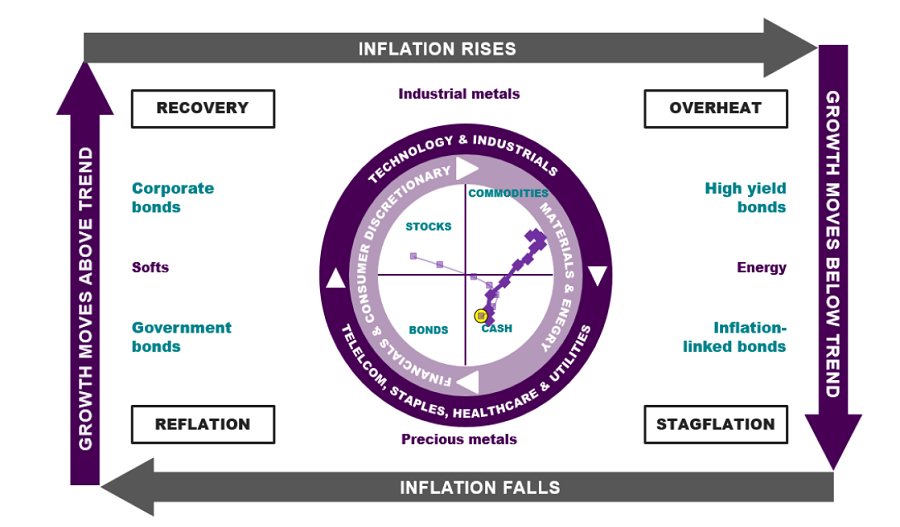

Markets have entered a period of stagflation and the only asset worth holding is commodities, according to multi-asset manager, Trevor Greetham, who was loaded up his portfolios with these stocks.

Stagflation occurs when economic growth slows in conjunction with higher unemployment and rising prices, a situation markets are now in, according to Greetham’s ‘Investment Clock’ – a self-developed metric he uses to guide his investment allocations at Royal London Asset Management.

“I’ve been banging on about stagflation for 30 years, since the last time it was a household name in the 1970s” Greetham said.

Source: Royal London Asset Management

On the surface the latest economic data is not in line with Greetham’s stance, as the UK economy grew at the fastest rate since the Second World War last year. But experts said this does not actually mean the UK economy is healthy. As 2020’s growth was abysmally low due to Covid it is more of a revision back to normality.

Ben Laidler, global markets strategist at eToro, argued growth was unimpressive last year and is only going to get worse with more inflation and rising costs.

He said UK growth is now facing a sharp slowdown as the “cost of living squeezes bite”, which could act as a headwind to more domestic-focused small and mid-cap stocks.

Greetham did not go do far as to say that growth was at a total standstill, but conceded that it has majorly slowed down.

He explained that stagflation occurs when markets have “overheated” and are “really, really late cycle” like they are now. The Royal London manager said that Covid interrupted the market cycle rather than ending it, meaning the current cycle has been unnaturally stretched because of the amount of monetary and fiscal stimulus pumped out to deal with the pandemic.

“It was not a proper clearing out like you usually get at that stage because there was so much stimulus from central banks and fiscal stimulus, which kept things running”, Greetham said.

“And it's not as if we're only a year or two into a 10 year cycle, it feels like we're in overtime already on the previous business cycle.”

The other elements to stagflation are rising prices and increased unemployment levels. The former is undoubtedly present with inflation reaching a 30 year high of 5.5% in January, exacerbated by the post-pandemic stimulus and ongoing supply chain issues.

Unemployment rates were not in-line with stagflation though, according to Ben Yearsley, co-founder of Fairview Investing, who agreed that inflation will likely remain higher than growth.

“However you normally need high unemployment too for proper stagflation and I can’t see that to be honest. The labour market is tight so what will drive that upwards?,” he asked.

Better employment stats would likely encourage the central bankers to take a more hawkish stance and commit to further rate hikes, which Yearsley said could cause some companies to shut down if they cannot offset the increased costs “but the [Monetary Policy Committee] MPC will halt rate rises before too much damage is done”.

Overall growth is so limited and inflation is so high that reviving unemployment stats might not be a enough to drag markets out of stagflation, according to Greetham’s thesis.

With so many headwinds facing economic and market growth it has made it increasingly difficult to know where to invest.

According to Greetham, when markets are in stagflation the only asset that does well is commodities, an area his Royal London multi-asset funds are now overweight on.

Commodities include stocks such as energy, oil & gas alongside materials such as gold and tactile goods, all seen as ways to hedge against inflation and have therefore received a lot of attention from investors during the recent recovery period.

Greetham said that these assets were more attractive than equity and bonds, which were “very expensive” after stimulus pushed up their valuations enormously “limiting the prospective returns”.

He has added specific exposure to the S&P 500 Energy sector and has bought a broader commodities ETF in his portfolios to capitalise on this.

“Cash is also unattractive,” he said, with low interest rates far below the current rate of inflation, leaving savers making negative real returns.

With limitations on what to hold Greetham said it was more important to focus on the rotation within markets rather than waiting for them to go back up, making active, tactical asset allocations and take advantage of any opportunities.

One area he has added to is the UK, which is full of miners, oil stocks and banks, which are all viewed as value strategies. Indeed, it is now the largest regional allocation in his portfolios.

“The UK market having been an absolute dog for the past 10 years but has been the best performing market year-to-date and we think the it is still very attractive,” he said.