Comgest, Jupiter and Martin Currie house some of the most expensive European funds available, but also the best-performing, according to data from FE Analytics.

Fund fees are a contentious topic, with some investors favouring low-cost funds that passively track indices that benefit from fees saved. Others prefer active funds, which they hope will outperform an index by a wide-enough margin to justify the higher fees paid.

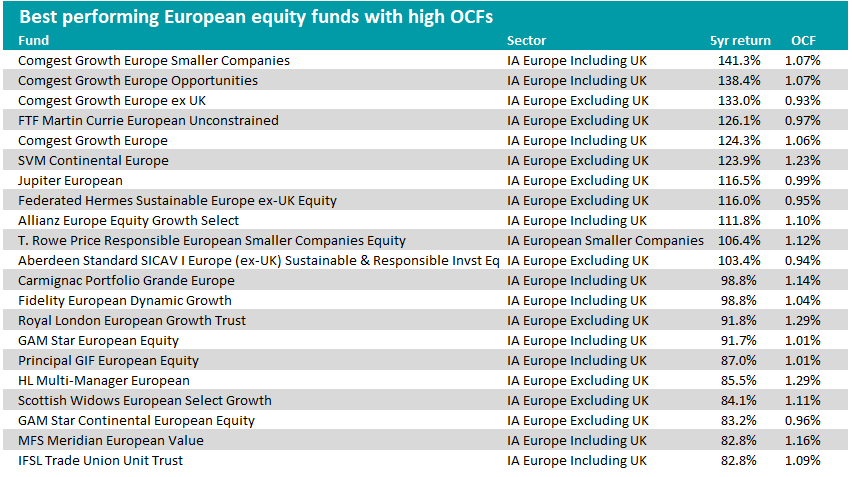

For the latter, below Trustnet reveals which European equity funds have delivered top-quartile performance over the past five years at a bottom-quartile (high) ongoing charges figure (OCF). Previously we looked at the high-performing, high-cost global equity funds and UK equity funds.

Of the 177 funds across the IA Europe excluding UK and IA European Smaller Companies sectors, there were 11 funds with high costs and top-ranked performance over the period.

Source: FE Analytics

The best performer on the list was the Comgest Growth Europe Smaller Companies, which sits in the IA Europe Including UK sector. Over the past five years, it has made 141.3% for investors, while charging 1.07%.

Eva Fornadi, Alistair Wittet and Denis Lepadatu co-manage the fund using Comgest’s quality growth investment style, buying companies that can sustainably grow their earnings over time.

It has more than three times the MSCI Europe Mid Cap index’s weighting to healthcare stocks and more than double its allocation to technology firms, while underweighting industrials. It has nothing in the value areas of the market – financials, energy, miners, real estate or utilities.

Also from the IA Europe Including UK sector Comgest Growth Europe Opportunities was second on the list, returning 138.4% with an identical OCF of 1.07%.

Out of 150 funds in the IA Europe excluding UK sector, the Comgest Growth Europe ex UK fund was the highest, rounding out the top-three top-performing but expensive European funds – all of which were from Comgest. It delivered 133% over the period, while charging an OCF of 0.93%.

Run by Arnaud Cosserat, Alistair Wittet and Franz Weis, the fund has a high-conviction approach, with its two largest holdings – semiconductor equipment manufacturer ASML Holding and Swiss healthcare giant Roche – making up 12.9% of the 30-stock portfolio.

Another notable fund on the list was the £4.7bn Jupiter European fund, which delivered 116.5% over the period and currently has an OCF of 0.99%.

For the years prior to 2019, the fund was run by respected stock-picker Alexander Darwall, who followed a quality growth approach, but left the fund to start his own investment company.

This has continued under FE fundinfo Alpha Managers Mark Heslop and Mark Nichols who started running the fund in 2019, having previously managed the top-performing European equity funds at Columbia Threadneedle.

They follow a buy-and-hold approach, searching for cash-generative businesses with clear barriers to entry and visible growth opportunities in attractive industries.

One of the biggest changes to the fund came weeks after the new managers took charge in 2019, when Heslop and Nichols began to sell out of Wirecard, one of the largest holdings in the fund at the time.

Last year Wirecard was declared insolvent after an accounting issue. They sold the company at an average price of €130 (£109) a share.

Elsewhere in the list, the FTF Martin Currie European Unconstrained fund (formerly Legg Mason IF Martin Currie European Unconstrained), delivered a top-ranked return of 126% with an OCF of 0.97%.

Run by FE Alpha Manager Zehrid Osmani, he also takes a concentrated approach to European equities, focusing on compounding returns from quality growth companies. Its biggest position is in ASML at 9.14%, followed by luxury brands Moncler and Kering at 6.93% and 6.22% respectively, representing more than a fifth of the total portfolio.

Out of the 27 funds in the IA European Smaller Companies sector, there was one fund that delivered top-ranked returns with high costs: the T. Rowe Price Responsible European Smaller Companies Equity portfolio.

Run by FE Alpha Manager Ben Griffiths, it delivered a return of 106.4% over the period, with an OCF of 1.12%.

The fund holds between 70 and 100 small- and mid-cap European stocks which the manager believes have above-average long-term earnings growth, including Italian healthcare company Amplifon and British Venture Capital firm Draper Esprit.

At the other end of the scale, there were only two funds that made top-quartile returns while charging investors low OCFs. The SSGA SPDR MSCI Europe Industrials UCITS ETF and the SSGA SDPR MSCI Europe Utilities UCITS ETF are both passive exchange-traded-funds which focus on individual sectors that have been resurgent of late.

Unlike the Global and UK equity sectors there were no active funds on the list among European portfolios that had both top-ranked returns and top-quartile (low) charges relative to their peer group.

However, there were a few funds that delivered top performance with charges slightly below their sector average.

For example, the Baillie Gifford European fund run by Stephen Paice, Moritz Sitte and Chris Davies, delivered top-quartile returns of 156.6% over the period with an OCF of 0.58% – more than 10 basis points cheaper than the IA Europe excluding UK sector average of 0.69%.

Similarly, the ASI European Smaller Companies fund run by Andrew Paisley, also delivered sector-busting returns of 145.1% over the period with an OCF of 0.87% – five basis points below the IA European Smaller Companies sector average of 0.92%.