage Investment Trust won’t have helped,” the report said.

Investment trusts tend to outperform in rising markets and underperform in falling markets due to gearing, which can maximise returns but also enhance losses.

“Meanwhile, older customers’ have a higher exposure to direct equities, with the 65+ holding the most in their portfolios (42.9% versus an overall average of 37.5%),” the report added, noting that investors that buy equities directly tend to do so with more of a UK bias.

Richard Wilson, chief executive of interactive investor, said: “Not even the most finely tuned investment portfolios were spared in 2022.”

Source: interactive investor

However, the younger generations are still up more over three years, as the above table shows, with the youngest investors making the best of it during the market rally of 2020.

Over this time, the average ordinary investor has beaten the average professional, with ii clients up 5.3% versus 1.8% for the average IA Mixed Investment 40-85% Shares fund.

Again, over three years the average female customer outperformed the average male customer, this time by 1.2 percentage points (up 6%, versus 4.8% for men).

Wilson said: “In spite of all this volatility, on a three-year basis the average ii customer remains in positive territory. Interestingly, our female cohort are performing the best on both a one-year and three-year basis.

“The twists and turns of the past three years show the importance of diversification. The only certainty in the short term is more uncertainty, given the nature of markets, but taking a long-term view is key to long-term wealth creation.”