Asset Value Investors (AVI) will launch a new Japan Special Situations fund with Joe Bauernfreund at the helm, the firm has announced today.

The manager of the existing £177.5m Japan Opportunity Trust said the decision will address the “significant demand” for a UCITS version of the closed-ended company launched in 2018.

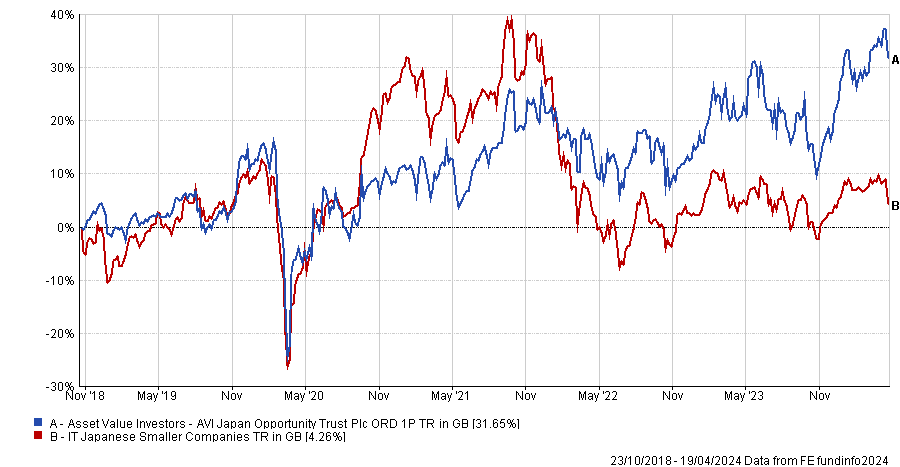

Since then, the portfolio has proved successful and was the top-performing trust in the three-strong IT Japanese Smaller Companies sector over five years and second-best over three years and 12 months. Since launch, it made a 31.6% return against the sector’s average of 4.3%, as the chart below illustrates.

Performance of fund against sector and index since launch

Source: FE Analytics

Bauernfreund will be supported by AVI’s six-strong Japan-dedicated research team and employ the same bottom-up, research-driven approach of the trust, engaging with companies to unlock hidden value.

The portfolio will be concentrated in 25-35 companies and charge a 1% ongoing charges figure (OCF).

Bauernfreund is optimistic about the macro-economic environment in Japan.

“The weak yen makes Japan highly cost-competitive, both for tourism and manufacturing. Inflation has returned after a 40-year absence and, with wage growth and increased spending, we could see a more rational allocation of capital and improved productivity, which would bode well for our portfolio companies,” he said.

“For sterling-based investors the yen has been a significant headwind over the past 10 years, but Japan’s central bank abandoning its yield curve control will enhance the returns on offer on the country’s debt, leading some investors to forecast that a ‘great repatriation’ of Japanese investment flows is set to accelerate.”

The market has been gaining momentum recently with a number of managers bullish on the opportunities going forward.

Bauernfreund’s AVI Japan Opportunity trust was also recently flagged by head of investment companies at QuotedData James Carthew (alongside JPMorgan Japanese) for investors seeking exposure to Japan’s improving corporate governance and rising stock market.