There’s no doubt an economic slowdown is underway. For many UK consumers, the biggest impact is being felt in the cost of living, with rising energy and fuel bills having the single biggest squeeze on incomes. Consumers are now having to make difficult choices between spending on necessities and non-essential goods. Discretionary spending on areas such as recreation, travel, alcohol and home furnishings is being cut back. These are clear signs of a slowdown, if not an outright recession.

For a recessionary environment to occur, economic activity would need to be declining, and this would be evident in lower real GDP, real incomes, employment, industrial production and retail sales. During June 2022, the UK experienced month-on-month falls in real GDP of -0.6%. So, some of the signs are already there, but the UK economy is not officially in a recession yet. It needs to see two consecutive negative quarters of real GDP before being in a technical recession.

Reading the signals

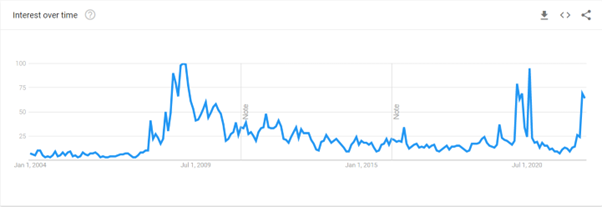

Google Trends suggests a recession in the UK is largely unavoidable and has probably already begun. It’s a powerful tool to gauge consumer sentiment. The chart below shows search interest for the word ‘Recession’ in the UK, recorded on a range of 0 to 100, with one hundred reflecting peak popularity. As you can see, periods of peak popularity align well with past recessions. Indeed, the Bank of England predict the UK to be in a recession by the end of the year and over the course of 2023 – so we’re nearly there.

Source: Google Finance

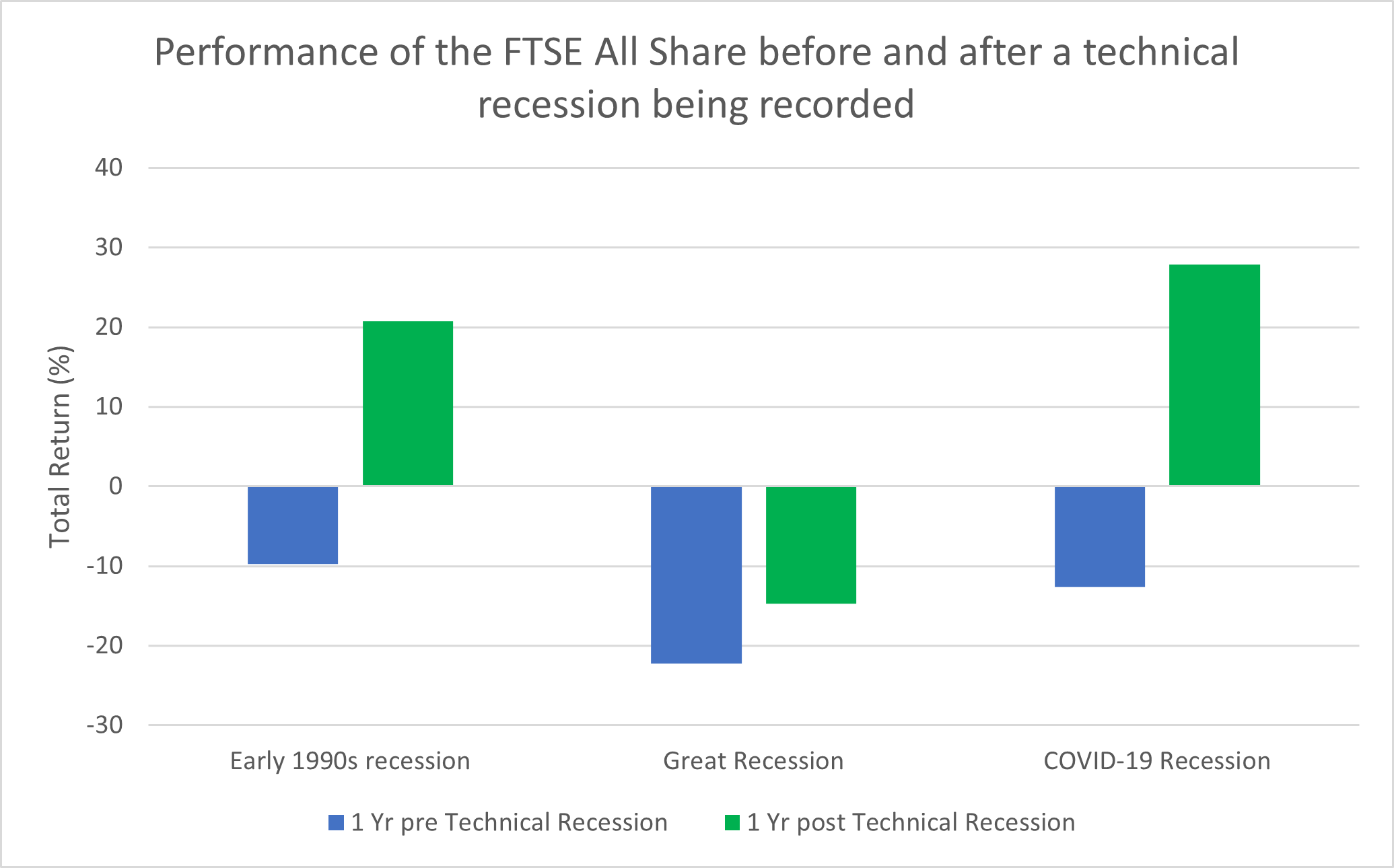

Recessions don’t typically last long. Since the beginning of the 20th century, the average recession in the UK has lasted 1.15 years and we’ve experienced 10 in those 120 years. So far, this year has been a painful time for equity investors and technically, we’re not even in a recession yet. But analysing the last three recessions: Early 1990s Recession (Q3 1990 – Q3 1991), Great Recession (Q2 2008 -Q2 2009) and COVID-19 Recession (Q1 2020 – Q2 2020), helps explain this. The chart below shows past market performance leading up to the event is usually far worse than during. In other words, stock markets and recessionary cycles are not usually in sync.

Source: Trading Economics

Stock markets are forward looking, so often reflect the weak economic environment before the worst has happened. Conversely, economic data is backward looking and released periodically. This makes timing stock markets, more often than not, futile. If you’re making decisions based on data alone, you’ll often be too late. Behavioural finance tells us investors can make poor investment decisions based on emotions and cognitive biases.

Don’t look back in anger

The first half of 2022 was an uncomfortable period for investors, and currently fear remains high. Markets may have breathed a sigh of relief more recently, but it’s too early to say if we’ll see a sustained market recovery. Investors will be questioning whether to sell while stock markets remain volatile, but don’t forget Warren Buffett’s wise words: ‘be fearful when others are greedy, and greedy when others are fearful’. Following bouts of poor returns, portfolios need time to recover and, in our view, selling now only crystallises losses. Rear-view mirror investing has never led to success. So for us the message is clear. Now is not the time to lose sight of your long-term financial goals and objectives. Keep your eyes on the road ahead.

Simon Molica is an investment manager at Parmenion. The views expressed above should not be taken as investment advice.