The S&P 500 is one of the few indices that have already managed rebound from the coronavirus crash and exceed their pre-coronavirus levels this year, but has this made it a riskier part of the market?

Year-to-date, the S&P 500 index, which is home of the US large- and mega-cap stocks, has made a total return of 12.04 per cent. As shown in the chart below, very few indices have achieved this level of recovery.

Indices’ performance YTD

Source: FE Analytics

In the space of eight months, the S&P 500 has gone through its shortest bear market in history – dropping from 3,386 points on 19 February to 2,237.4 points on 23 March – before exceeding its pre-coronavirus high by August on the back of massive amounts of fiscal and monetary stimulus.

Yesterday, the S&P 500 closed at 3511.93 points, still ahead of its pre-coronavirus high.

This rally has been largely driven by growth/tech stocks. Companies such as Microsoft, Apple, Amazon and Facebook have thrived in the low interest rate environment, while lockdown restrictions increased demand on tech to carry out working from home and socialising.

But this rapid rally has compounded worries that US stocks’ valuations are too stretched and that the index has become immensely concentrated. A significant share of the S&P 500’s returns are down to just a few tech giants.

The Russell 2000 index – the US small-cap market – has rallied following the initial coronavirus sell-off. But year-to-date the index has made a total return of just 0.85 per cent.

Performance of Russell 2000 index and S&P 500 YTD

.png)

Source: FE Analytics

Although small-caps have historically been the riskier asset class compared to large-caps, could the S&P 500 rally’s be a case of too much too soon and could small-caps now be a less risky option?

“I think that you took some of the words right out of my mouth,” said Jon Brachle, manager of the JP Morgan US Smaller Companies trust (pictured).

Brachle, whose runs a bottom-up, quality focused process on the trust, said: “For existing small-cap investors or potential small-cap investors, that’s one of the most exciting things for small-caps in particular.

“If we look at the valuation of small-caps today versus large caps, it’s actually the lowest in two decades. Historically when small-caps are this cheap versus large-caps, they’ve outperformed large-caps by a single digit per cent annually over the next decade.”

The manager added: “Obviously we wouldn’t say that valuation is a catalyst. But it certainly matters when thinking about long-term returns. So you know, that is certainly one of the more exciting things in our view about the small-cap space.”

Brachle pointed out that the major rally seen in the S&P 500 is partially a product of the highly volatile macroeconomic environment this year.

He said: “I would bring it back to the macro environment that we’ve been in and what that has meant for some of the performance.

“Obviously, Covid-19 hit and the US economy ground to a halt for a certain period of time, and then the Fed acted very quickly to lower interest rates. And when you think about that type of environment, people are going to go towards what they perceive to be safer and that’s larger-cap companies over smaller-cap companies, which tend to be a little bit more macro sensitive.”

A similar pattern also played out in the small-cap space, Brachle said, where investors flocked to the more expensive but high returning tech and healthcare stocks during the crisis.

“Both during the sell-off end of February to the end of March and the subsequent rally, tech and healthcare are the only two sectors– and I’m talking small cap here that outperformed the market both on the way down and on the way up,” Brachle said.

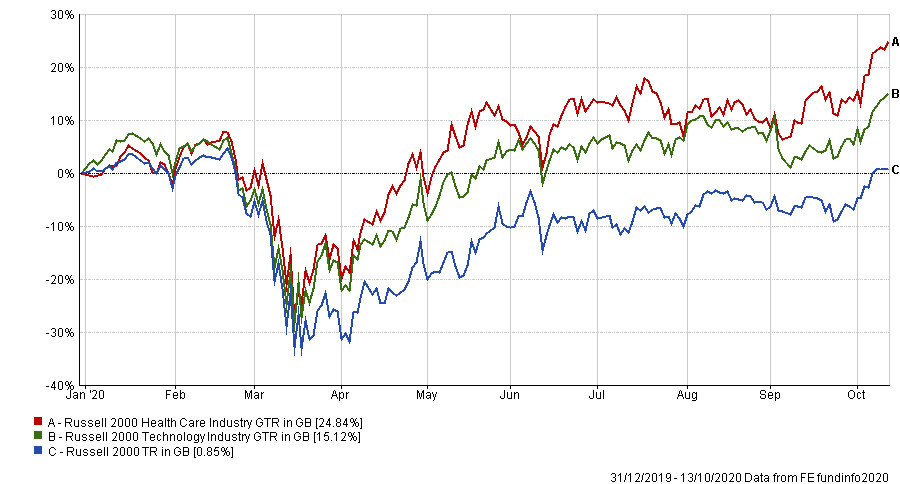

Performance of small-cap healthcare and technology sectors versus the index YTD

Source: FE Analytics

This, the manager said, reflects that in volatile periods investors want to go where they are certain of top-line growth for safety.

But although these two sectors have held up well during the crisis, Brachle pointed out that they are two areas the JP Morgan US Smaller Companies trust has been historically underweight in.

Looking at the trust’s latest sector weighting compared to the Russell 2000 benchmark, the trust is underweight healthcare by 6.7 per cent and tech by 1.1 per cent.

But this hasn’t made it underperform over the long term.

Over the past five years, the $223.5m JP Morgan US Smaller Companies trust has made a total return of 76.22 per cent, outperforming both the sector and index.

Performance of trust vs sector & index over 5yrs

Source: FE Analytics

Being able to move away from the benchmark but still outperform is partly what makes being a small-cap manager so exciting, according to Brachle.

He said: “One of the things which excites me personally as a small-cap investor is that it’s a more inefficient market [compared] to large caps.

“It gives managers like ourselves, with a really defined investment process, the opportunity to apply that to a broad universe of stocks and really put together a portfolio that we feel is far better and far higher quality than the overall benchmark.”

Ultimately, the small-cap space creates more room for managers to flex their managerial muscles and implement their process, which Brachle agreed with.

“I think that we’ve certainly found that to be true for our investment process,” he said.

This is something which isn’t as easily done in the highly scrutinised and efficient large-cap space he added.

“If there’s fewer people paying attention to these companies then it gives us more opportunity to apply our investment process to identify good long-term winners. I don’t know how many analysts Apple has covering it right now, for example but it must be dozens and you don’t usually find that in a small-cap space.”

JP Morgan US Smaller Companies is currently trading at a 9.2 per cent discount to net asset value (NAV) – as at 14 October – is 5 per cent geared, has a dividend yield of 0.8 per cent and an ongoing charges of 1.23 per cent.