Two thirds of the Japanese GDP is about to be released into the market and will flow back to investors as dividends or will be used for investments and mergers, according to Sam Perry, manager of the Pictet Japanese Equity Selection fund.

“I've been waiting for this moment for 10 years, ever since Haruhiko Kuroda [the previous governor of the Bank of Japan] started QQE [quantitative and qualitative monetary easing] with the goal to increase inflation expectations.”

“It’s been quite a long process, but I’m sure we’re there now. This is what we've been waiting to see.”

It might be strange for Westerners to read, but Perry’s enthusiasm for the Japanese market is due to the return of inflation, which we are fighting in the West, but is a God-send for Japan. In fact, the lack of inflation is what made the market uninspiring for so many years.

“I remember being in a meeting with brokers in 2006 and a person came into the room and was very excited because he had just been able to persuade his bosses to make a shift from covering Japan to covering commodities,” he said.

“Let's face it, if you turn around to a young, enthusiastic graduate here and say: ‘Great news, you can go on the Japanese team’, he's not going to be that excited. We've been cutting a fairly lonely figure for quite a long time.”

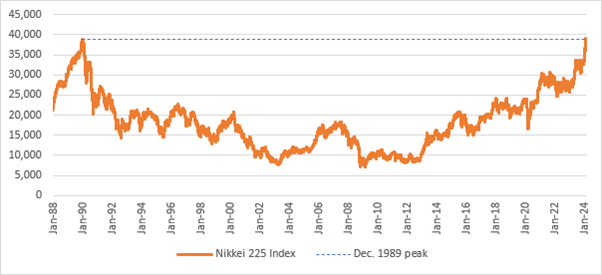

Recently, Japan made the headlines because the Nikkei index hit an all-time high. Historically, people have added money into the market on this kind of news, but that’s not what moved Perry.

Nikkei 225 Index passes its December 1989 peak

Sources: Fidelity and Bloomberg, data to 22 Feb 2024

“It’s a nice headline. But index movements (be it in the Nikkei or the Topix) only make a difference in terms of awareness,” he said.

“Amongst investor groups, almost nobody has dedicated in-house Japanese expertise. And why would you? So who can blame them if they use price momentum to enter the market? But that’s not going to move the needle for Japan.”

People usually also talk about improving corporate governance, increasing dividend payments and less cross-shareholding.

“All this is true, and plenty has happened in Japan since the early 2000s. But that’s been going on for a long time already, so if we’re going to say that that’s driving the market, I am afraid I don’t buy it.”

The limit of these arguments is that they try to explain the bull run in relation to foreign investors, whereas the market this time is being driven domestically.

What it really does make a difference this time around is “a really straightforward, secular macroeconomic story”.

One thing to be aware of is that cashflow has exploded in Japan, where there’s net cash sitting on balance sheets at levels about two thirds of GDP.

This is because of the Japanese banking collapse in the 1990s, which generated a deflationary spiral (declining prices) and a very high hurdle for investments. In a deflationary environment, nobody wants to borrow, because debt is always going to grow in real terms. But people get a real return on cash risk-free, so they hold cash and investing makes little sense.

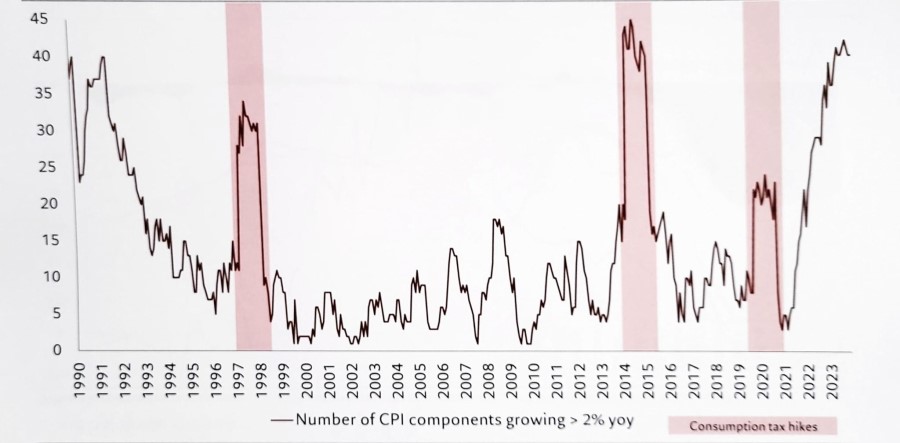

As soon as you move into an inflationary scenario, then cash is a wasting asset and people have to invest. Inflation is the real reason why Japan is interesting today, with the chart below showing that inflation is as widespread in Japan now as the asset price bubble of the 90s.

Inflation more widespread than at any time since the Japanese bubble

Source: Bloomberg, Pictet.

And not only that, it’s also becoming embedded.

“We've seen a complete break in general inflation, with people expecting to be able to count on increase in prices. This is a massive shift in corporate mindset,” Perry said.

“For years, we've been talking to companies and asked them about average selling price and they would say: ‘We can raise in the US and Europe. We can't raise in Japan’. But now that's reversed. They are really confident about being able to raise prices at home and they have been doing so.

“It’s just basic macroeconomics. This is the opportunity now where we should see that cash get liberated and flow back to us as investors, to mergers and acquisitions or into investments. I've been waiting for this moment for 10 years,” he concluded.