It might be easy to dismay at what the year 2022 has brought investors so far. In only six months, they have seen stocks and bonds plummet, inflation skyrocket and one of the longest volatility bouts since the financial crisis.

In a context such as this, it can be difficult to see the glass half-full. Yet despite the headwinds, European and UK financial professionals remain positive about the financial outcomes of 2022, according to Natixis’ latest investment managers survey, which came out today.

Although volatility is considered as a key risk by many, together with the geopolitical risk (a particular concern for those on the continent, given their proximity to Ukraine) and inflationary risk, few respondents thought that the market slide would continue through year-end.

“On average, financial professionals in Europe project most major indices will post modest gains by the end of December including: 4.1% (2.2% in the UK) for the S&P 500, while UK professionals anticipate 4.7% gains for the FTSE 100”, read the report.

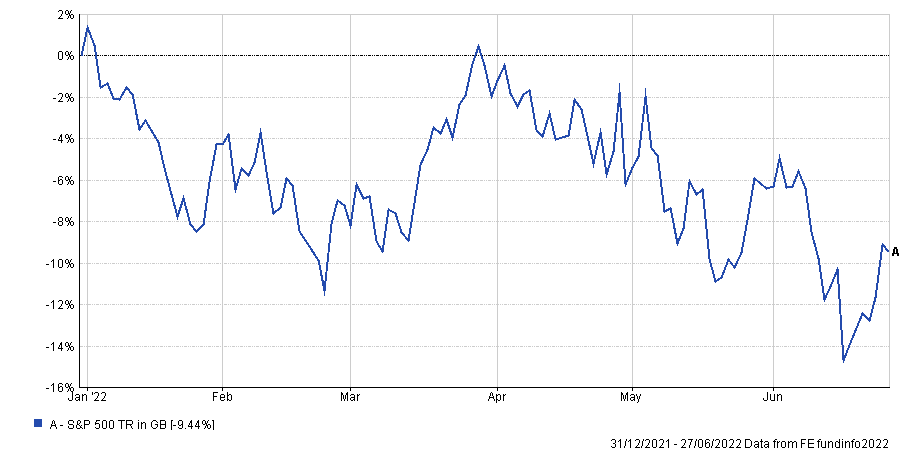

So far, the indices are down 18.3% and 2% year-to-date respectively, but seem to have started to recuperate in the past few weeks, as shown by the graphs below.

S&P 500 performance year to date

Source: FE Analytics

FTSE 100 performance year to date

-8.png)

Source: FE Analytics

Although armed with this faith, managers have not been resting on laurels. In fact, they are having to adapt to the new circumstances.

Darren Pilbeam, head of UK sales at Natixis, suggested that “in the short-term they’ll need to reset investment strategies for turbulent markets and emotional clients” but added that in the long term adviser will need to re-evaluate their market “assumptions” and determine how much the world has really changed if they are to hit their growth expectations.

In their new portfolio strategies, managers are opting for alternatives to money-losing stocks and bonds, reallocating to commodities, infrastructure and private assets.

But in order to keep their growth objectives, the whole industry is moving forward and reinventing itself, like many others have had to do.

Head of multi-asset solutions James Beaumont noted: “Financial professionals are adapting their businesses to focus on more than just asset allocation, instead focusing more widely on demonstrating value.”

According to Natixis, the changes implemented to offer more value include concentrating on improving access to technology, implementing model portfolios, and assisting clients with their estate and finance planning in preparation for the next generation as well as incorporating tax minimisation strategies when considering portfolio decisions.

“On top of this, financial professionals are having to manage anxious clients and temper expectations to avoid emotional selling decisions. They must work hard to keep clients grounded and focused on things that they can control, such as their expectations”, concluded Beaumont.

He added that investors should indeed try to keep a cool head and to look past the current volatility at this particular eye of the storm in the same way that the advisers surveyed had.